Health and wellness products company USANA Health Sciences (NYSE: USNA) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 6.7% year on year to $213.7 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $920 million at the midpoint. Its non-GAAP loss of $0.15 per share was in line with analysts’ consensus estimates.

Is now the time to buy USANA? Find out by accessing our full research report, it’s free for active Edge members.

USANA (USNA) Q3 CY2025 Highlights:

- Revenue: $213.7 million vs analyst estimates of $213.9 million (6.7% year-on-year growth, in line)

- Adjusted EPS: -$0.15 vs analyst estimates of -$0.15 (in line)

- Adjusted EBITDA: $14.59 million vs analyst estimates of $13.78 million (6.8% margin, 5.8% beat)

- The company dropped its revenue guidance for the full year to $920 million at the midpoint from $960 million, a 4.2% decrease

- Management lowered its full-year Adjusted EPS guidance to $1.73 at the midpoint, a 35.3% decrease

- EBITDA guidance for the full year is $98 million at the midpoint, above analyst estimates of $96.74 million

- Operating Margin: 0.6%, down from 7.8% in the same quarter last year

- Market Capitalization: $384.3 million

“USANA provided third quarter results in line with the preliminary results we announced on October 9, 2025,” said Jim Brown, President and Chief Executive Officer.

Company Overview

Going to market with a direct selling model rather than through traditional retailers, USANA Health Sciences (NYSE: USNA) manufactures and sells nutritional, personal care, and skincare products.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $912.7 million in revenue over the past 12 months, USANA is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

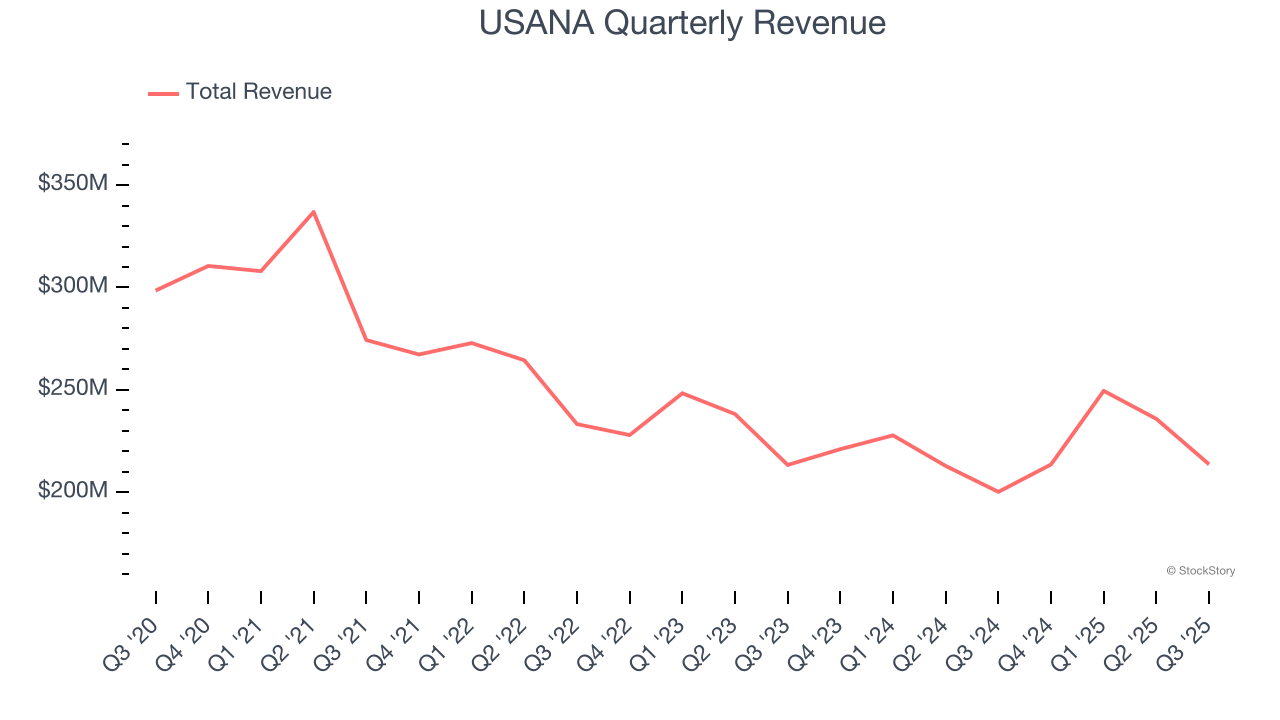

As you can see below, USANA’s demand was weak over the last three years. Its sales fell by 4.2% annually, a poor baseline for our analysis.

This quarter, USANA grew its revenue by 6.7% year on year, and its $213.7 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.3% over the next 12 months. While this projection suggests its newer products will fuel better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Cash Is King

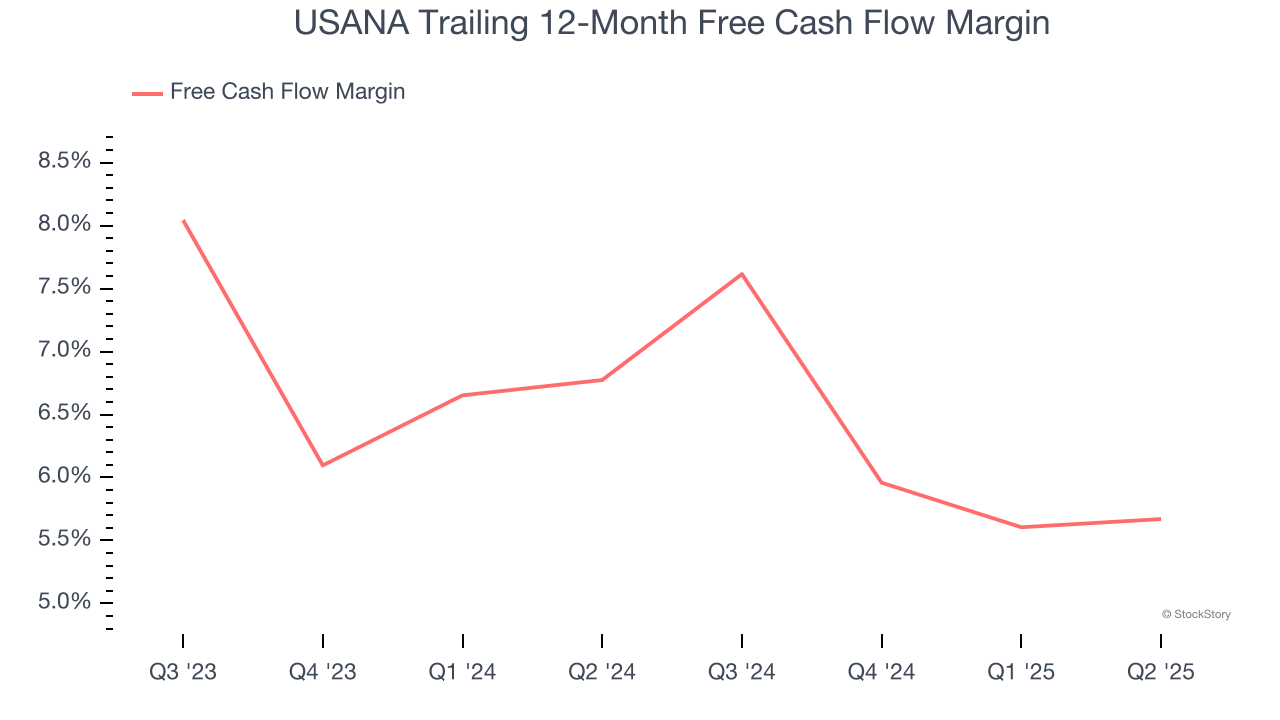

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

USANA has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.7% over the last two years, slightly better than the broader consumer staples sector.

Key Takeaways from USANA’s Q3 Results

Revenue and EPS met Wall Street's expectations. However, the company lowered full-year revenue and EPS guidance, which is usually a big negative. The stock traded down 10.2% to $18.80 immediately after reporting.

So do we think USANA is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.