MasTec currently trades at $218.54 and has been a dream stock for shareholders. It’s returned 249% since December 2020, tripling the S&P 500’s 84.3% gain. The company has also beaten the index over the past six months as its stock price is up 38.6% thanks to its solid quarterly results.

Is now the time to buy MasTec, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Is MasTec Not Exciting?

Despite the momentum, we don't have much confidence in MasTec. Here are three reasons why MTZ doesn't excite us and a stock we'd rather own.

1. Low Gross Margin Reveals Weak Structural Profitability

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products and commands stronger pricing power.

MasTec has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 12.9% gross margin over the last five years. Said differently, MasTec had to pay a chunky $87.07 to its suppliers for every $100 in revenue.

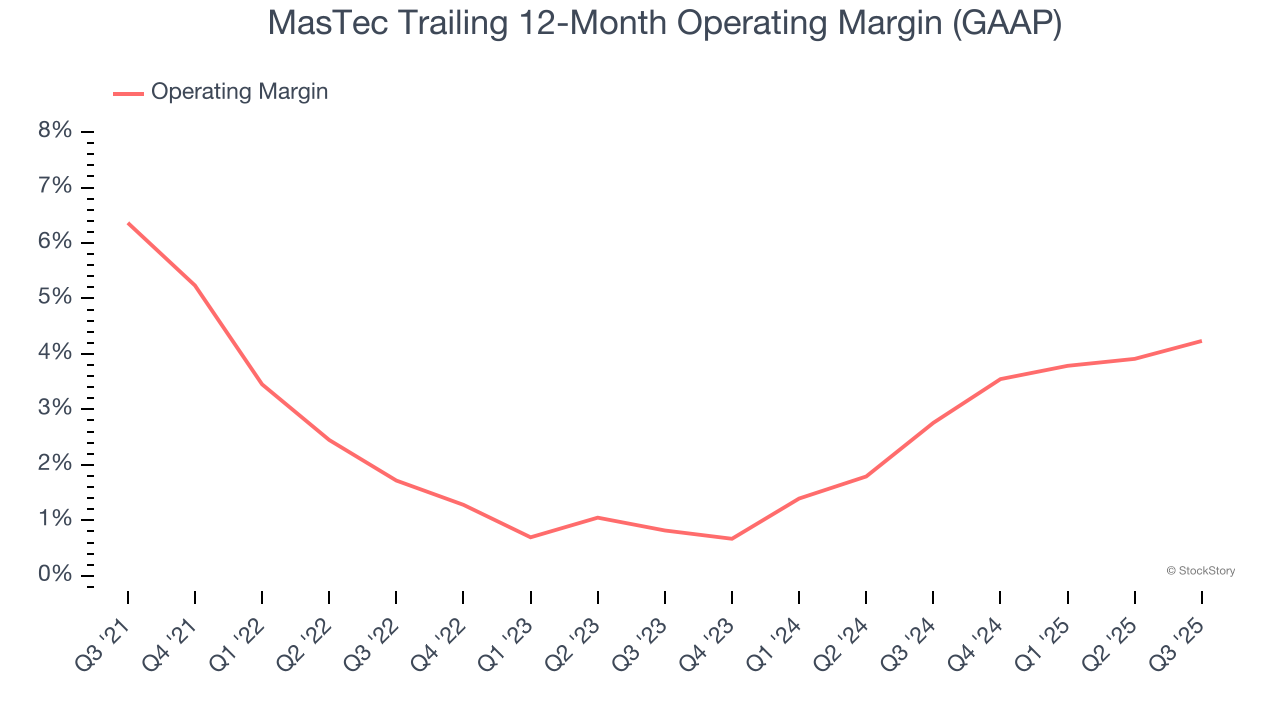

2. Weak Operating Margin Could Cause Trouble

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

MasTec was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.1% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

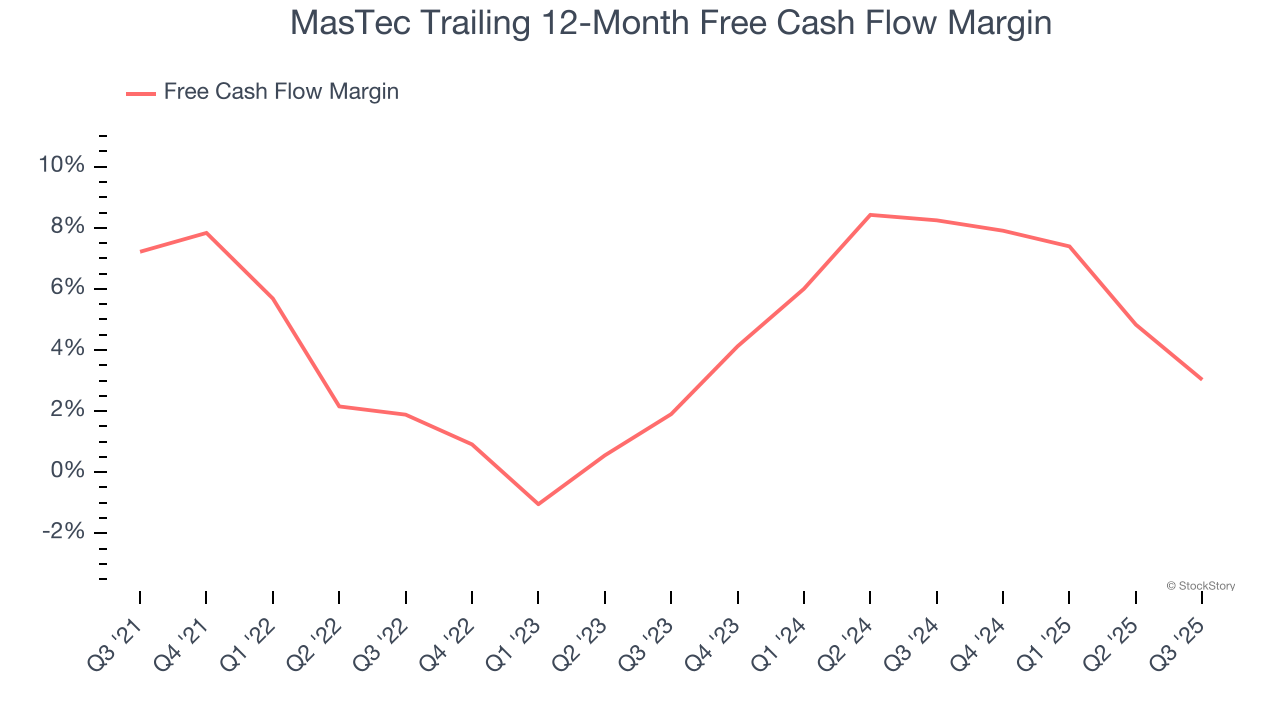

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, MasTec’s margin dropped by 4.2 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business. MasTec’s free cash flow margin for the trailing 12 months was 3%.

Final Judgment

MasTec isn’t a terrible business, but it isn’t one of our picks. With its shares outperforming the market lately, the stock trades at 28× forward P/E (or $218.54 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Like More Than MasTec

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.