Over the past six months, Rapid7’s stock price fell to $19.56. Shareholders have lost 19.3% of their capital, which is disappointing considering the S&P 500 has climbed by 22.9%. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Rapid7, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Do We Think Rapid7 Will Underperform?

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons we avoid RPD and a stock we'd rather own.

1. Weak ARR Points to Soft Demand

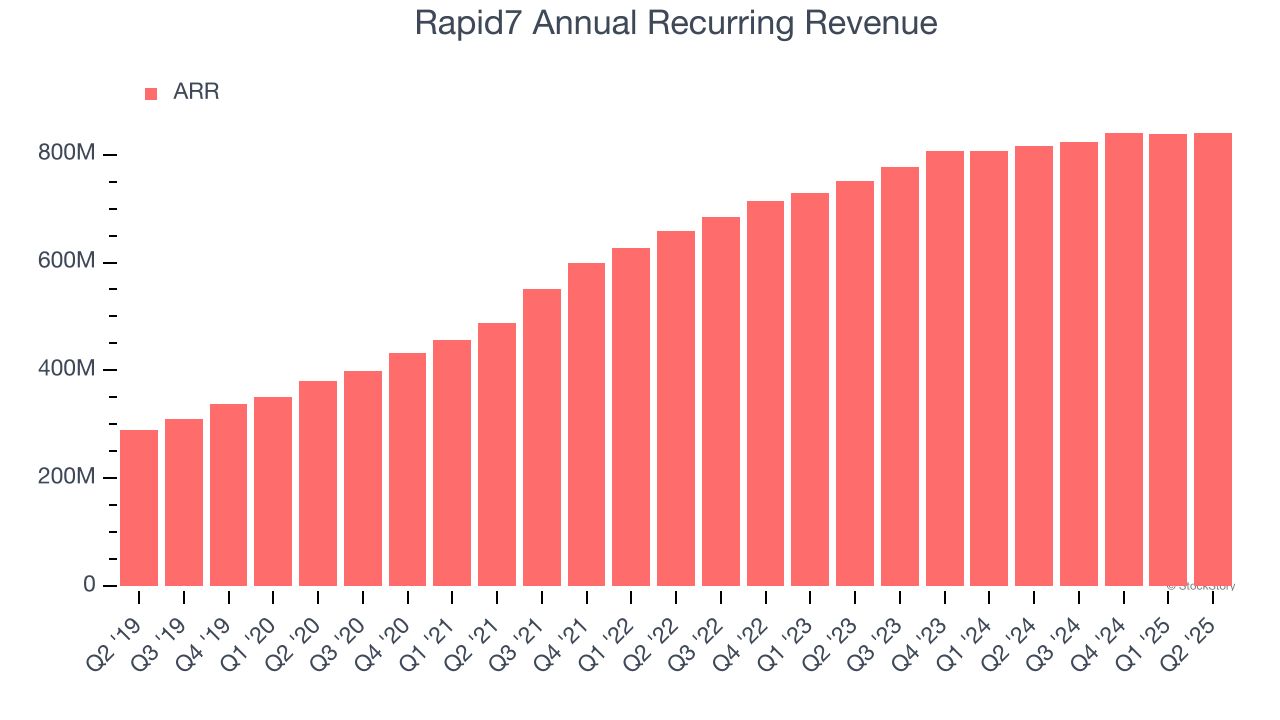

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Rapid7’s ARR came in at $840.6 million in Q2, and over the last four quarters, its year-on-year growth averaged 4.2%. This performance was underwhelming and suggests that increasing competition is causing challenges in securing longer-term commitments.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Rapid7’s revenue to rise by 1.8%, a deceleration versus its 18.4% annualized growth for the past five years. This projection doesn't excite us and implies its products and services will face some demand challenges.

3. Operating Margin Rising, Profits Up

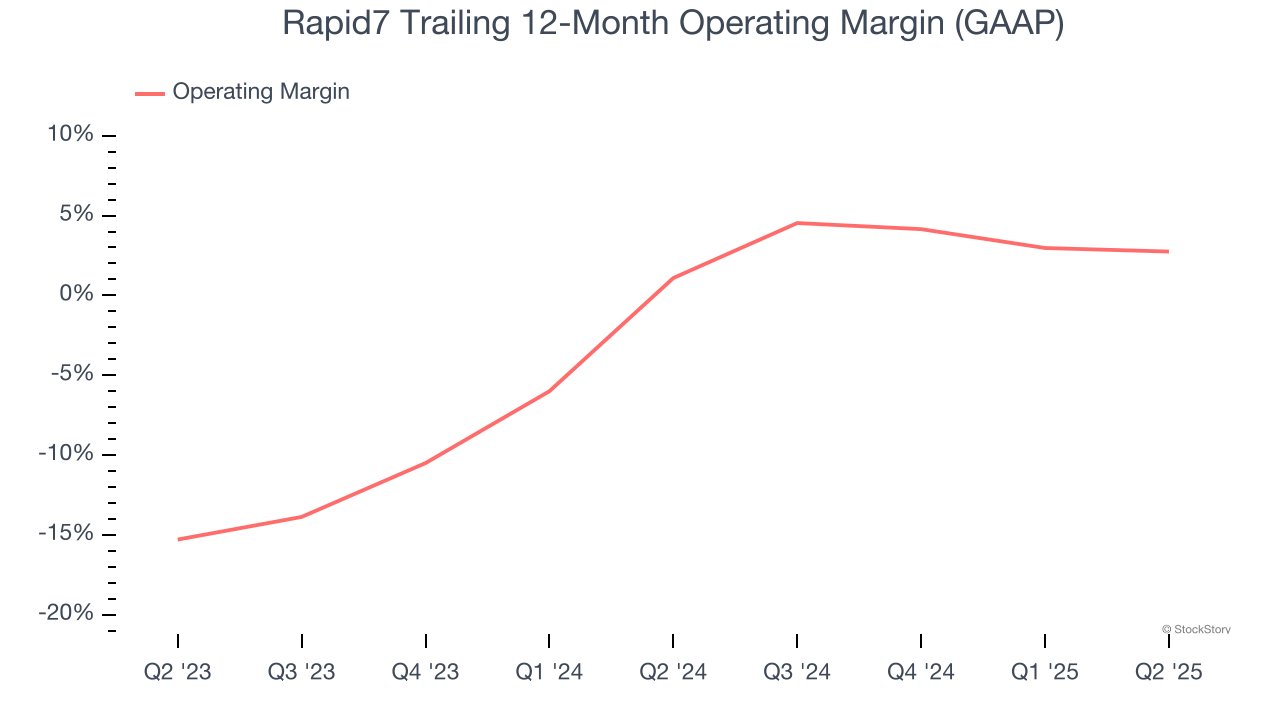

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Analyzing the trend in its profitability, Rapid7’s operating margin rose by 1.7 percentage points over the last two years, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 2.7%.

Final Judgment

Rapid7 doesn’t pass our quality test. Following the recent decline, the stock trades at 1.4× forward price-to-sales (or $19.56 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are more exciting stocks to buy at the moment. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Rapid7

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.