Over the last six months, Workiva shares have sunk to $66.74, producing a disappointing 15.6% loss - worse than the S&P 500’s 9.8% drop. This might have investors contemplating their next move.

Following the drawdown, is now the time to buy WK? Find out in our full research report, it’s free.

Why Does WK Stock Spark Debate?

Founded in 2010, Workiva (NYSE: WK) offers software as a service product that makes financial and compliance reporting easier, especially for publicly traded corporations.

Two Things to Like:

1. ARR Surges as Recurring Revenue Flows In

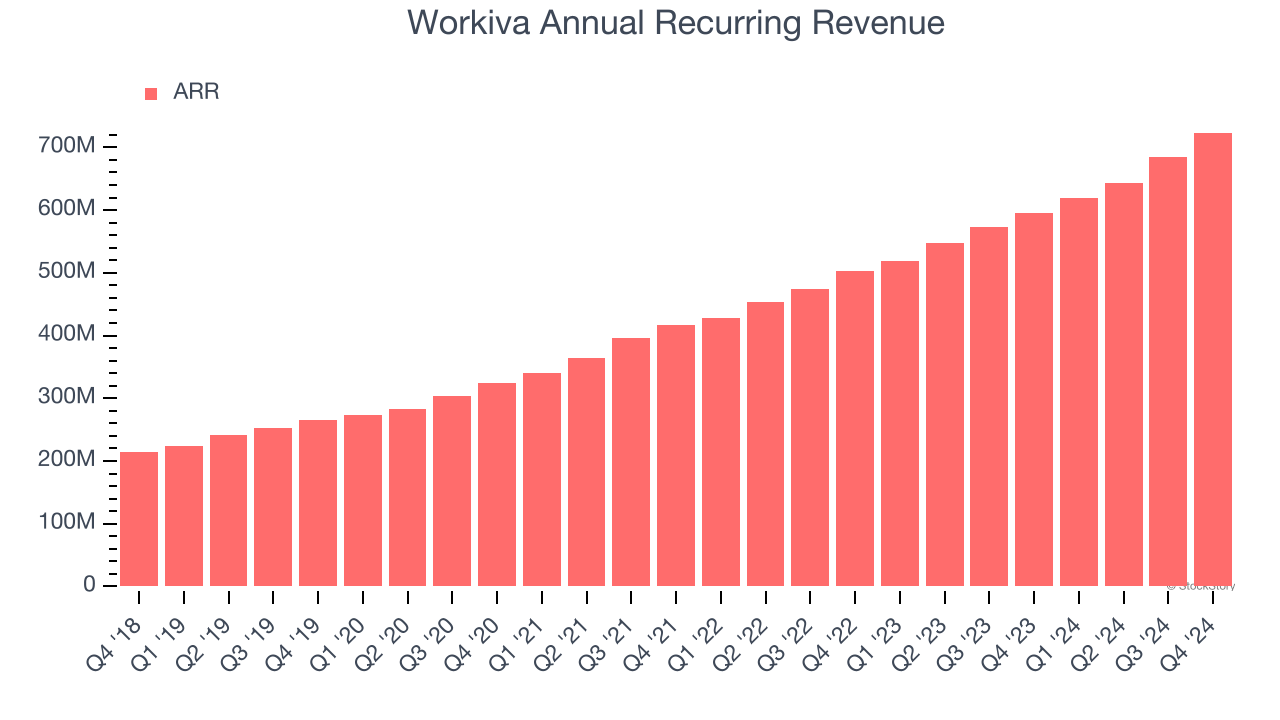

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Workiva’s ARR punched in at $723.6 million in Q4, and over the last four quarters, its year-on-year growth averaged 19.5%. This performance was impressive and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes Workiva a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

2. Projected Revenue Growth Is Remarkable

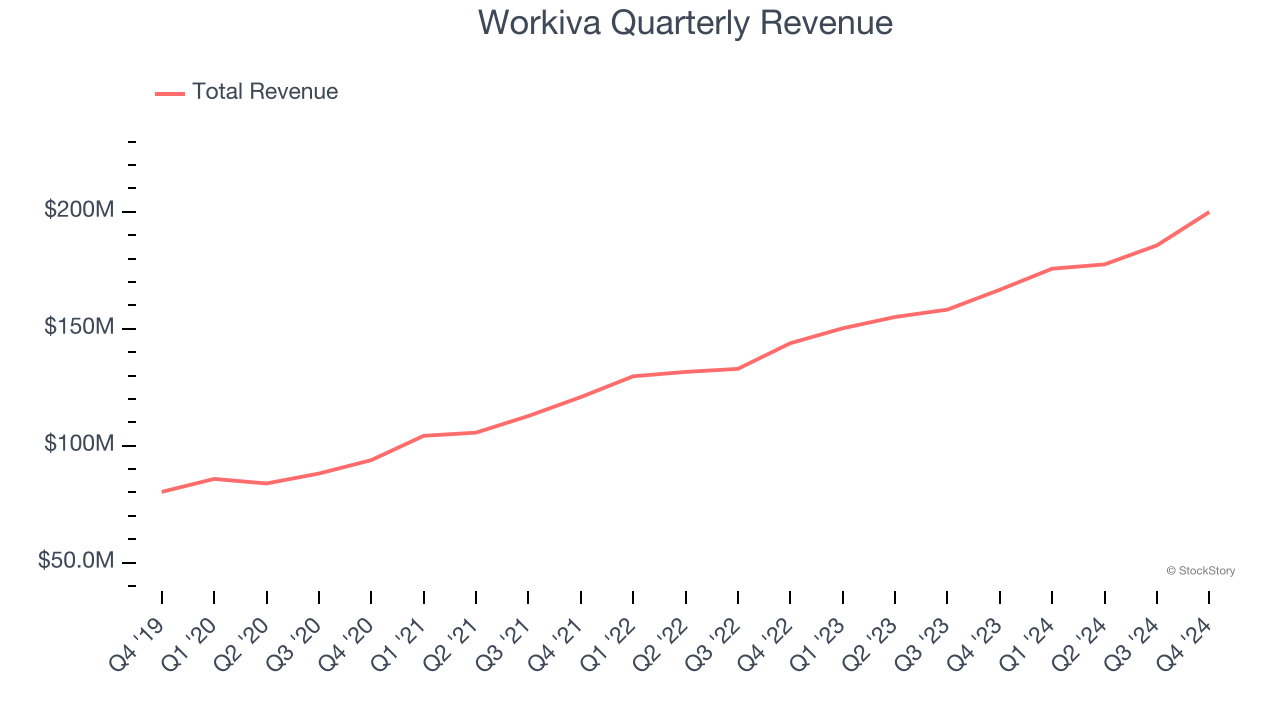

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Workiva’s revenue to rise by 17.3%, close to its 18.6% annualized growth for the past three years. This projection is commendable and indicates the market is baking in success for its products and services.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Workiva grew its sales at a 18.6% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Workiva.

Final Judgment

Workiva’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 4.3× forward price-to-sales (or $66.74 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Workiva

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.