As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the therapeutics industry, including Sarepta Therapeutics (NASDAQ: SRPT) and its peers.

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

The 10 therapeutics stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 2.6%.

In light of this news, share prices of the companies have held steady as they are up 1.3% on average since the latest earnings results.

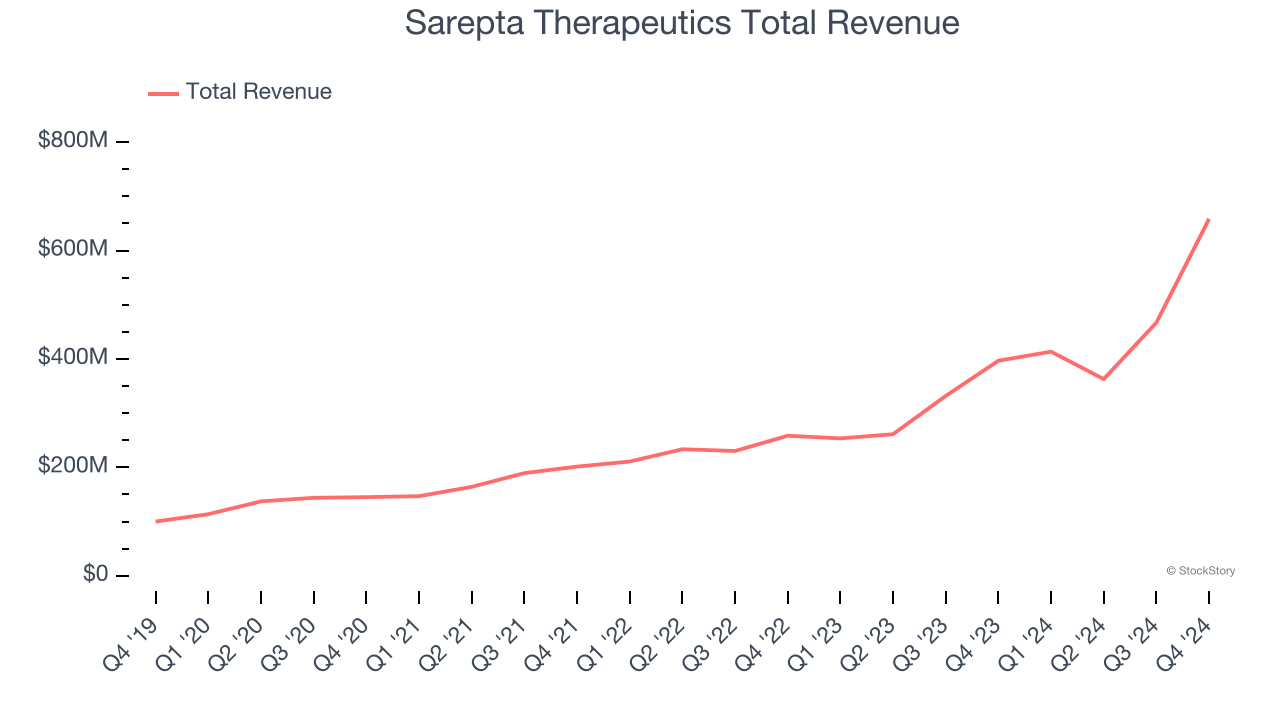

Sarepta Therapeutics (NASDAQ: SRPT)

Founded in 1980, Sarepta Therapeutics (NASDAQ: SRPT) is a biopharmaceutical company focused on developing precision genetic medicines to treat rare neuromuscular diseases, including Duchenne muscular dystrophy (muscle cell breakdown over time).

Sarepta Therapeutics reported revenues of $658.4 million, up 65.9% year on year. This print exceeded analysts’ expectations by 4.3%. Despite the top-line beat, it was still a mixed quarter for the company.

“2024 performance represented the fruition of our multi-year strategy to become a self-sustaining profitable biotech dedicated to improving the lives of patients with rare genetic disease. After obtaining a broad label for our gene therapy ELEVIDYS covering the vast majority of Duchenne patients, we had the most successful gene therapy launch in history, even as we continued to serve the community with our PMOs, EXONDYS 51, VYONDYS 53 and AMONDYS 45. And as we advanced our internal gene therapy pipeline, we also continued our diversification and secured our future by in-licensing a broad platform of siRNA programs, with potential blockbuster opportunities that could reach the market in 2028 and 2029,” said Doug Ingram, president and chief executive officer, Sarepta Therapeutics.

Sarepta Therapeutics achieved the fastest revenue growth of the whole group. Still, the market seems discontent with the results. The stock is down 5.8% since reporting and currently trades at $101.36.

Is now the time to buy Sarepta Therapeutics? Access our full analysis of the earnings results here, it’s free.

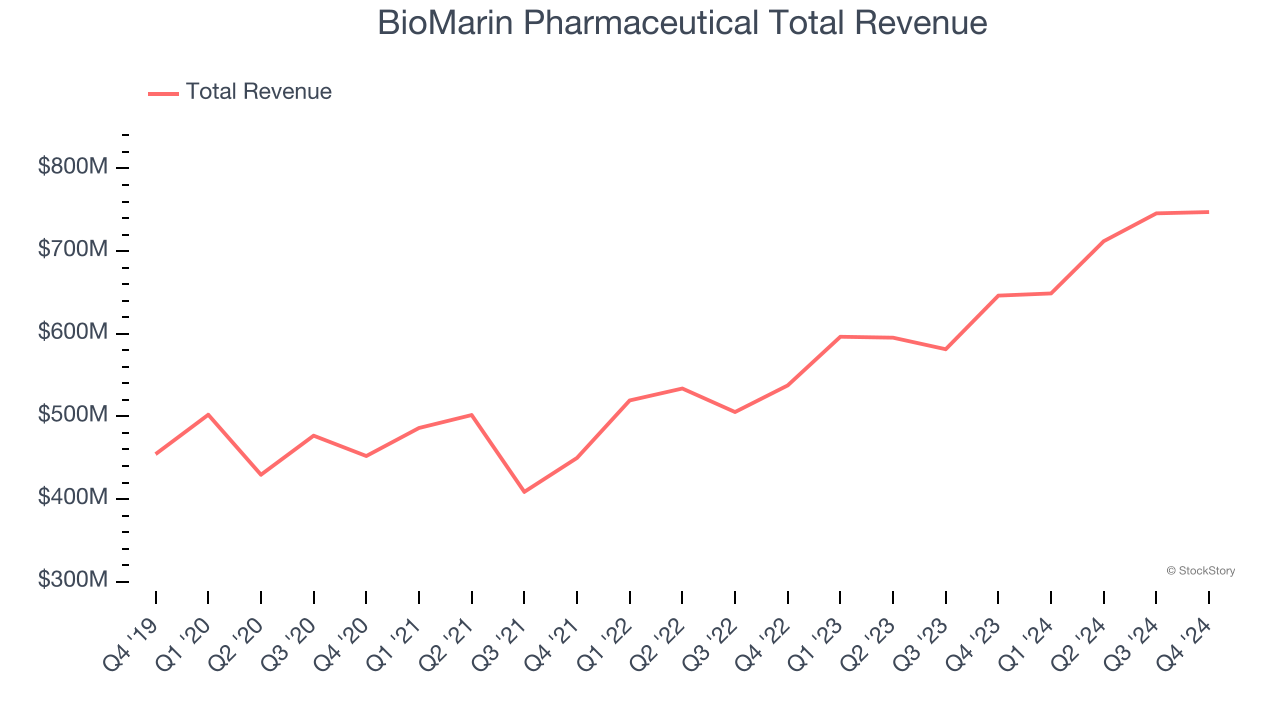

Best Q4: BioMarin Pharmaceutical (NASDAQ: BMRN)

Founded in 1997, BioMarin Pharmaceutical (NASDAQ: BMRN) is a biopharmaceutical company specializing in developing and commercializing innovative therapies for rare genetic disorders, with key products addressing disorders where the body can’t break down certain sugars (Morquio A syndrome) and certain proteins (phenylketonuria).

BioMarin Pharmaceutical reported revenues of $747.3 million, up 15.6% year on year, outperforming analysts’ expectations by 4.8%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ full-year EPS guidance estimates.

BioMarin Pharmaceutical delivered the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 5.8% since reporting. It currently trades at $69.47.

Is now the time to buy BioMarin Pharmaceutical? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Moderna (NASDAQ: MRNA)

Founded in 2010 and widely known for its COVID-19 vaccine, Moderna (NASDAQ: MRNA) is a biotechnology company focused on developing messenger RNA (mRNA) therapeutics and vaccines.

Moderna reported revenues of $966 million, down 65.6% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year revenue guidance missing analysts’ expectations.

Moderna delivered the slowest revenue growth and weakest full-year guidance update in the group. As expected, the stock is down 5.5% since the results and currently trades at $30.20.

Read our full analysis of Moderna’s results here.

Myriad Genetics (NASDAQ: MYGN)

Founded in 1991, Myriad Genetics (NASDAQ: MYGN) provides genetic testing and precision medicine solutions, with a focus on identifying hereditary risks for cancer, guiding treatment decisions, and supporting mental health diagnosis.

Myriad Genetics reported revenues of $210.6 million, up 7.1% year on year. This number lagged analysts' expectations by 0.6%. Zooming out, it was a mixed quarter as it also recorded a solid beat of analysts’ full-year EPS guidance estimates but full-year revenue guidance missing analysts’ expectations.

Myriad Genetics had the weakest performance against analyst estimates among its peers. The stock is down 22.9% since reporting and currently trades at $10.60.

Read our full, actionable report on Myriad Genetics here, it’s free.

AbbVie (NYSE: ABBV)

Founded in 2013 as a spin-off from Abbott Laboratories (NYSE: ABT), AbbVie (NYSE: ABBV) is a biopharmaceutical company that develops and sells prescription medicines focused on areas like immunology (arthritis, for example), oncology (cancers), and neuroscience (depression, for example).

AbbVie reported revenues of $15.1 billion, up 5.6% year on year. This print topped analysts’ expectations by 1.9%. It was a strong quarter as it also recorded an impressive beat of analysts’ constant currency revenue estimates and a narrow beat of analysts’ full-year EPS guidance estimates.

The stock is up 20.4% since reporting and currently trades at $211.48.

Read our full, actionable report on AbbVie here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.