Let’s dig into the relative performance of Ulta (NASDAQ: ULTA) and its peers as we unravel the now-completed Q2 beauty and cosmetics retailer earnings season.

Beauty and cosmetics retailers understand that beauty is in the eye of the beholder, but a little lipstick, nail polish, and glowing skin also help the cause. These stores—which mostly cater to consumers but can also garner the attention of salon pros—aim to be a one-stop personal care and beauty products shop with many brands across many categories. E-commerce is changing how consumers buy cosmetics, so these retailers are constantly evolving to meet the customer where and how they want to shop.

The 4 beauty and cosmetics retailer stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Best Q2: Ulta (NASDAQ: ULTA)

Offering high-end prestige brands as well as lower-priced, mass-market ones, Ulta Beauty (NASDAQ: ULTA) is an American retailer that sells makeup, skincare, haircare, and fragrance products.

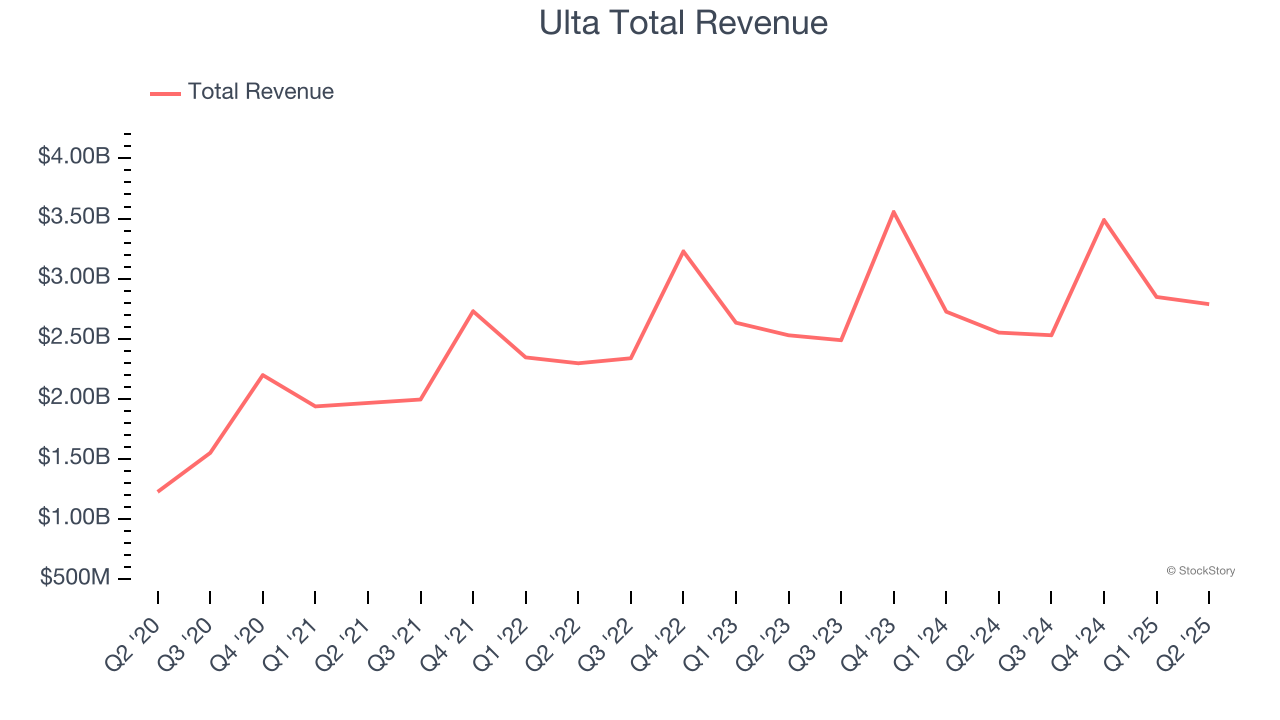

Ulta reported revenues of $2.79 billion, up 9.3% year on year. This print exceeded analysts’ expectations by 4.2%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ revenue estimates.

Ulta achieved the biggest analyst estimates beat and highest full-year guidance raise of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 3.9% since reporting and currently trades at $509.64.

Sally Beauty (NYSE: SBH)

Catering to both everyday consumers as well as salon professionals, Sally Beauty (NYSE: SBH) is a retailer that sells salon-quality beauty products such as makeup and haircare products.

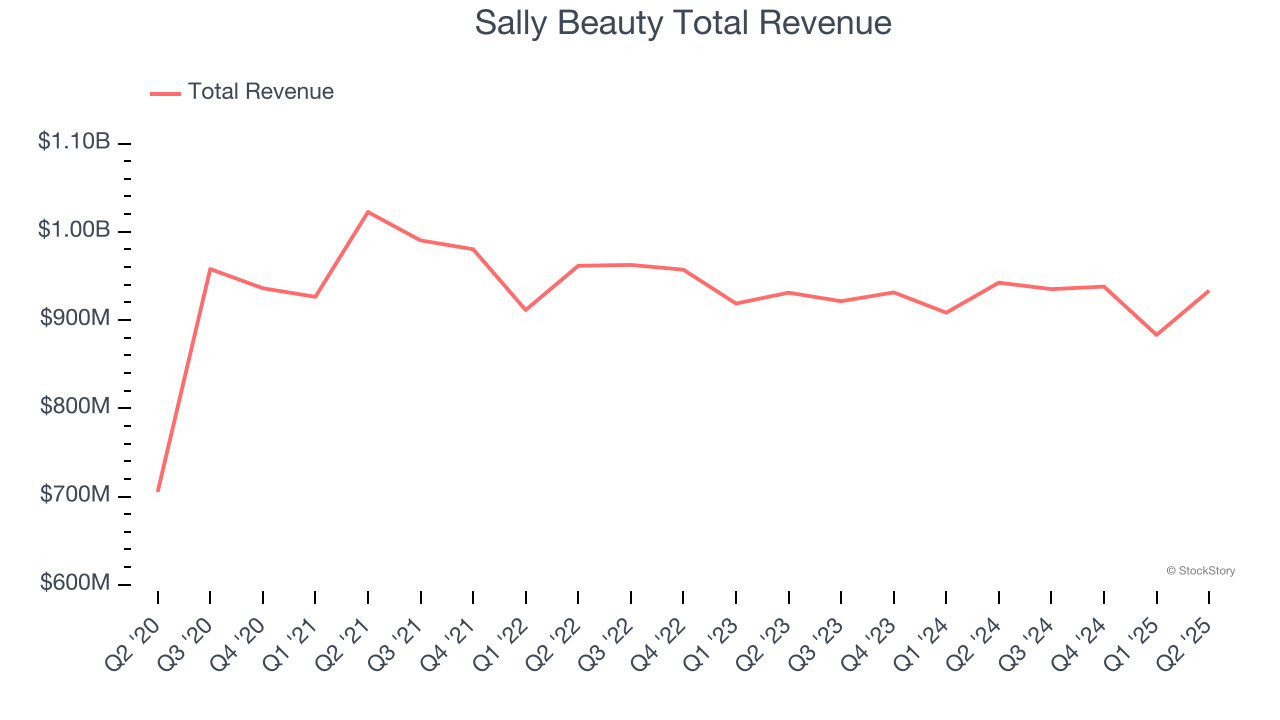

Sally Beauty reported revenues of $933.3 million, flat year on year, in line with analysts’ expectations. The business had a very strong quarter with an impressive beat of analysts’ EBITDA and EPS estimates.

The market seems happy with the results as the stock is up 45.3% since reporting. It currently trades at $14.49.

Is now the time to buy Sally Beauty? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Bath and Body Works (NYSE: BBWI)

Spun off from L Brands in 2020, Bath & Body Works (NYSE: BBWI) is a personal care and home fragrance retailer where consumers can find specialty shower gels, scented candles for the home, and lotions.

Bath and Body Works reported revenues of $1.55 billion, up 1.5% year on year, in line with analysts’ expectations. It was a softer quarter as it posted EPS guidance for next quarter missing analysts’ expectations.

Bath and Body Works delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 23.8% since the results and currently trades at $24.02.

Read our full analysis of Bath and Body Works’s results here.

Warby Parker (NYSE: WRBY)

Founded in 2010, Warby Parker (NYSE: WRBY) designs, manufactures, and sells eyewear, including prescription glasses, sunglasses, and contact lenses, through its e-commerce platform and physical retail locations.

Warby Parker reported revenues of $214.5 million, up 13.9% year on year. This number topped analysts’ expectations by 0.7%. It was a very strong quarter as it also put up a solid beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Warby Parker scored the fastest revenue growth but had the weakest full-year guidance update among its peers. The stock is down 20.7% since reporting and currently trades at $19.27.

Read our full, actionable report on Warby Parker here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.