Although Mission Produce (currently trading at $11.43 per share) has gained 6.1% over the last six months, it has trailed the S&P 500’s 11.3% return during that period. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Mission Produce, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Do We Think Mission Produce Will Underperform?

We're swiping left on Mission Produce for now. Here are three reasons there are better opportunities than AVO and a stock we'd rather own.

1. Fewer Distribution Channels Limit its Ceiling

With $1.43 billion in revenue over the past 12 months, Mission Produce is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Mission Produce’s revenue to drop by 7.1%, a decrease from This projection is underwhelming and indicates its products will face some demand challenges.

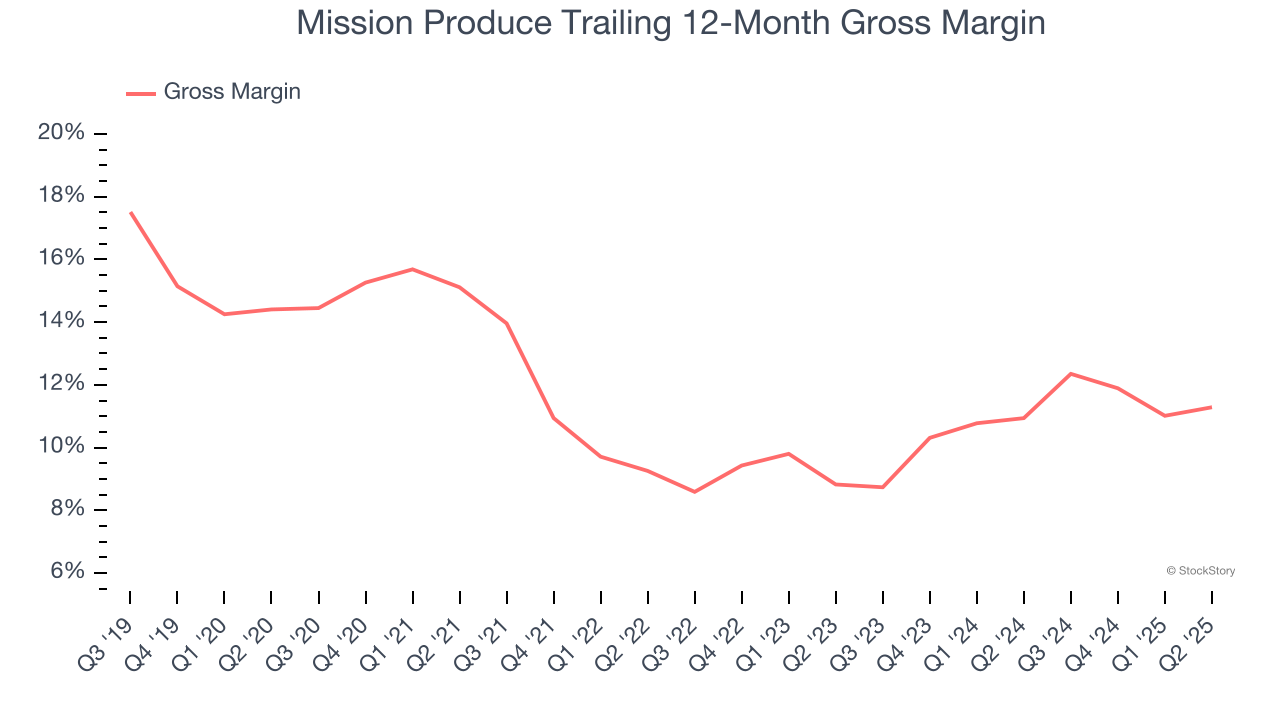

3. Low Gross Margin Reveals Weak Structural Profitability

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Mission Produce has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 11.1% gross margin over the last two years. Said differently, for every $100 in revenue, a chunky $88.87 went towards paying for raw materials, production of goods, transportation, and distribution.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Mission Produce, we’ll be cheering from the sidelines. With its shares trailing the market in recent months, the stock trades at 17.3× forward P/E (or $11.43 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Mission Produce

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.