The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how healthcare technology stocks fared in Q3, starting with Hims & Hers Health (NYSE: HIMS).

Healthcare Technology

The 8 healthcare technology stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 4.3% while next quarter’s revenue guidance was 0.9% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Hims & Hers Health (NYSE: HIMS)

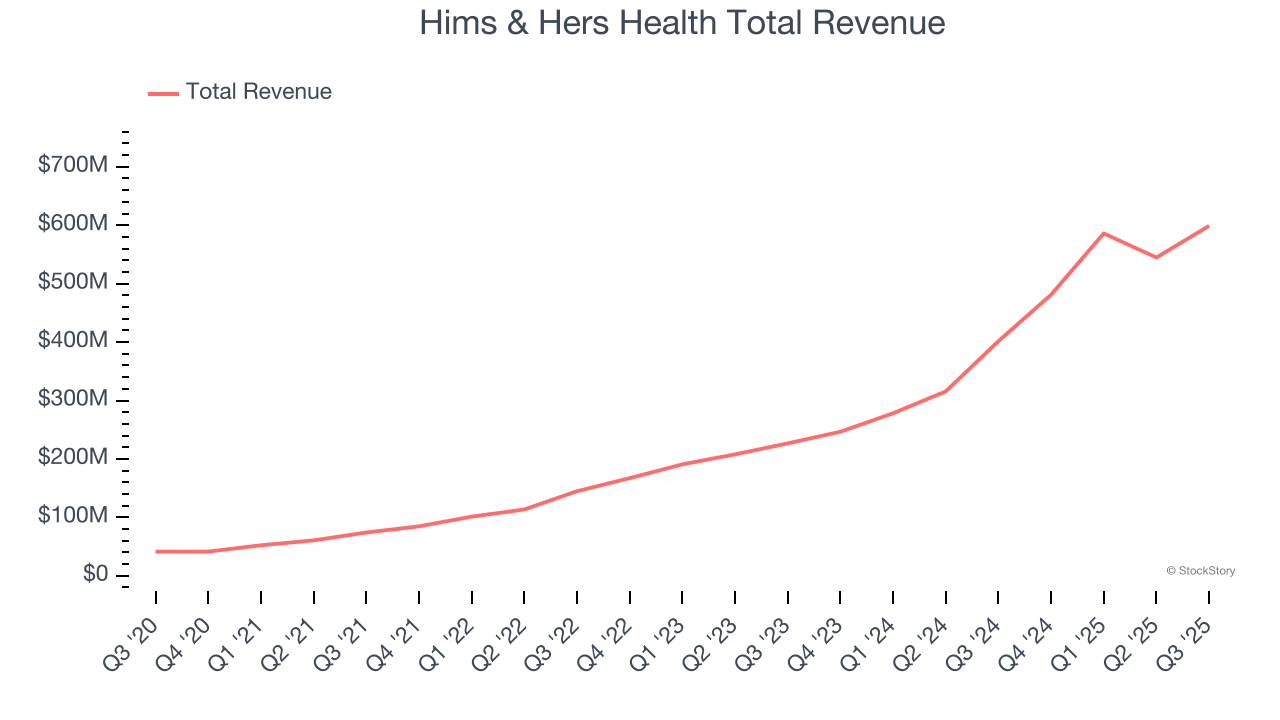

Originally launched with a focus on stigmatized conditions like hair loss and sexual health, Hims & Hers Health (NYSE: HIMS) operates a consumer-focused telehealth platform that connects patients with healthcare providers for prescriptions and wellness products.

Hims & Hers Health reported revenues of $599 million, up 49.2% year on year. This print exceeded analysts’ expectations by 3.3%. Despite the top-line beat, it was still a mixed quarter for the company with a beat of analysts’ EPS estimates but revenue guidance for next quarter missing analysts’ expectations significantly.

“This quarter we continued to prove that our vision of helping tens of millions of people around the world access best-in-class, personalized care, from the comfort of their own home is more real than ever. We’re building a platform that gets more personal, more proactive, and resonates with more people as we scale,” said Andrew Dudum, co-founder and CEO.

Unsurprisingly, the stock is down 9.9% since reporting and currently trades at $39.99.

Is now the time to buy Hims & Hers Health? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Privia Health (NASDAQ: PRVA)

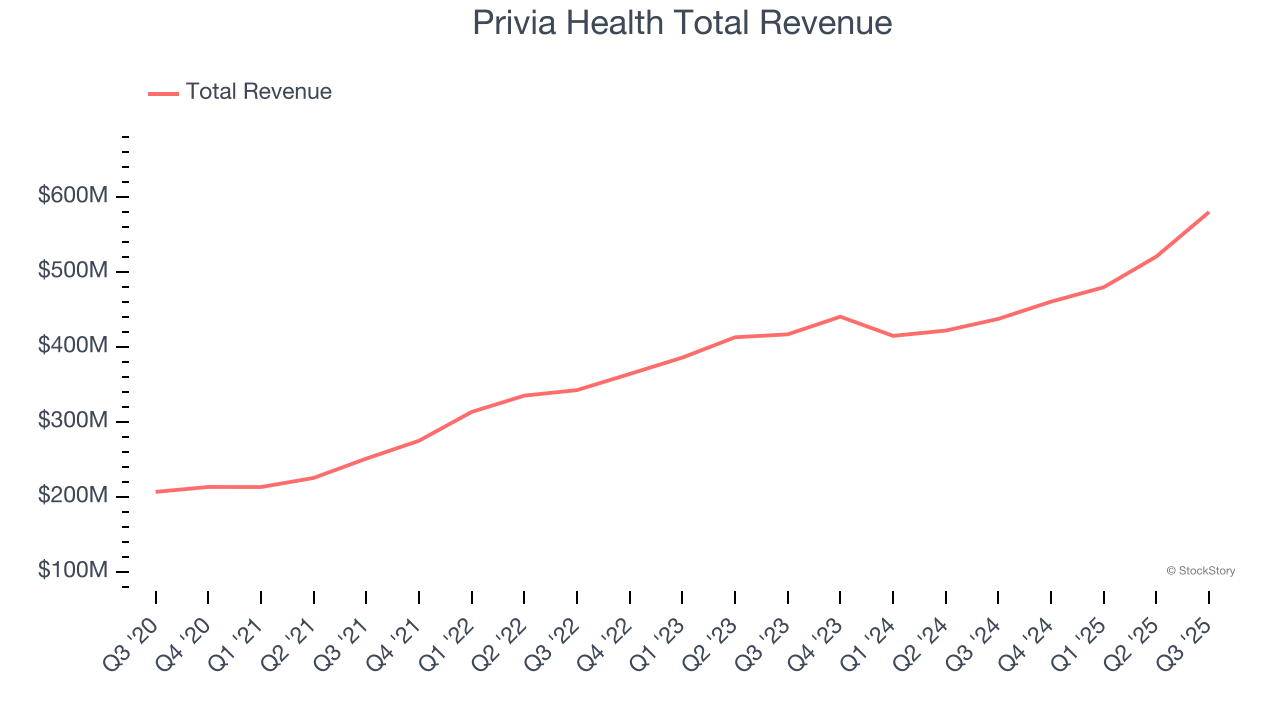

Operating in 13 states and the District of Columbia with over 4,300 providers serving more than 4.8 million patients, Privia Health (NASDAQ: PRVA) is a technology-driven company that helps physicians optimize their practices, improve patient experiences, and transition to value-based care models.

Privia Health reported revenues of $580.4 million, up 32.5% year on year, outperforming analysts’ expectations by 16.6%. The business had a stunning quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ revenue estimates.

Privia Health pulled off the biggest analyst estimates beat and highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 3% since reporting. It currently trades at $24.29.

Is now the time to buy Privia Health? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Astrana Health (NASDAQ: ASTH)

Formerly known as Apollo Medical Holdings until early 2024, Astrana Health (NASDAQ: ASTH) operates a technology-powered healthcare platform that enables physicians to deliver coordinated care while successfully participating in value-based payment models.

Astrana Health reported revenues of $956 million, up 99.7% year on year, exceeding analysts’ expectations by 0.6%. Still, it was a softer quarter as it posted a significant miss of analysts’ EPS estimates and full-year revenue guidance missing analysts’ expectations.

Astrana Health delivered the fastest revenue growth but had the weakest full-year guidance update in the group. As expected, the stock is down 28.1% since the results and currently trades at $24.

Read our full analysis of Astrana Health’s results here.

Premier (NASDAQ: PINC)

Operating one of the largest healthcare group purchasing organizations in the United States with over 4,350 hospital members, Premier (NASDAQ: PINC) is a technology-driven healthcare improvement company that helps hospitals, health systems, and other providers reduce costs and improve clinical outcomes.

Premier reported revenues of $240 million, down 3.3% year on year. This number came in 1% below analysts' expectations. More broadly, it was a mixed quarter as it also recorded a beat of analysts’ EPS estimates but a slight miss of analysts’ revenue estimates.

Premier had the weakest performance against analyst estimates among its peers. The stock is flat since reporting and currently trades at $28.19.

Read our full, actionable report on Premier here, it’s free for active Edge members.

Omnicell (NASDAQ: OMCL)

Driven by the vision of an "Autonomous Pharmacy" with zero medication errors, Omnicell (NASDAQ: OMCL) provides medication management automation and adherence tools that help healthcare systems and pharmacies reduce errors and improve efficiency.

Omnicell reported revenues of $310.6 million, up 10% year on year. This result topped analysts’ expectations by 5%. It was a very strong quarter as it also recorded a beat of analysts’ EPS estimates and a solid beat of analysts’ revenue estimates.

The stock is up 23.5% since reporting and currently trades at $36.51.

Read our full, actionable report on Omnicell here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.