Breakfast restaurant chain First Watch Restaurant Group (NASDAQ: FWRG) missed Wall Street’s revenue expectations in Q3 CY2024, but sales rose 14.8% year on year to $251.6 million. Its GAAP profit of $0.03 per share was also 36.3% below analysts’ consensus estimates.

Is now the time to buy First Watch? Find out by accessing our full research report, it’s free.

First Watch (FWRG) Q3 CY2024 Highlights:

- Revenue: $251.6 million vs analyst estimates of $256.6 million (2% miss)

- EPS: $0.03 vs analyst expectations of $0.05 (36.3% miss)

- EBITDA: $25.62 million vs analyst estimates of $24.38 million (5.1% beat)

- EBITDA guidance for the full year is $111 million at the midpoint, above analyst estimates of $108.6 million

- Gross Margin (GAAP): 20.7%, in line with the same quarter last year

- Operating Margin: 2.5%, down from 3.5% in the same quarter last year

- EBITDA Margin: 10.2%, in line with the same quarter last year

- Locations: 547 at quarter end, up from 505 in the same quarter last year

- Same-Store Sales fell 1.9% year on year (4.8% in the same quarter last year)

- Market Capitalization: $1.10 billion

“We are pleased with our performance in Q3 as it reflects our teams’ superb restaurant-level operations, especially considering an uneven consumer backdrop. Traffic picked up through the quarter, our employee turnover once again improved and remains favorable relative to the industry as a whole and Adjusted EBITDA grew 18%,” said Chris Tomasso, First Watch CEO and President.

Company Overview

Based on a nautical reference to the first work shift aboard a ship, First Watch (NASDAQ: FWRG) is a chain of breakfast and brunch restaurants whose menu is heavily-focused on eggs and griddle items such as pancakes.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Sales Growth

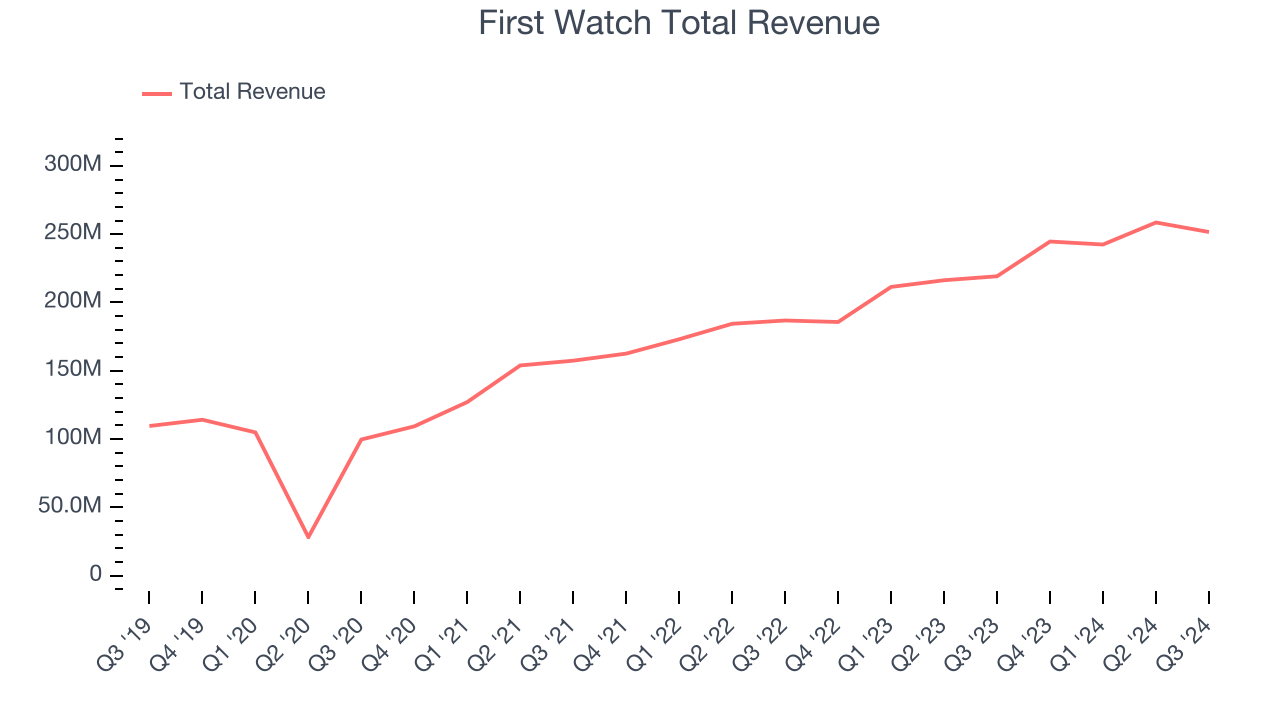

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

First Watch is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it’s working from a smaller revenue base.

As you can see below, First Watch’s 18.5% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was excellent as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, First Watch’s revenue grew 14.8% year on year to $251.6 million, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 13.7% over the next 12 months, a deceleration versus the last five years. This projection is still commendable and shows the market is baking in success for its offerings.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Restaurant Performance

Number of Restaurants

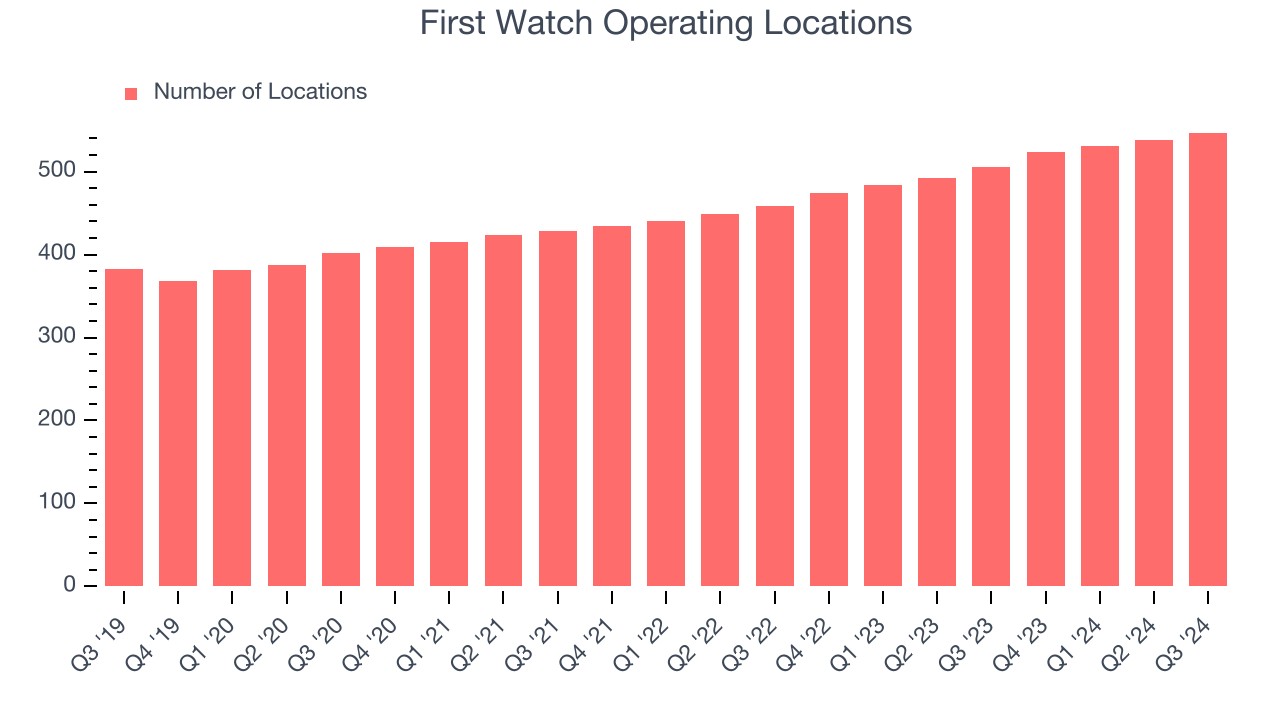

A restaurant chain’s total number of dining locations often determines how much revenue it can generate.

First Watch operated 547 locations in the latest quarter. It has opened new restaurants at a rapid clip over the last two years and averaged 9.5% annual growth, much faster than the broader restaurant sector. This gives it a chance to become a large, scaled business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where the concept has few or no locations.

Same-Store Sales

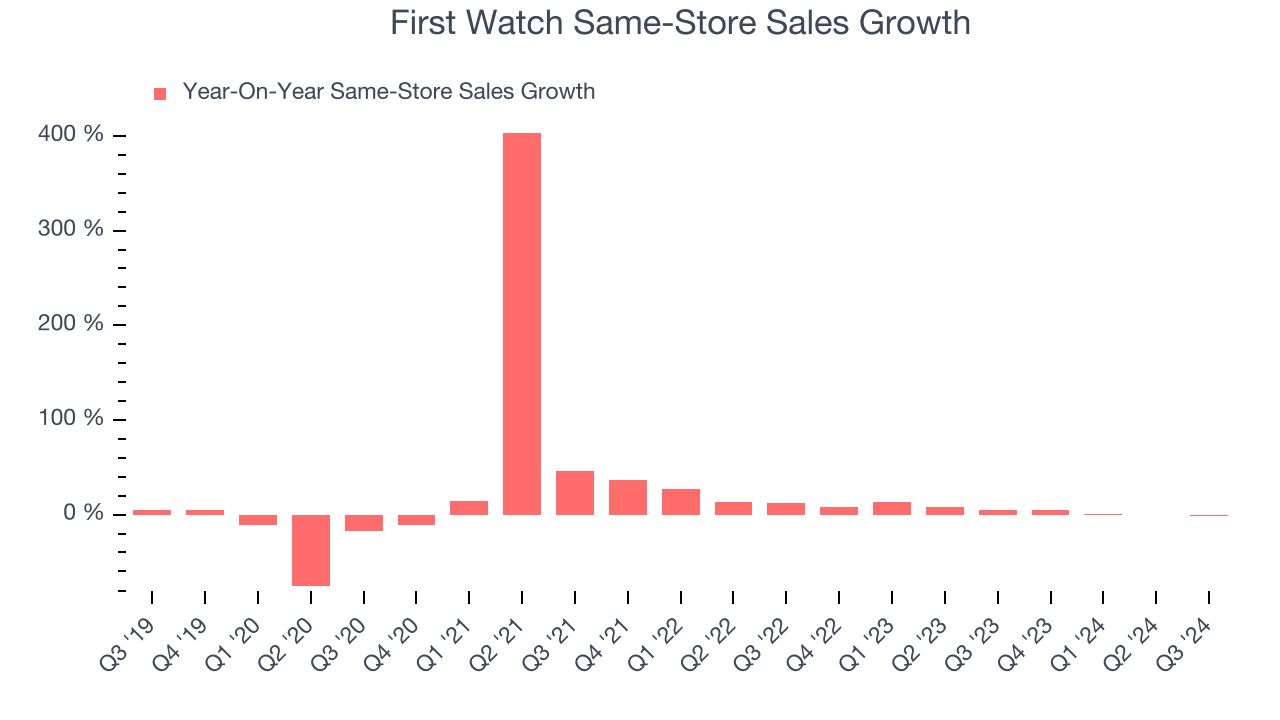

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing restaurants and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

First Watch has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 4.6%. This performance suggests its rollout of new restaurants is beneficial for shareholders. We like this backdrop because it gives First Watch multiple ways to win: revenue growth can come from new restaurants or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, First Watch’s same-store sales fell by 1.9% annually. This decline was a reversal from the 4.8% year-on-year increase it posted 12 months ago. We’ll keep a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from First Watch’s Q3 Results

We enjoyed seeing First Watch exceed analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. On the other hand, its revenue and EPS missed. Overall, this was a mixed quarter. The stock traded down 1.6% to $17.95 immediately after reporting.

First Watch’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.