Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Potbelly (NASDAQ: PBPB) and the best and worst performers in the modern fast food industry.

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

The 7 modern fast food stocks we track reported a mixed Q4. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 14% since the latest earnings results.

Potbelly (NASDAQ: PBPB)

With a unique origin story where the company actually started as an antique shop, Potbelly (NASDAQ: PBPB) today is a chain known for its toasty sandwiches.

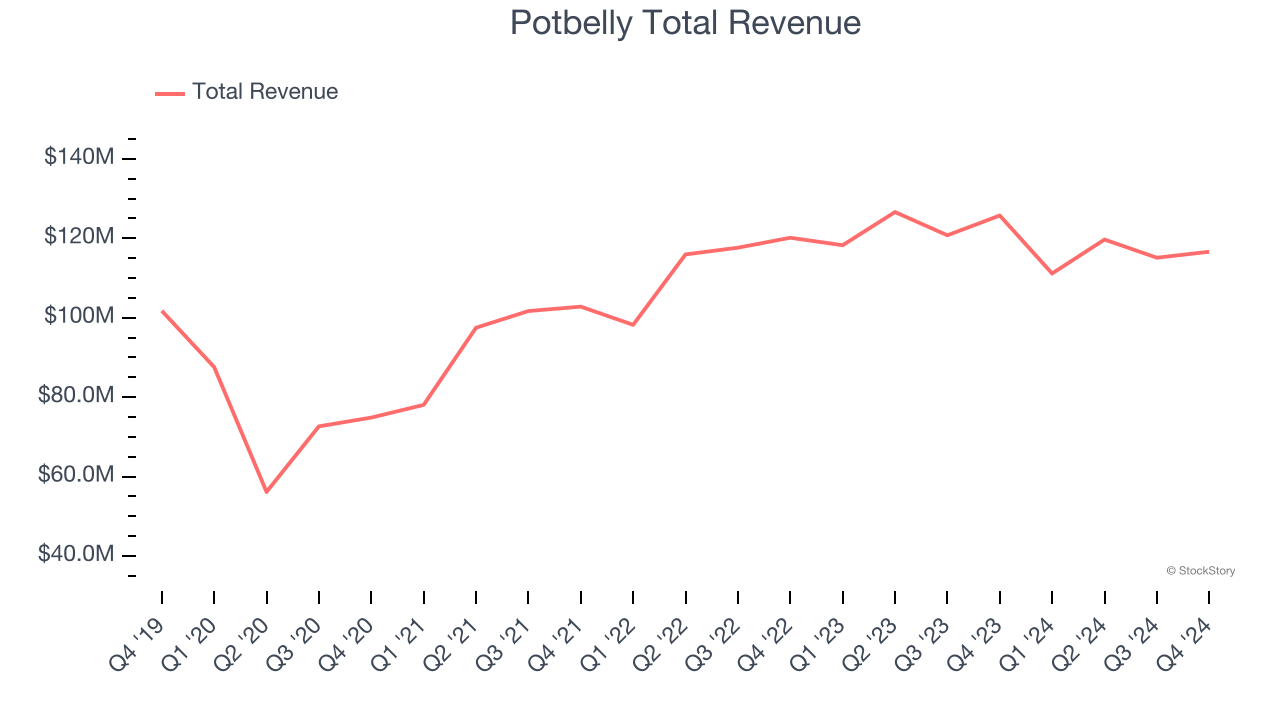

Potbelly reported revenues of $116.6 million, down 7.3% year on year. This print was in line with analysts’ expectations, and overall, it was a very strong quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Bob Wright, President and Chief Executive Officer of Potbelly Corporation, commented, “We are pleased with what we have accomplished in 2024 as our team did a tremendous job executing against our five-pillar strategy. From re-igniting unit growth with 23 new shop openings and adding 115 shops to our open and committed shop total, to driving a 15% increase in Adjusted EBITDA and developing strong growth drivers with the enhancement of our perks loyalty program and significant menu innovation work, we believe we have taken yet another step toward achieving Potbelly’s long-term growth objectives. As we look ahead, we will continue to drive comp sales growth through menu innovation and investments in customer-facing digital assets, accelerate unit growth with a strong unit development pipeline and modernize our footprint, and exercise smart cost management to further improve profitability. We believe we have positioned Potbelly well for growth in 2025 and beyond.”

Potbelly delivered the slowest revenue growth of the whole group. The stock is down 15.4% since reporting and currently trades at $10.

Is now the time to buy Potbelly? Access our full analysis of the earnings results here, it’s free.

Best Q4: CAVA (NYSE: CAVA)

Starting from a single Washington, D.C. location, CAVA (NYSE: CAVA) operates a fast-casual restaurant chain offering customizable Mediterranean-inspired dishes.

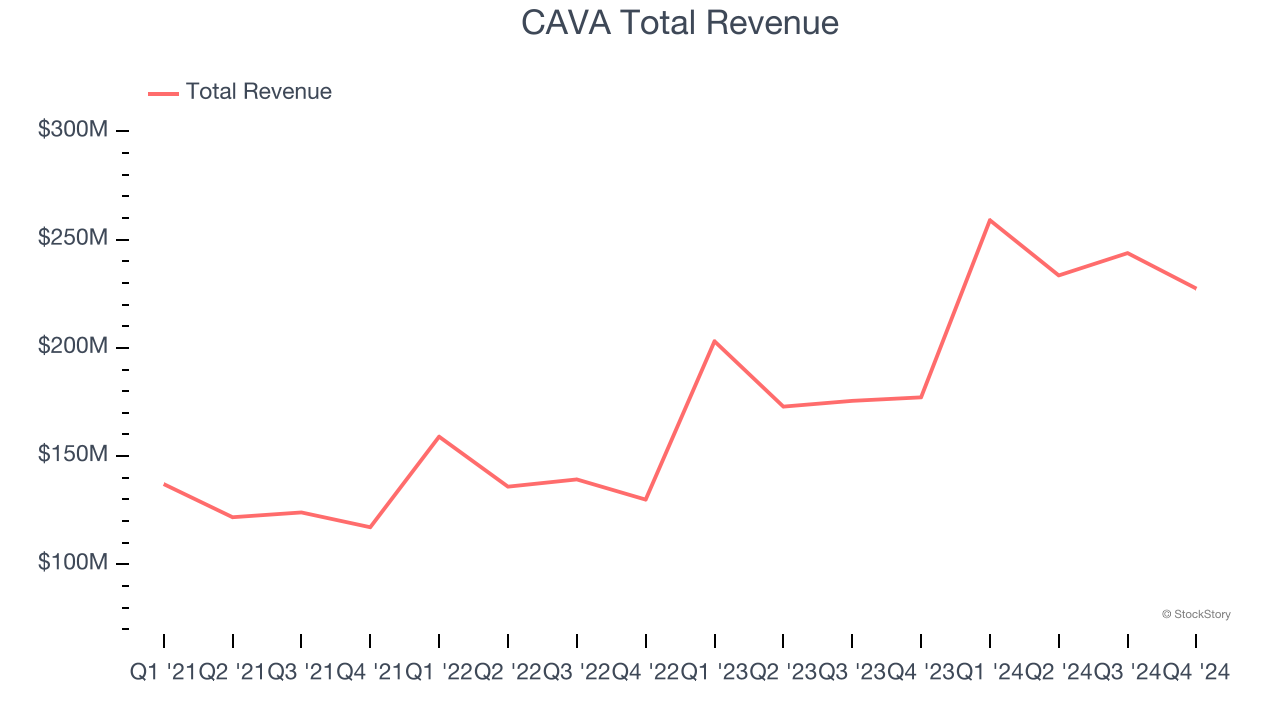

CAVA reported revenues of $227.4 million, up 28.3% year on year, outperforming analysts’ expectations by 2.2%. The business had a very strong quarter with an impressive beat of analysts’ EPS estimates and an impressive beat of analysts’ same-store sales estimates.

CAVA pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 18.6% since reporting. It currently trades at $80.84.

Is now the time to buy CAVA? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Sweetgreen (NYSE: SG)

Founded in 2007 by three Georgetown University alum, Sweetgreen (NYSE: SG) is a casual quick service chain known for its healthy salads and bowls.

Sweetgreen reported revenues of $160.9 million, up 5.1% year on year, in line with analysts’ expectations. It was a softer quarter as it posted a significant miss of analysts’ EBITDA estimates.

Sweetgreen delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 7.8% since the results and currently trades at $24.99.

Read our full analysis of Sweetgreen’s results here.

Shake Shack (NYSE: SHAK)

Started as a hot dog cart in New York City's Madison Square Park, Shake Shack (NYSE: SHAK) is a fast-food restaurant known for its burgers and milkshakes.

Shake Shack reported revenues of $328.7 million, up 14.8% year on year. This print met analysts’ expectations. Aside from that, it was a mixed quarter as its performance in some other areas of the business was disappointing.

The stock is down 21.1% since reporting and currently trades at $87.69.

Read our full, actionable report on Shake Shack here, it’s free.

Chipotle (NYSE: CMG)

Born from a desire to offer quick meals with fresh, flavorful ingredients, Chipotle (NYSE: CMG) is a fast-food chain known for its healthy, Mexican-inspired cuisine and customizable dishes.

Chipotle reported revenues of $2.85 billion, up 13.1% year on year. This result was in line with analysts’ expectations. Zooming out, it was a slower quarter as it logged a slight miss of analysts’ EBITDA estimates and same-store sales in line with analysts’ estimates.

The stock is down 14.6% since reporting and currently trades at $50.40.

Read our full, actionable report on Chipotle here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.