The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how THOR Industries (NYSE: THO) and the rest of the automobile manufacturing stocks fared in Q4.

Much capital investment and technical know-how are needed to manufacture functional, safe, and aesthetically pleasing automobiles for the mass market. Barriers to entry are therefore high, and auto manufacturers with economies of scale can boast strong economic moats. However, this doesn’t insulate them from new entrants, as electric vehicles (EVs) have entered the market and are upending it. This has forced established manufacturers to not only contend with emerging EV-first competitors but also decide how much they want to invest in these disruptive technologies, which will likely cannibalize their legacy offerings.

The 7 automobile manufacturing stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 6.1%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 21.9% since the latest earnings results.

THOR Industries (NYSE: THO)

Created through the acquisition and merger of various RV manufacturers, THOR Industries manufactures and sells a range of recreational vehicles, including motorhomes and travel trailers, catering to consumers seeking the freedom and comfort of the RV lifestyle.

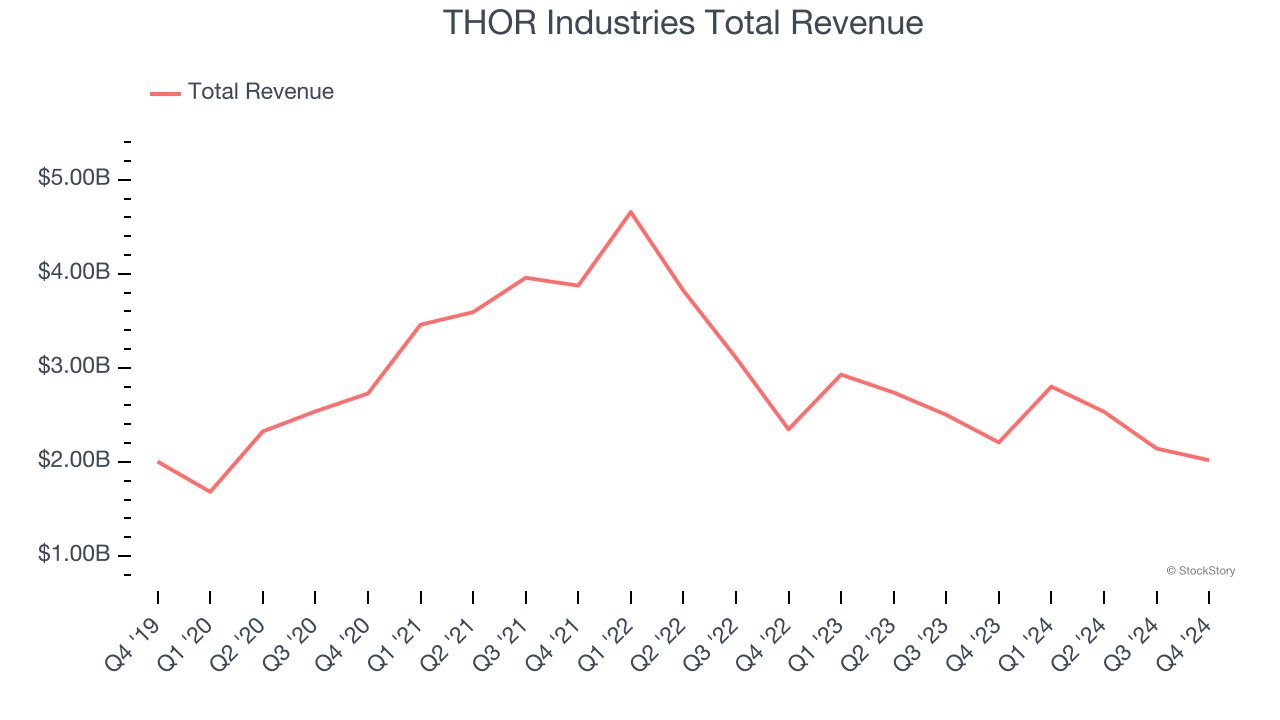

THOR Industries reported revenues of $2.02 billion, down 8.6% year on year. This print exceeded analysts’ expectations by 1.1%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ adjusted operating income estimates.

“At the beginning of fiscal 2025, we foresaw that the first half of our fiscal year would be challenging and that certainly has proven to be accurate. Our focus on maintaining a healthy balance between wholesale and retail activity enabled our segments to hold margins reasonably well with consolidated gross margins for the second quarter of fiscal 2025 at 12.1% compared to 12.3% for the prior-year period. As we anticipated and messaged at the beginning of our fiscal year, our North American Motorized and European segments have both seen a year-over-year decline in gross margins while our North American Towable segment has seen meaningful improvement on a year-over-year basis, with gross margins up 370 basis points over the same quarter last year. Our consolidated margin this quarter was also impacted by actions we took to deepen our partnerships with key dealers. Strategically, deepening these key relationships is important to our long-term market position. These strategic decisions position THOR well as we look ahead. The takeaway for this quarter and for the first half of our fiscal year is that we performed as we expected,” said Todd Woelfer, Senior Vice President and Chief Operating Officer.

The stock is down 32% since reporting and currently trades at $64.83.

Read our full report on THOR Industries here, it’s free.

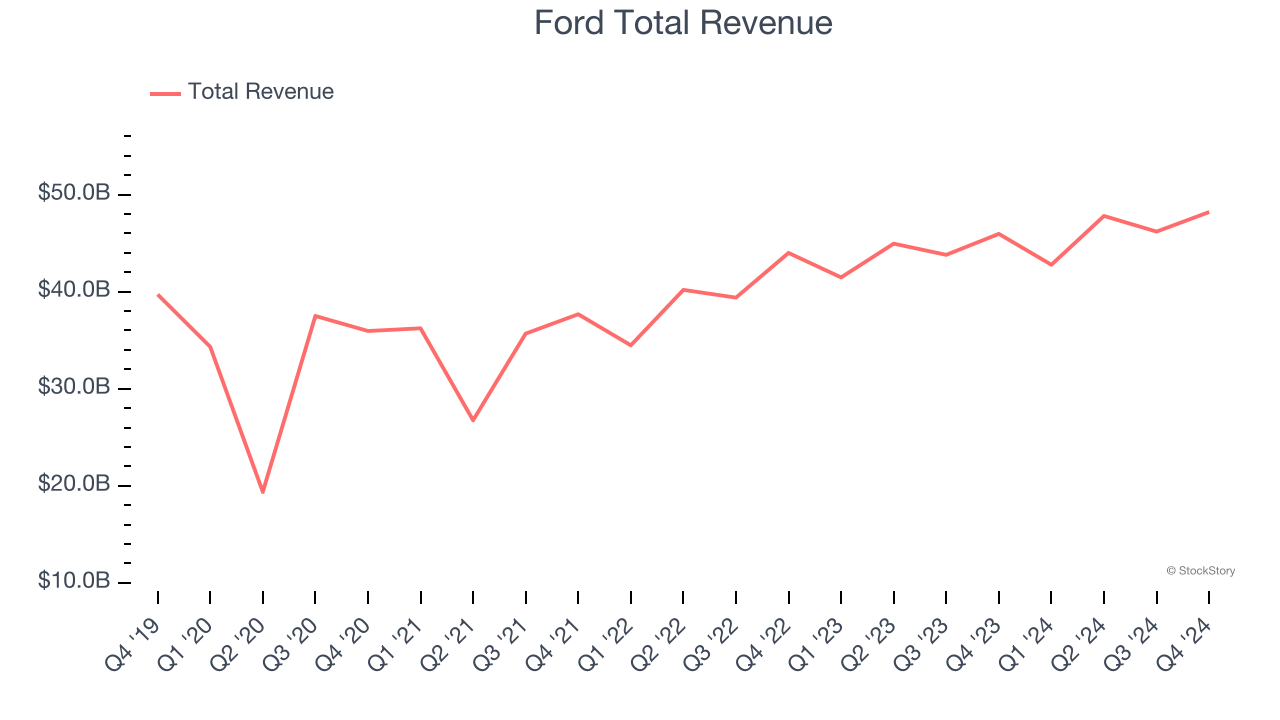

Best Q4: Ford (NYSE: F)

Established to make automobiles accessible to a broader segment of the population, Ford (NYSE: F) designs, manufactures, and sells a variety of automobiles, trucks, and electric vehicles.

Ford reported revenues of $48.21 billion, up 4.9% year on year, outperforming analysts’ expectations by 5.5%. The business had a stunning quarter with a solid beat of analysts’ sales volume and EBITDA estimates.

The stock is down 12.3% since reporting. It currently trades at $8.77.

Is now the time to buy Ford? Access our full analysis of the earnings results here, it’s free.

Tesla (NASDAQ: TSLA)

Originally founded by Martin Eberhard and Marc Tarpenning in 2003, Tesla (NASDAQ: TSLA) is an electric vehicle company accelerating the world’s transition to sustainable energy.

Tesla reported revenues of $25.71 billion, up 2.1% year on year, falling short of analysts’ expectations by 6%. It was a disappointing quarter as it posted a significant miss of analysts’ operating income and EPS estimates.

Tesla delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 40.6% since the results and currently trades at $230.65.

Read our full analysis of Tesla’s results here.

General Motors (NYSE: GM)

Founded in 1908 by William C. Durant, General Motors (NYSE: GM) offers a range of vehicles and automobiles through brands such as Chevrolet, Buick, GMC, and Cadillac.

General Motors reported revenues of $47.7 billion, up 11% year on year. This result beat analysts’ expectations by 8%. Overall, it was a very strong quarter as it also produced an impressive beat of analysts’ sales volume estimates and full-year EPS guidance exceeding analysts’ expectations.

The stock is down 22.2% since reporting and currently trades at $42.83.

Read our full, actionable report on General Motors here, it’s free.

Lucid (NASDAQ: LCID)

Founded by a former Tesla Vice President, Lucid Group (NASDAQ: LCID) designs, manufactures, and sells luxury electric vehicles with long-range capabilities.

Lucid reported revenues of $234.5 million, up 49.2% year on year. This print topped analysts’ expectations by 10.8%. It was an exceptional quarter as it also logged an impressive beat of analysts’ sales volume and EPS estimates.

Lucid delivered the fastest revenue growth among its peers. The stock is down 10% since reporting and currently trades at $2.35.

Read our full, actionable report on Lucid here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.