--News Direct--

By Kyle Anthony, Benzinga

The success of companies such as Airbnb (NASDAQ: ABNB), Snowflake (NYSE: SNOW), and Uber (NYSE: UBER) in recent years has led many individuals to realize their genesis began in private markets, where venture capital firms, private equity institutions and angel investors financed their initial ideas and benefited immensely from their growth over time. The degree of wealth generation these companies have provided investors before their initial public offerings (IPOs) has piqued the interest of the public, particularly individuals who desire to invest in such companies at their early stages – but the capital required to do so is often beyond their immediate access.

Linqto recognizes that there is a growing cohort of knowledgeable but capital-constrained individuals who want to invest in pre-IPO companies; as such, the firm’s vision is to democratize private investing by making it accessible, affordable and liquid for individual investors.

Staying Private For Longer

A paradigm shift has occurred within the capital markets landscape in recent years, with more companies choosing to stay private. In earlier years, an IPO was viewed as a milestone in a company’s history, as it signified a firm achieving the necessary scale and cache to be listed on a public exchange. At present, private funding is readily available from different sources, thus extending the runway for these firms to prove their business model, grow their addressable market and create multiple revenue streams without ever needing to access public markets.

A clear example of the success of this approach is Uber and Airbnb, two of the largest-ever technology IPOs that waited 10 and 12 years, respectively, before entering the public markets. Uber seriously impacted public transportation access, while Airbnb redefined vacation lodging. In delaying their public listing, both firms cemented their value proposition and grew their user base over time, resulting in sizable returns for private investors of each firm before they went public, and great anticipation for investors who desired to have some ownership of the company.

Accessing Private Markets With Linqto

Given the wealth generation that can be attained through private market investments, Linqto’s mission is to make investing in private companies as easy and accessible as investing in the public stock market. Their platform features high-growth, technology-driven companies that they believe will go public or be acquired within five years.

Linqto’s approach to private market investing is distinct from that of its peers. Firstly, the company primarily invests in mid-to-late-stage private companies within the technology industry, where selected firms must be generating a minimum revenue amount, with institutional venture capital or private equity investor backing.

Linqto seeks to invest in visionary leaders and management teams that have a proven track record of bringing timely products and services to market. The thematic focus of the platform’s investment generally falls within the technology sub-verticals of artificial intelligence, blockchain and digital assets, enterprise software, networking and IoT, hardware and FinTech.

Secondly, Linqto conducts in-depth due diligence on the firms it includes on its platform, as the company invests alongside its investors. By investing first and ensuring that Linqto has skin in the game, the firm can streamline the investment process, making it as easy as pointing and clicking to participate in the investment opportunities presented on the platform. Leveraging its in-house research expertise and evaluation capabilities, Linqto can offer access to top private companies with industry-low minimums and no fees.

Finally, Linqto’s fee structure is a true differentiator, as it is a zero-fee investment management platform. Given that Linqto purchases shares in large quantities from founders, employees and investors, it receives shares at a negotiated price. Linqto can then make smaller quantities of its shareholdings available to investors at a reasonable markup, thus eliminating the need for further follow-on fees for the investor. Historically, investing in a private company required individuals to invest at least $100,000. Linqto’s initial minimum investment amount is $2,500, with subsequent investment amounts being $5,000. In comparison to the pricing structure of other private investment platforms, such as Forge Global Holdings (NYSE: FRGE), EquityZen, and HIIVE, Linqto says its fee structure is very advantageous to retail investors desiring access to private investment opportunities.

Capitalizing On A Growing Opportunity

Companies remaining private for longer is not just a passing trend but a deliberate action being taken by many business leaders to attain operational scale and revenue growth without ceding control of their company or being hampered by regulatory oversight.

With the depth of private capital available to these private companies, they can grow with a degree of flexibility and freedom that public companies are not afforded. Investors in these private firms can be beneficial participants in the potentially phenomenal growth these firms may experience, which could result in them garnering investment returns far beyond what is attainable in public markets.

For retail investors who have been unable to add non-public investment to their portfolio due to high minimum investments and restrictive fee structures, Linqto is revolutionizing the investment journey in the private market by making it more affordable, accessible and easy.

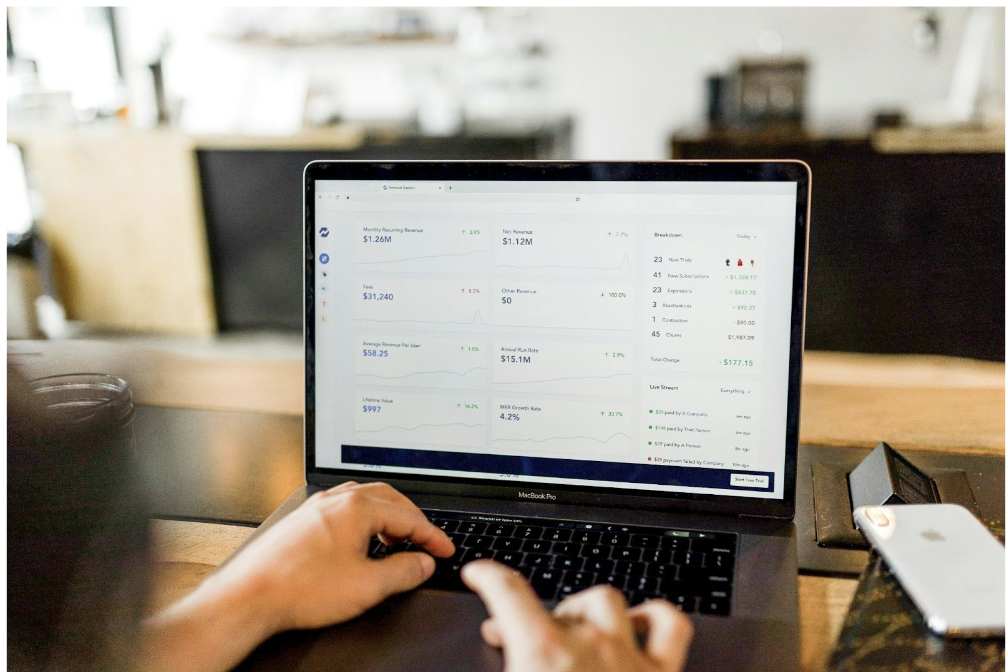

Featured photo by Austin Distel on Unsplash.

Benzinga is a leading financial media and data provider, known for delivering accurate, timely, and actionable financial information to empower investors and traders.

This post contains sponsored content. This content is for informational purposes only and is not intended to be investing advice.

Contact Details

Benzinga

+1 877-440-9464

Company Website

View source version on newsdirect.com: https://newsdirect.com/news/interested-in-investing-in-private-companies-like-openai-but-dont-have-the-capital-check-out-linqto-924047151