What a time it’s been for VSE Corporation. In the past six months alone, the company’s stock price has increased by a massive 44.1%, reaching $161.99 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Following the strength, is VSEC a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free for active Edge members.

Why Does VSEC Stock Spark Debate?

With roots dating back to 1959 and a strategic focus on extending the life of transportation assets, VSE Corporation (NASDAQ: VSEC) provides aftermarket parts distribution and maintenance, repair, and overhaul services for aircraft and vehicle fleets in commercial and government markets.

Two Positive Attributes:

1. Long-Term Revenue Growth Shows Momentum

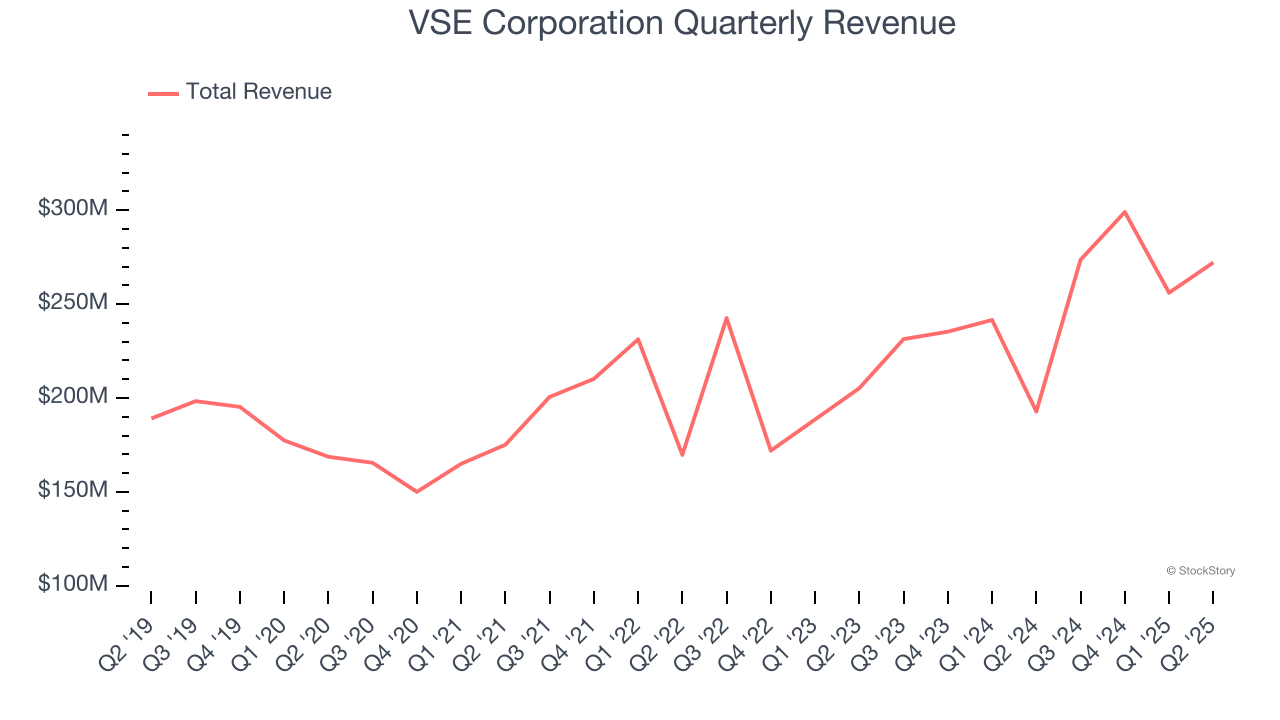

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, VSE Corporation’s 8.3% annualized revenue growth over the last five years was decent. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

2. Operating Margin Rising, Profits Up

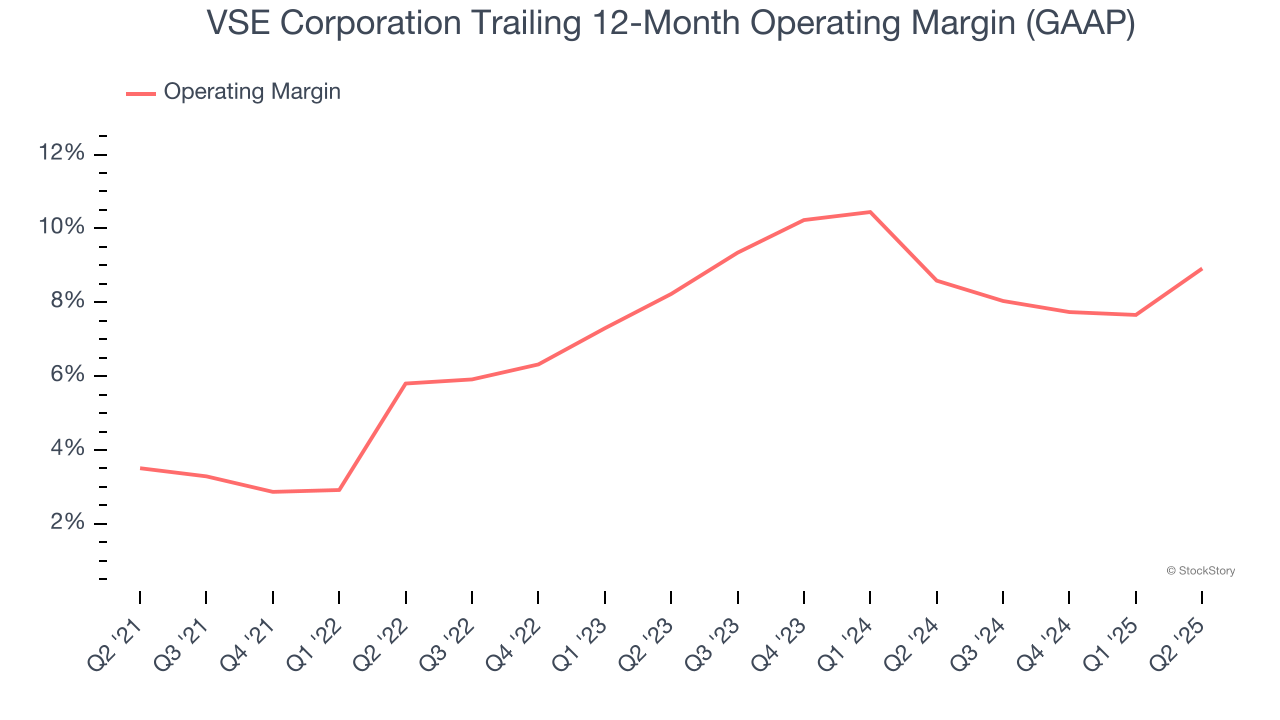

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

VSE Corporation’s operating margin rose by 5.4 percentage points over the last five years, as its sales growth gave it immense operating leverage. Its operating margin for the trailing 12 months was 8.9%.

One Reason to be Careful:

Cash Burn Ignites Concerns

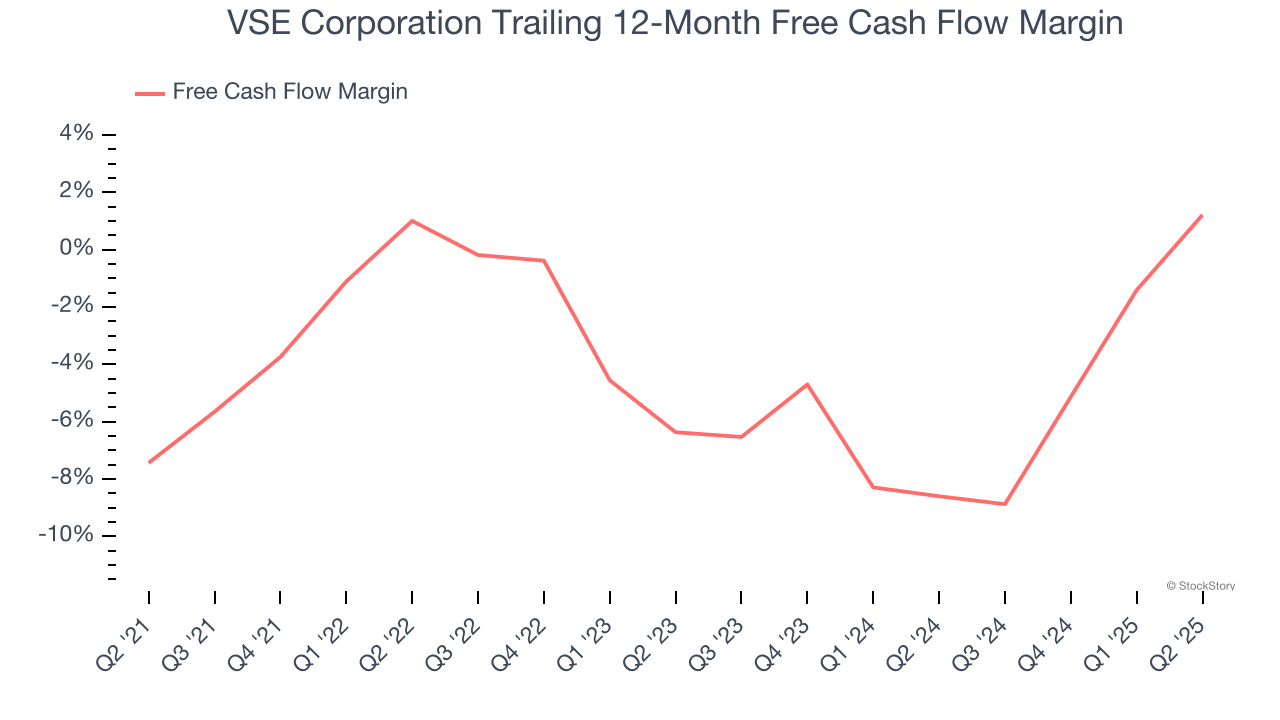

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While VSE Corporation posted positive free cash flow this quarter, the broader story hasn’t been so clean. VSE Corporation’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 3.7%, meaning it lit $3.66 of cash on fire for every $100 in revenue.

Final Judgment

VSE Corporation’s merits more than compensate for its flaws, and after the recent surge, the stock trades at 41.5× forward P/E (or $161.99 per share). Is now a good time to buy despite the apparent froth? See for yourself in our full research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.