Over the last six months, Home Bancshares’s shares have sunk to $27.16, producing a disappointing 7% loss - a stark contrast to the S&P 500’s 16.3% gain. This may have investors wondering how to approach the situation.

Following the drawdown, is now an opportune time to buy HOMB? Find out in our full research report, it’s free for active Edge members.

Why Does Home Bancshares Spark Debate?

Founded in Conway, Arkansas in 1998 and growing through strategic acquisitions across the Southeast, Home Bancshares (NYSE: HOMB) operates as the bank holding company for Centennial Bank, providing commercial and retail banking services to businesses and individuals across multiple states.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities.

Luckily, Home Bancshares’s revenue grew at an impressive 9.4% compounded annual growth rate over the last five years. Its growth beat the average banking company and shows its offerings resonate with customers.

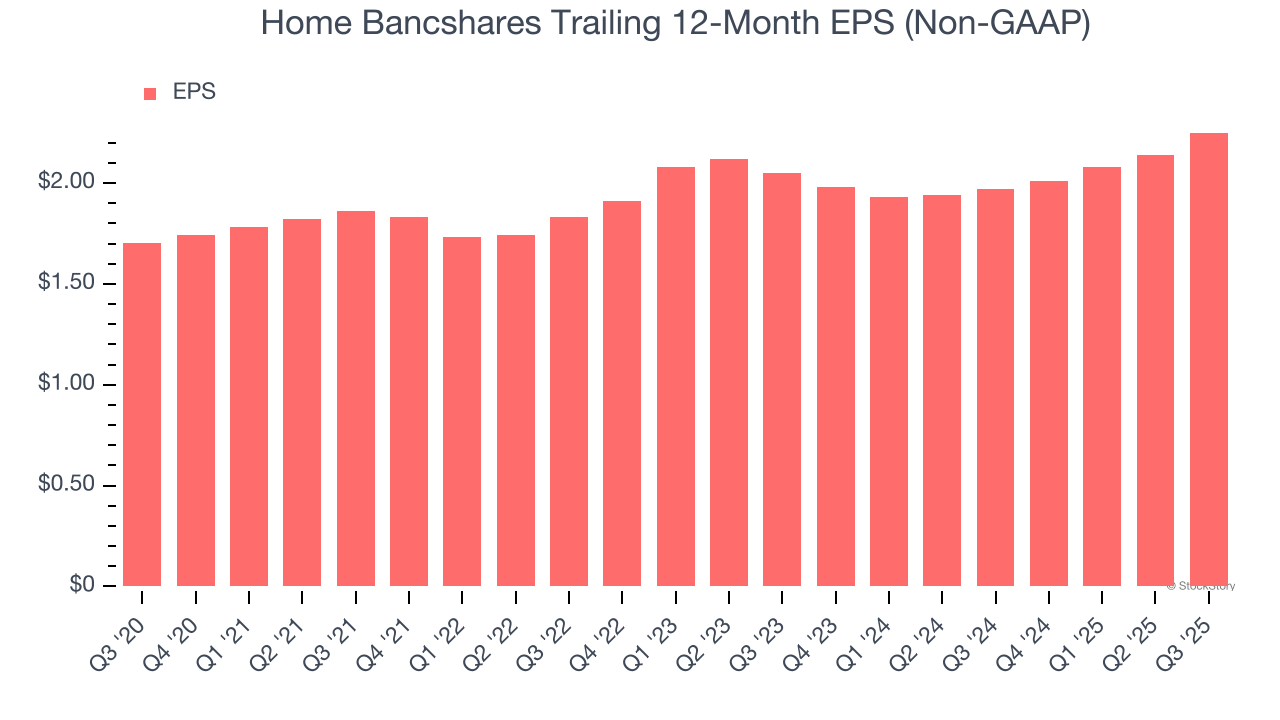

2. EPS Moving Up Steadily

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Home Bancshares’s EPS grew at a decent 5.8% compounded annual growth rate over the last five years. This performance was better than most banking businesses.

One Reason to be Careful:

Projected Net Interest Income Growth Is Slim

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Home Bancshares’s net interest income to rise by 3.5%, close to its 2.2% annualized growth for the past two years.

Final Judgment

Home Bancshares’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 1.3× forward P/B (or $27.16 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.