| |||||||||

|  |  | |||||||

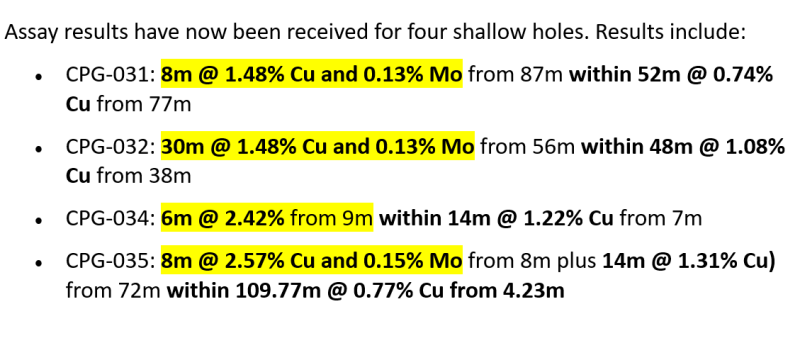

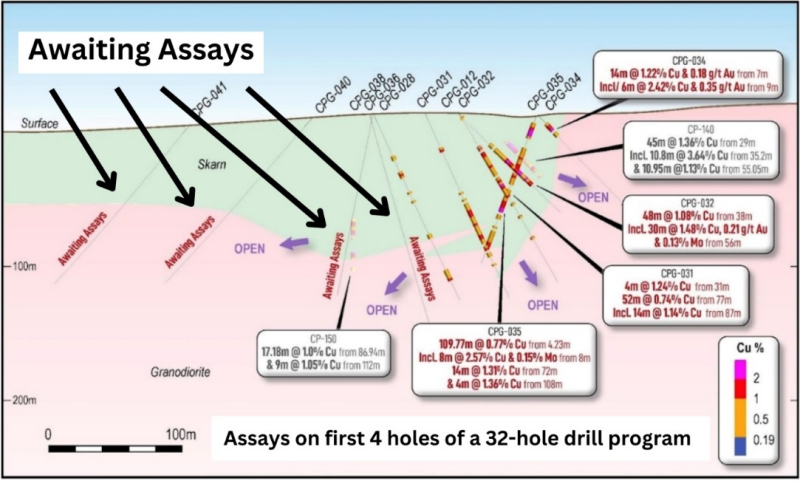

Vancouver, BC, October 15, 2024 – TheNewswire – Global Stocks News – Sponsored content disseminated on behalf of Gladiator Metals. On October 3, 2024 Gladiator Metals Corp. (TSX-V: GLAD) (OTC: GDTRF) (FSE: ZX7) reported assay results from the first 4 holes of a 32-hole drill program totalling 5,623 meters at its Whitehorse Copper Project in Yukon, Canada.

“These four holes represent the first 500 meters of our current program,” geologist and Gladiator President Marcus Harden told Guy Bennett, the CEO of Global Stocks News (GSN).

“Our first objective is to build confidence in our geological model at Cowley Park,” continued Harden. “We're doing that by drilling four sections spaced around 150 meters apart directly through the known body of mineralization.”

“The second objective is to push the boundaries of that model, testing exploration theories. We are going to find out how big this copper prospect is.”

“Assay results continue to define the near surface continuity and scale of high-grade copper skarn mineralization at Cowley Park,” stated Gladiator CEO Jason Bontempo in the October 3, 2024 release.

“These assay results also importantly provide further definition to the potentially significant coincident molybdenum-gold and silver mineralization which materially increases the potential value where credits can be applied.”

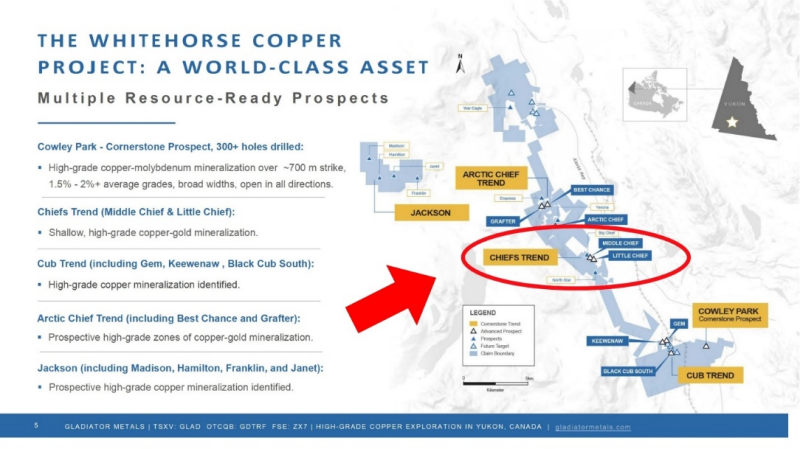

“We are testing exploration targets and extensions to zones of known, high-grade, copper-skarn mineralization to demonstrate the near-term resource potential of our lead prospects including Cowley Park, Arctic Chief, Best Chance and the Cub trend.”

Figure 1: Section A-A’ through the Cowley Park prospect looking 280o showing all Gladiator drilling and all recently returned assay results and interpreted granite-skarn boundary.

“The White Horse Copper Project was a producing mine from 1967-1982, operated by Hud Bay,” Harden told GSN. “They extracted 10.5 million tons at around 1.5% copper and almost a gram per ton of gold. The mine was shut down in 1982 when copper was trading at sixty-eight cents per pound.”

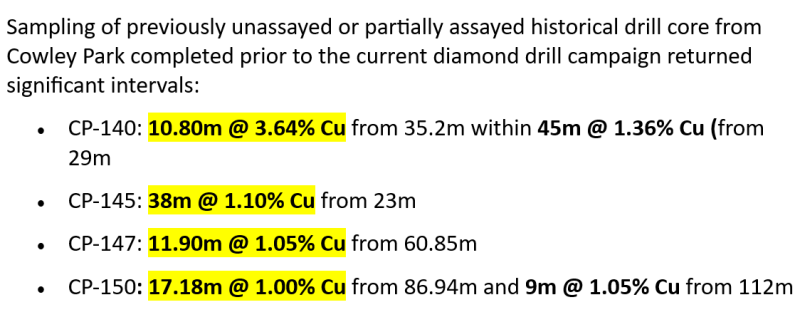

In conjunction with the 4 new holes, Gladiator released assay results from untested Cowley Park historical drill core.

The recently concluded diamond drilling at Cowley Park was designed to target:

-

Southeastern Extension: Mineralization remains open under cover to the south-east of existing drilling.

-

Northeastern Extension: The most north-easterly copper-skarn intercept at Cowley Park is 43.28m @ 2.24% Cu from 93.27m, including 13.72m @ 5.41% Cu (19-CP-08) with mineralization remaining open to the east under cover.

-

Sub-Parallel Trends: Additional, unexplored sub-parallel trends under cover indicated by initial drilling including 10m @ 1.23% Cu from 204m in CPG-015.

-

Western Extension: Recent mapping undertaken at Cowley Park has identified a significant fault that may have displaced the main mineralized body on the western side, opening up significant potential for the mineralization to extend west.

Exploration Strategy

1-Advancing to resource definition at:

-

Cowley Resource Target: 3,000m. Establish initial drilling framework for Inferred Resource drilling at the Cowley Park Prospect.

-

Chiefs Trend Resource Target: 1,500m. Highlight further high-grade, near-term Copper resource potential by testing Southern Target area.

2 – Exploration drilling at: Arctic Chief: 2,500m. Highlight continuity of high-grade near surface copper and gold mineralisation for future resource drilling.

-

Best Chance: 1,500m. First drill test of outcropping high-grade, magnetite-copper skarn mineralisation and test continuity of mineralisation between target and Arctic Chief.

-

Cowley Exploration: 2,000m. Targeting upside potential for further copper-skarn mineralisation at Cowley Park.

-

Cub Trend Exploration: 2,500m. Highlight continuity of high-grade, near surface, copper and gold mineralisation for future resource drilling.

On September 6, 2024 Marcus Harden, President of Gladiator Metals spoke with CEO.ca’s Rachel Lee to discuss the drill program at Cowley Park and the company’s wider objectives.

“We picked up the project a year ago,” Harden told Lee. “It's been a forensic exercise, putting back together the historic data. We were pleased to find some advanced targets that have been drilled by Hud Bay, sometimes down to 12 X 12 meter spacing. We regard them as advanced resource-ready prospects.”

“Cowley Park is the current lead, but we have another target called Little Chief, which was the previous area of historical production,” continued Harden. “It produced 8.5 of the 10.5 million tons that came out of the district. In the last days of production, Hud Bay discovered an ore body just to the north, called Middle Chief.”

“Drilling at Middle Chief defined some broad widths, up to 43 meters of 3.1% copper. That’s with no co-products, despite gold being a significant credit at the time of production. We're looking to do some step out drilling, see if there's a larger target that we can be put into resource status.”

A 2015 report by the Prospectors & Developers Association of Canada estimated Northern Canada remote drilling costs (projects > 50 km from supply route) to be $460/meter. With inflation running hot, the 2024 cost is projected to be significantly higher, up to $1,000/meter.

Gladiator’s project is a 20-minute drive from Whitehorse, Yukon (pop. 30,000). An assay lab is situated at the edge of GLAD’s tenements. It takes 30 minutes to mobilize a drill rig to the site. There is no need for a work camp. Geologists and drill crews typically sleep in their own beds in Whitehorse at night.

“We budgeted $300/meter for the current drill program at Cowley,” Harden told GSN. “The costs are coming in lower, at around $250/meter, which includes labour, rig and assays. We currently have $9 million cash in the bank. Our proximity to drill rigs, machinery and skilled labour allows us to drill more meters within a fixed budget.”

“Gladiator Metals is the first company to apply modern techniques to this project,” continued Harden. “Hud Bay had Cowley ranked for near term production, but they never mined it. We inherited a compact data set, with attractive targets. There has been no depletion of metal inventory. We consider Cowley to be resource ready. We’re drilling relatively shallow holes to bring the resource into modern compliance.”

Gladiator will update the market in the coming weeks with results from a further 28 diamond holes (5,088m) completed and submitted to the laboratory for assay.

All scientific and technical information in this news release has been prepared or reviewed and approved by Kell Nielsen, the Company’s Vice President Exploration, a “qualified person” as defined by NI 43-101.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: Gladiator Metals paid Global Stocks News (GSN) $1,500 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we can not ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

Copyright (c) 2024 TheNewswire - All rights reserved.