Synopsys (SNPS) stock closed up nearly 5% after the artificial intelligence (AI) darling, Nvidia (NVDA), announced a $2 billion stake in the electronic design automation firm.

This strategic partnership is aimed at accelerating next-gen AI and chip-design tools, according to the companies’ joint press release on Monday morning.

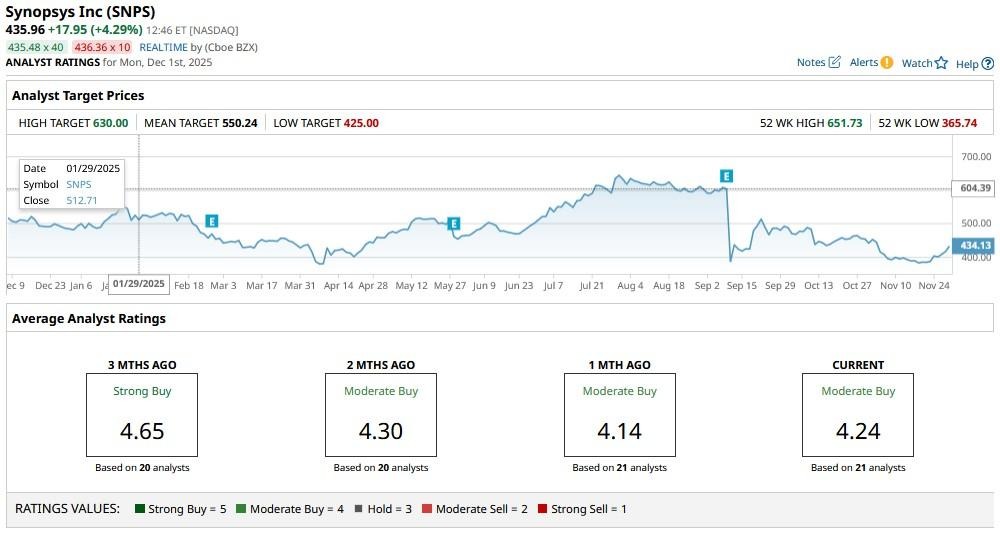

Despite today’s run, Synopsys stock remains down over 30% versus its year-to-date high of $645.

Does the Nvidia Deal Warrant Buying Synopsys Stock?

Investors are cheering the NVDA announcement primarily because it validates SNPS’ leadership in electronic design automation and strengthens its role in next-gen chip innovation.

As Jensen Huang, the chief executive of Nvidia put it: “This is a huge deal … this partnership is about revolutionizing one of the most compute-intensive industries: design and engineering.”

In a CNBC interview on Dec. 1, Huang even said Nvidia was “built on a foundation of design tools from Synopsys,” further reinforcing confidence in SNPS stock as a core enable of semiconductor innovation and a beneficiary of the rising AI demand.

For Synopsys, doubling down on its partnership with Nvidia could prove a significant catalyst for revenue growth, deeper industry integration, and long-term competitive advantage.

All in all, the announcement aligns SNPS with one of the fastest-growing AI companies, ensuring demand for its design tools and expanding its market relevance.

How High Could SNPS Shares Fly in 2026?

Morgan Stanley believes NVDA’s stake will help Synopsys shares hit $510 by the end of next year, indicating potential upside of about 17% from current levels.

According to its analysts, this strategic alliance further entrenches the company’s competitive moat in the EDA space by integrating it deeply with the dominant AI computing platform.

Still, SNPS is going for about 10x sales only at the time of writing versus more than 33x for Nvidia.

From a technical perspective, the NVDA-driven rally briefly pushed the AI stock above its 50-day moving average (MA) today, suggesting continued bullish momentum in the near term.

In Q3, Norges Bank loaded up on more than 1.2 million shares of Synopsys, revealing significant institutional confidence in the company’s growth trajectory.

What’s the Consensus Rating on Synopsys?

Note that Morgan Stanley is among the more conservative Wall Street firms on SNPS stock.

The consensus rating on Synopsys shares currently sits at “Moderate Buy” with the mean target of about $550 indicating potential upside of more than 25% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart