Kaleido Intelligence, a leading connectivity market intelligence and consulting firm, has announced its latest Connectivity Vendor Hub research, providing the most up-to-date rankings and scores for IoT connectivity service providers across four categories.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211018005228/en/

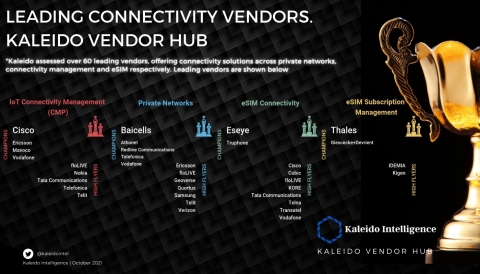

Cisco, Baicells, Eseye & Thales No 1 vendors for IoT CMP, Private Networks, eSIM Connectivity and eSIM Subscription Management. Results from a highly detailed assessment of over 60 connectivity vendors. Champion vendor status is given to Ericsson, Vodafone, Mavoco, Athonet, Redline Communications, Telefonica, Truphone and G+D across the same categories. High Flyer vendor status is given to additional vendors including Cubic, Geoverse, IDEMIA, Kigen, KORE, floLIVE, Nokia, Samsung, Tata Communications, Telit, Telna, Transatel and Verizon.

The Connectivity Vendor Hub H2 2021 research analysed 60 leading cellular IoT connectivity service providers across Connectivity Management Platforms (CMP), eSIM connectivity services, eSIM Subscription management Services and Private 4G and 5G Network solutions. It includes an in-depth assessment of the service offerings and updated Kaleido Scores for all companies.

Number 1, Champion and High Flyer vendors across each product segment scored by Kaleido Intelligence, including Ericsson, Nokia, Telefonica, Vodafone and others, can be found in the accompanying image.

Kaleido’s approach focused on categorising service providers based on product features and depth, underlying technology, in addition to differentiation and innovation factors that help accelerate the market. Vendors with leading product offerings are labelled as Kaleido Champion and High Flyer vendors, representing their leading market offering.

The research is the culmination of more than 6-months’ worth of primary research, including product demos, questionnaires, and detailed briefings.

A COMPLETE LIST OF VENDORS ASSESSED CAN BE FOUND ON OUR PUBLIC VENDOR DIRECTORY

Quotes from Cisco, Eseye & Thales on No 1 Vendor Scoring

Cisco - No 1 IoT Connectivity Management Platform

Ken Davidson, Director of Product Management, IoT Control Center, Cisco commented: “The future of connectivity is wireless, and Cisco is focused on driving wireless innovation to help our service provider customers deliver the full benefits of 5G for IoT . This recognition as a Champion vendor for connectivity validates our commitment to helping businesses accelerate their digital transitions.”

Eseye - No 1 in eSIM Connectivity

Nick Earle, CEO Eseye commented: “Eseye’s AnyNet+ eSIM solution delivers highly reliable global IoT connectivity. As category leaders, Eseye continues to push the technological boundaries to help Enterprises confidently deploy IoT at scale.”

Thales - No 1 in eSIM Subscription Management

Nicolas Chalvin, VP Marketing Connectivity and Embedded services commented: “We are honoured to be named ‘No.1 Ranked Vendor Champion for eSIM Management Platform.’ Over one billion eSIM devices are expected to be shipped annually by 2025 and we are committed to continuing to innovate in security and connectivity management to enable the trusted connections of tomorrow.”

Leading Providers Placed to Support Burgeoning Cellular IoT Market

Kaleido has found that demand for cellular IoT connectivity is set to expand considerably, with the need for simplified global deployments, roaming and localisation as well as enterprise private cellular networks all serving to create complexity. Kaleido expects the installed base of cellular IoT connections to reach over 5.7 billion in 2025, up from 1.7 billion in 2020.

Steffen Sorrell, Chief of Research at Kaleido Intelligence commented: “Cellular IoT has never been an off-the-shelf endeavour, while scaling up has posed significant challenges. However, the leading service providers assessed in this research report have all made significant inroads in smoothing the path towards deployments through technology innovation and flexibility to accommodate the bespoke nature of enterprise IoT requirements.”

The leadership scoring analysis for over 60 connectivity service providers is summarised in the Vendor Hub report, along with an impartial assessment of company strengths and opportunities.

VIEW THE FULL PRESS RELEASE ON OUR WEBSITE

About Kaleido Intelligence

Kaleido Intelligence is a specialist consulting and market research firm with a proven track record delivering telecom research at the highest level. Kaleido Intelligence covers a host of high growth telecom sectors, providing a complete research picture covering:

- Data Forecasts by Market

- Historical & Forecast Viewpoints

- Competitive Intelligence

- Strategic Insight

- Trend Analysis

Research is led by expert analysts, each with significant experience delivering telco research and insights that matter.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211018005228/en/

Contacts:

Jon.king@kaleidointelligence.com