American Eagle has been on fire lately. In the past six months alone, the company’s stock price has rocketed 50.4%, reaching $16.71 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in American Eagle, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is American Eagle Not Exciting?

Despite the momentum, we're cautious about American Eagle. Here are three reasons we avoid AEO and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

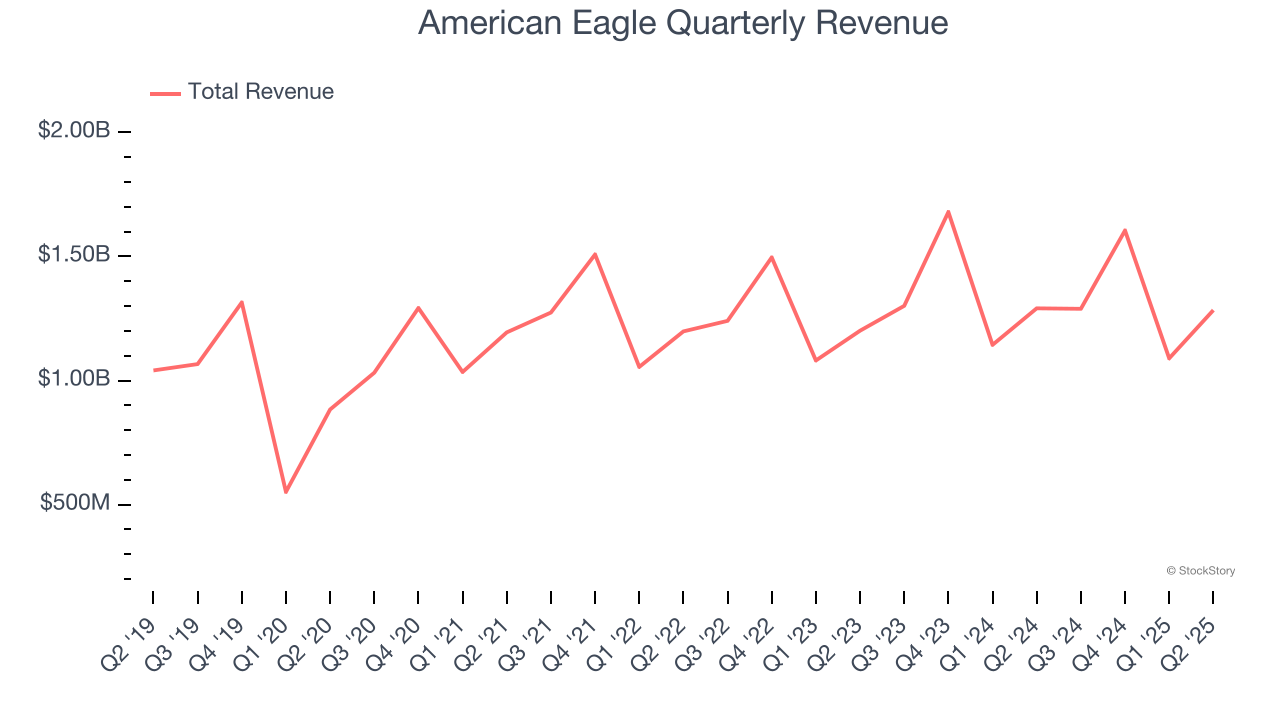

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last six years, American Eagle grew its sales at a sluggish 3.9% compounded annual growth rate. This was below our standard for the consumer retail sector.

2. Weak Operating Margin Could Cause Trouble

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

American Eagle’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 5.4% over the last two years. This profitability was paltry for a consumer retail business and caused by its suboptimal cost structure.

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

American Eagle historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.3%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

Final Judgment

American Eagle isn’t a terrible business, but it doesn’t pass our quality test. After the recent surge, the stock trades at 12× forward P/E (or $16.71 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere. Let us point you toward one of our top digital advertising picks.

Stocks We Like More Than American Eagle

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.