Shareholders of Alight would probably like to forget the past six months even happened. The stock dropped 40.6% and now trades at $3.09. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Alight, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Do We Think Alight Will Underperform?

Despite the more favorable entry price, we're cautious about Alight. Here are three reasons we avoid ALIT and a stock we'd rather own.

1. Revenue Spiraling Downwards

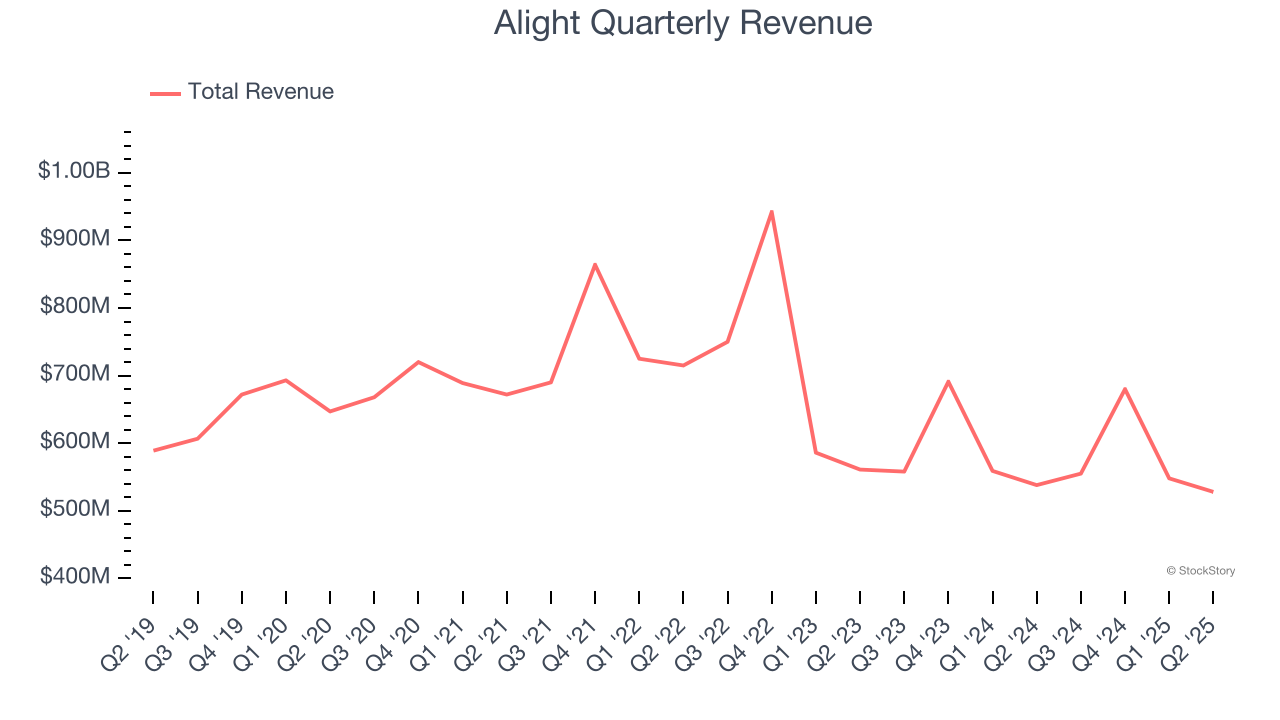

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Alight’s demand was weak over the last five years as its sales fell at a 2.5% annual rate. This wasn’t a great result and signals it’s a low quality business.

2. EPS Barely Growing

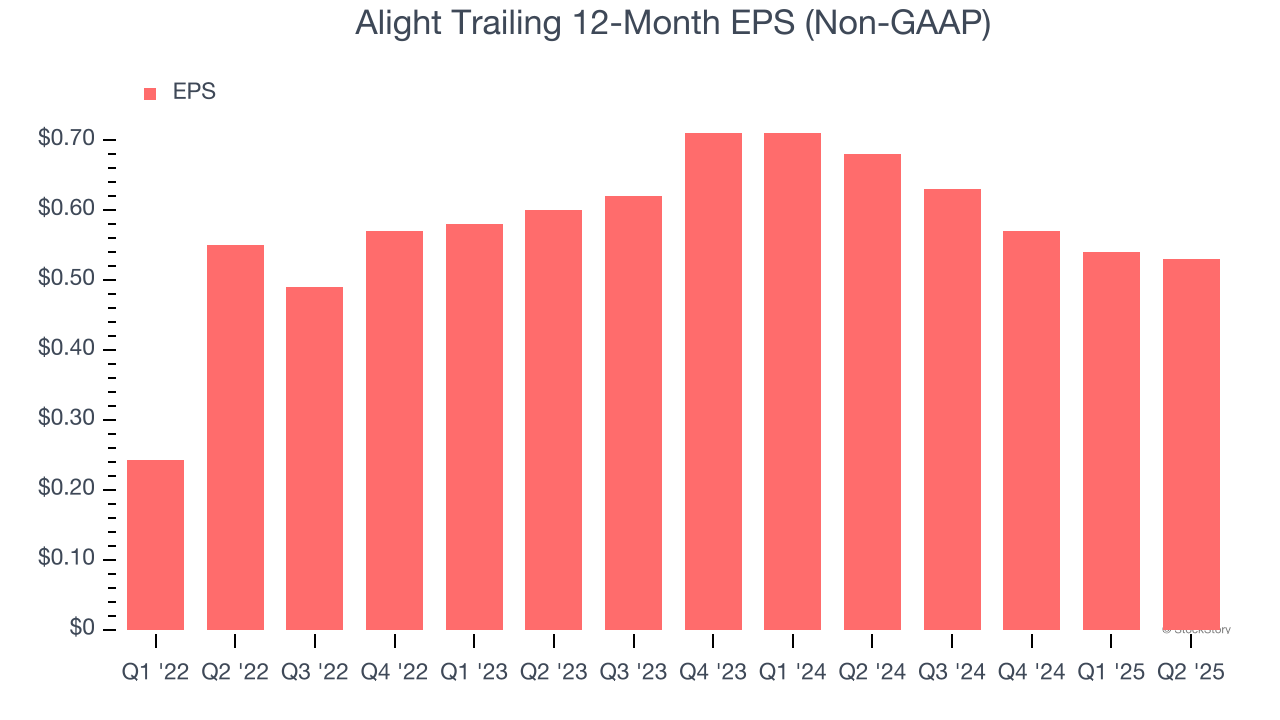

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Alight’s full-year EPS grew at a weak 2.1% compounded annual growth rate over the last three years, worse than the broader business services sector.

3. New Investments Fail to Bear Fruit as ROIC Declines

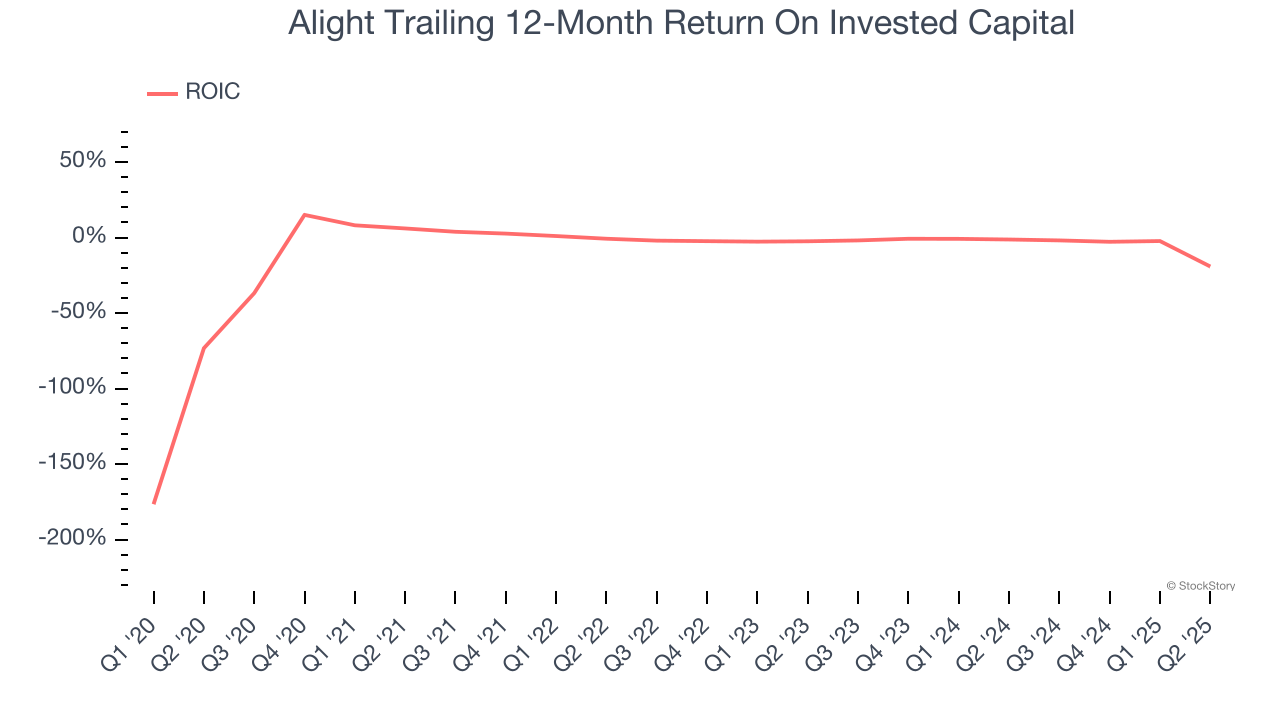

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Alight’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Alight doesn’t pass our quality test. Following the recent decline, the stock trades at 4.9× forward P/E (or $3.09 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. We’d suggest looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Would Buy Instead of Alight

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.