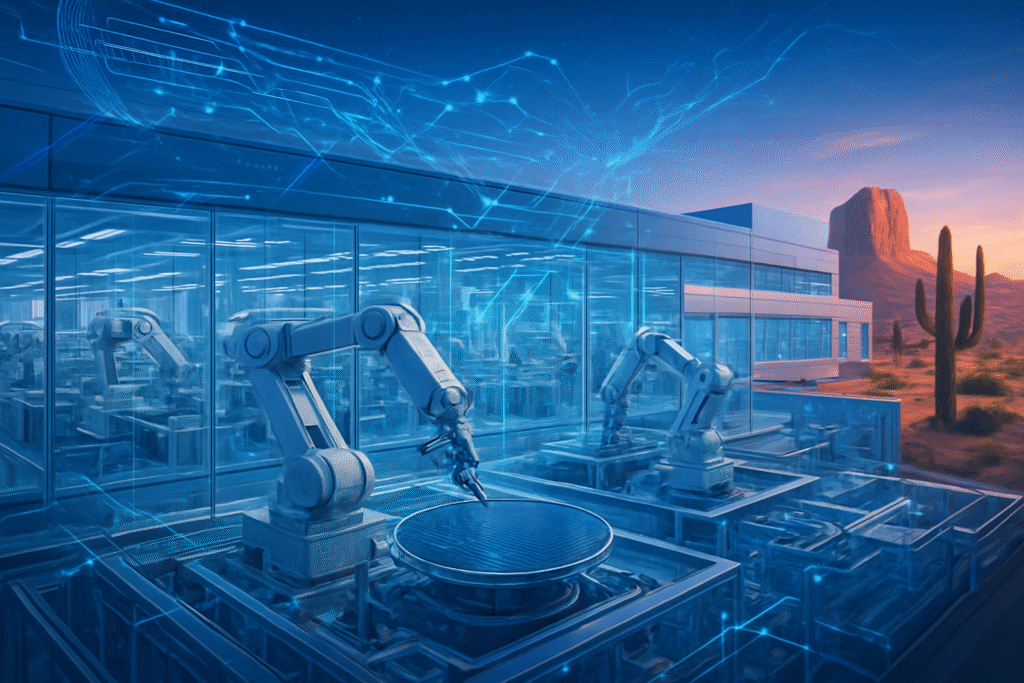

The United States is witnessing a pivotal moment in its industrial policy, as robust government incentives, spearheaded by the landmark CHIPS and Science Act, are catalyzing a dramatic resurgence in domestic semiconductor manufacturing. This strategic pivot, enacted in August 2022, is designed to reverse decades of decline in U.S. chip production, bolster national security, and fortify economic resilience by bringing critical manufacturing capabilities back to American soil. Nowhere is this transformation more evident than in Arizona, which has rapidly emerged as a burgeoning hub for advanced chip fabrication, attracting unprecedented levels of private investment and setting the stage for a new era of technological independence.

The immediate significance of these incentives cannot be overstated. The COVID-19 pandemic laid bare the perilous vulnerabilities of a globally concentrated semiconductor supply chain, causing widespread disruptions across virtually every industry. By offering substantial financial backing, including grants, loans, and significant tax credits, the U.S. government is directly addressing the economic disparities that previously made domestic manufacturing less competitive. This initiative is not merely about constructing new factories; it's a comprehensive effort to cultivate an entire ecosystem, from cutting-edge research and development to a highly skilled workforce, ensuring the U.S. maintains its technological leadership in an increasingly competitive global landscape.

The CHIPS Act: A Blueprint for High-Tech Manufacturing Revival

The CHIPS and Science Act stands as the cornerstone of America's renewed commitment to semiconductor sovereignty. This bipartisan legislation authorizes approximately $280 billion in new funding, with a substantial $52.7 billion specifically appropriated to supercharge domestic chip research, development, and manufacturing. Key allocations include $39 billion in subsidies for chip manufacturing on U.S. soil, complemented by a crucial 25% investment tax credit for manufacturing equipment costs. Furthermore, $13 billion is earmarked for semiconductor research and workforce training, with an additional $11 billion dedicated to advanced semiconductor R&D, including the establishment of the National Semiconductor Technology Center (NSTC) – a public-private consortium aimed at fostering innovation.

This robust financial framework is meticulously designed to offset the higher operational costs associated with building and running fabs in the U.S., which can be 30-50% more expensive than in Asian counterparts. The Act also includes "guardrails" that prohibit recipients of CHIPS funding from expanding certain advanced semiconductor manufacturing operations in "countries of concern" for at least a decade, thereby safeguarding national security interests. This represents a significant departure from previous laissez-faire approaches, marking a proactive industrial policy aimed at strategic technological self-sufficiency. Initial reactions from the AI research community and industry experts have been largely positive, recognizing the long-term benefits of a diversified and secure chip supply for advancements in AI, high-performance computing, and other critical technologies. They emphasize that a stable domestic supply chain is crucial for accelerating innovation and mitigating future risks.

The technical specifications of the fabs being built or expanded under these incentives are at the leading edge of semiconductor technology. Companies like Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) and Intel Corporation (NASDAQ: INTC) are constructing facilities capable of producing advanced nodes, including 4-nanometer and eventually 3-nanometer chips. These nodes are vital for the next generation of AI processors, high-performance computing, and advanced mobile devices, requiring highly complex lithography techniques, extensive cleanroom environments, and sophisticated automation. The shift from older, larger nodes to these smaller, more efficient transistors allows for greater computational power and energy efficiency, which are critical for demanding AI workloads. This level of advanced manufacturing was virtually non-existent in the U.S. just a few years ago, highlighting the transformative impact of the CHIPS Act.

Arizona's Ascent: A New Silicon Desert

The ripple effects of the CHIPS Act are profoundly reshaping the landscape for AI companies, tech giants, and startups. Major players like Intel and TSMC stand to benefit immensely, leveraging the substantial government support to expand their manufacturing footprints. Intel, a long-standing fixture in Arizona, has received $8.5 billion from the CHIPS Act, fueling significant expansions at its Chandler campus, bringing its total investment in the state to over $50 billion. This enables Intel to strengthen its IDM 2.0 strategy, which aims to become a major foundry player while continuing its own product innovation.

TSMC's commitment to Arizona is even more staggering, with up to $6.6 billion in grants and approximately $5 billion in loans under the CHIPS Act supporting its ambitious plans for three fabrication plants in Phoenix. This represents a total investment exceeding $65 billion, making it the largest foreign direct investment in Arizona's history. These facilities are projected to create around 6,000 high-paying manufacturing jobs and 20,000 construction jobs, creating a robust local economy. The presence of these titans creates a magnet effect, attracting an ecosystem of ancillary suppliers, equipment manufacturers, and logistics providers, all of whom stand to gain from the burgeoning chip industry.

For smaller AI labs and startups, a secure and diverse domestic chip supply chain means greater reliability and potentially faster access to advanced components, reducing reliance on potentially volatile international markets. This could foster greater innovation by lowering barriers to entry for hardware-intensive AI applications. While the competitive landscape will intensify, with increased domestic production, it also creates opportunities for specialized companies in areas like chip design, packaging, and testing. The strategic advantages include reduced lead times, enhanced intellectual property protection, and a more resilient supply chain, all of which are critical for companies operating at the cutting edge of AI development.

Broader Implications: National Security, Economic Resilience, and Global Leadership

The revitalization of domestic chip production through government incentives extends far beyond economic benefits, fitting squarely into a broader strategic push for national security and technological self-reliance. Semiconductors are the bedrock of modern society, underpinning everything from advanced military systems and critical infrastructure to the burgeoning field of artificial intelligence. The concentration of advanced chip manufacturing in East Asia, particularly Taiwan, has long been identified as a significant geopolitical vulnerability. By reshoring this critical capability, the U.S. is proactively mitigating supply chain risks and strengthening its defense posture against potential disruptions or conflicts.

Economically, the investments are projected to create hundreds of thousands of high-paying jobs, not just in direct semiconductor manufacturing but also across the wider economy in supporting industries, research, and development. This surge in economic activity contributes to a more robust and resilient national economy, less susceptible to global shocks. The focus on advanced R&D, including the NSTC, ensures that the U.S. remains at the forefront of semiconductor innovation, which is crucial for maintaining global leadership in emerging technologies like AI, quantum computing, and advanced communications. This mirrors historical government investments in foundational technologies that have driven past industrial revolutions, positioning the current efforts as a critical milestone for future economic and technological dominance.

While the benefits are substantial, potential concerns include the immense capital expenditure required, the challenge of cultivating a sufficiently skilled workforce, and the risk of over-subsidization distorting market dynamics. However, the prevailing sentiment is that the strategic imperative outweighs these concerns. The comparisons to previous AI milestones underscore the foundational nature of this effort: just as breakthroughs in algorithms and computing power have propelled AI forward, securing the hardware supply chain is a fundamental requirement for the next wave of AI innovation. The long-term impact on the broader AI landscape is a more stable, secure, and innovative environment for developing and deploying advanced AI systems.

The Road Ahead: Sustaining Momentum and Addressing Challenges

Looking ahead, the near-term developments will focus on the accelerated construction and operationalization of these new and expanded fabrication facilities, particularly in Arizona. We can expect further announcements regarding specific production timelines and technology nodes. In the long term, the goal is to establish a robust, self-sufficient semiconductor ecosystem capable of meeting both commercial and defense needs. This includes not only manufacturing but also advanced packaging, materials science, and equipment production. Potential applications and use cases on the horizon include more powerful and energy-efficient AI accelerators, specialized chips for edge AI, and secure semiconductors for critical infrastructure.

However, significant challenges remain. The most pressing is the development of a highly skilled workforce. While initiatives like the Arizona CHIPS consortium are expanding apprenticeship and training programs, the demand for engineers, technicians, and researchers will be immense. Sustaining the momentum of private investment beyond the initial CHIPS Act funding will also be crucial, requiring continued policy stability and a competitive business environment. Experts predict that while the initial phase is about building capacity, the next phase will focus on integrating these new capabilities into the broader tech ecosystem, fostering innovation, and ensuring the U.S. remains competitive on a global scale. Continued collaboration between government, industry, and academia will be paramount.

A New Chapter for American Innovation

In summary, the U.S. government's strategic investment in domestic chip production, particularly through the CHIPS and Science Act, marks a critical turning point for American innovation and national security. The rapid transformation seen in Arizona, with massive investments from industry giants like TSMC and Intel, underscores the immediate and tangible impact of these incentives. This initiative is not merely about economic stimulus; it's a profound commitment to rebuilding a vital industrial base, securing critical supply chains, and ensuring the nation's technological leadership in an era increasingly defined by artificial intelligence.

The significance of this development in AI history is profound, as a stable and advanced domestic semiconductor supply chain is foundational for future AI breakthroughs. Without reliable access to cutting-edge chips, the pace of AI innovation would be severely hampered. As these new fabs come online and the semiconductor ecosystem matures, the long-term impact will be a more resilient, secure, and innovative environment for developing and deploying advanced AI systems across all sectors. In the coming weeks and months, all eyes will be on the progress of construction, the success of workforce development initiatives, and further announcements from major chip manufacturers as they solidify America's position as a global leader in semiconductor technology.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.