ACV Auctions has had an impressive run over the past six months as its shares have beaten the S&P 500 by 9.6%. The stock now trades at $22, marking a 18.7% gain. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is it too late to buy ACVA? Find out in our full research report, it’s free.

Why Is ACVA a Good Business?

Founded in 2014, ACV Auctions (NASDAQ: ACVA) is an online auction marketplace for car dealers and wholesalers to buy and sell used cars.

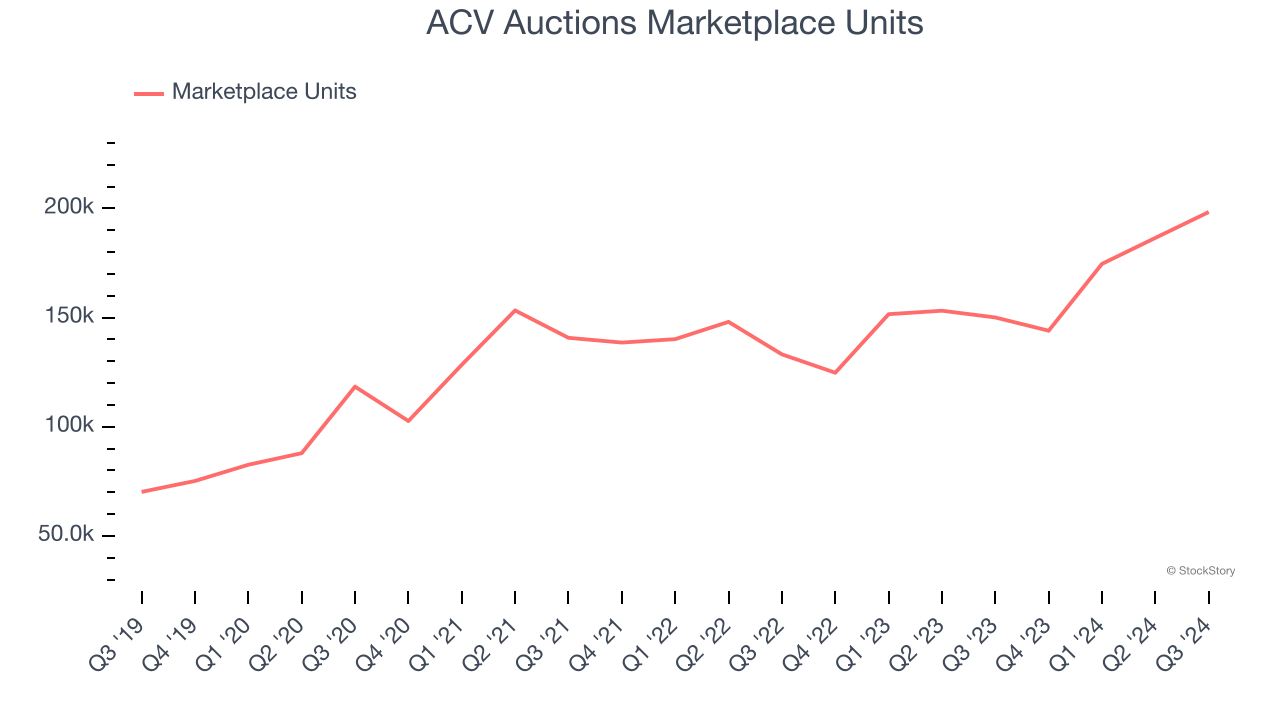

1. Marketplace Units Skyrocket, Fueling Growth Opportunities

As an online marketplace, ACV Auctions generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, ACV Auctions’s marketplace units, a key performance metric for the company, increased by 12.4% annually to 198,354 in the latest quarter. This growth rate is strong for a consumer internet business and indicates people love using its offerings.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect ACV Auctions’s revenue to rise by 24.9%, close to its 24.1% annualized growth for the past three years. This projection is noteworthy and implies the market is baking in success for its products and services.

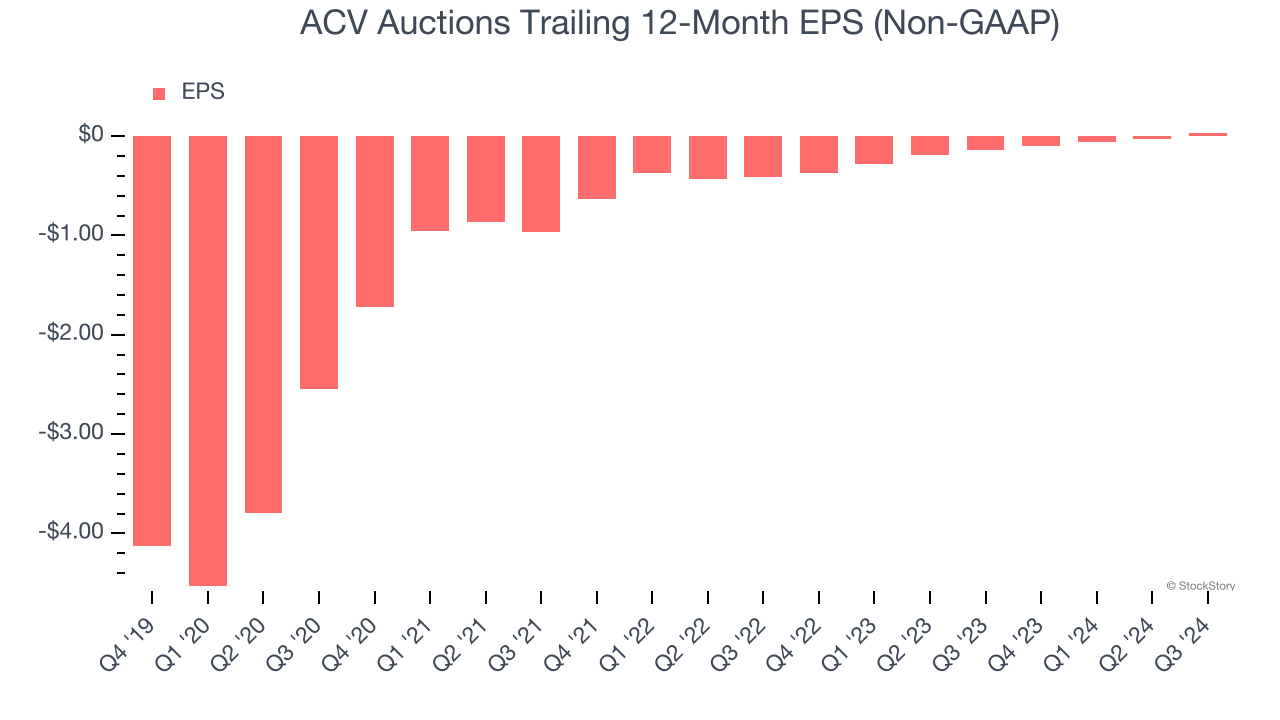

3. Outstanding Long-Term EPS Growth

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

ACV Auctions’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

Final Judgment

These are just a few reasons why we think ACV Auctions is a great business, and with its shares beating the market recently, the stock trades at 52.9× forward EV-to-EBITDA (or $22 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than ACV Auctions

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.