Freight delivery company Werner (NASDAQ:WERN) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 8.8% year on year to $745.7 million. Its non-GAAP profit of $0.15 per share was also 27.6% below analysts’ consensus estimates.

Is now the time to buy Werner? Find out by accessing our full research report, it’s free.

Werner (WERN) Q3 CY2024 Highlights:

- Revenue: $745.7 million vs analyst estimates of $766 million (2.6% miss)

- Adjusted Operating Profit: $21.6 million vs analyst expectations of $25.0 (13.6% miss)

- Adjusted EPS: $0.15 vs analyst expectations of $0.21 (27.6% miss)

- “Freight conditions remained challenging while tightening late in the quarter from hurricane related supply chain disruptions."

- Gross Margin (GAAP): 20%, in line with the same quarter last year

- Market Capitalization: $2.36 billion

“Freight conditions remained challenging while tightening late in the quarter from hurricane related supply chain disruptions. One-Way Truckload revenue per total mile increased year over year for the first time in seven quarters, and production improved for the sixth consecutive quarter. Our Dedicated fleet grew sequentially, and revenue per truck growth continued,” said Derek Leathers, Chairman and CEO.

Company Overview

Conducting business in over a 100 countries, Werner (NASDAQ:WERN) offers full-truckload, less-than-truckload, and intermodal delivery services.

Ground Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Sales Growth

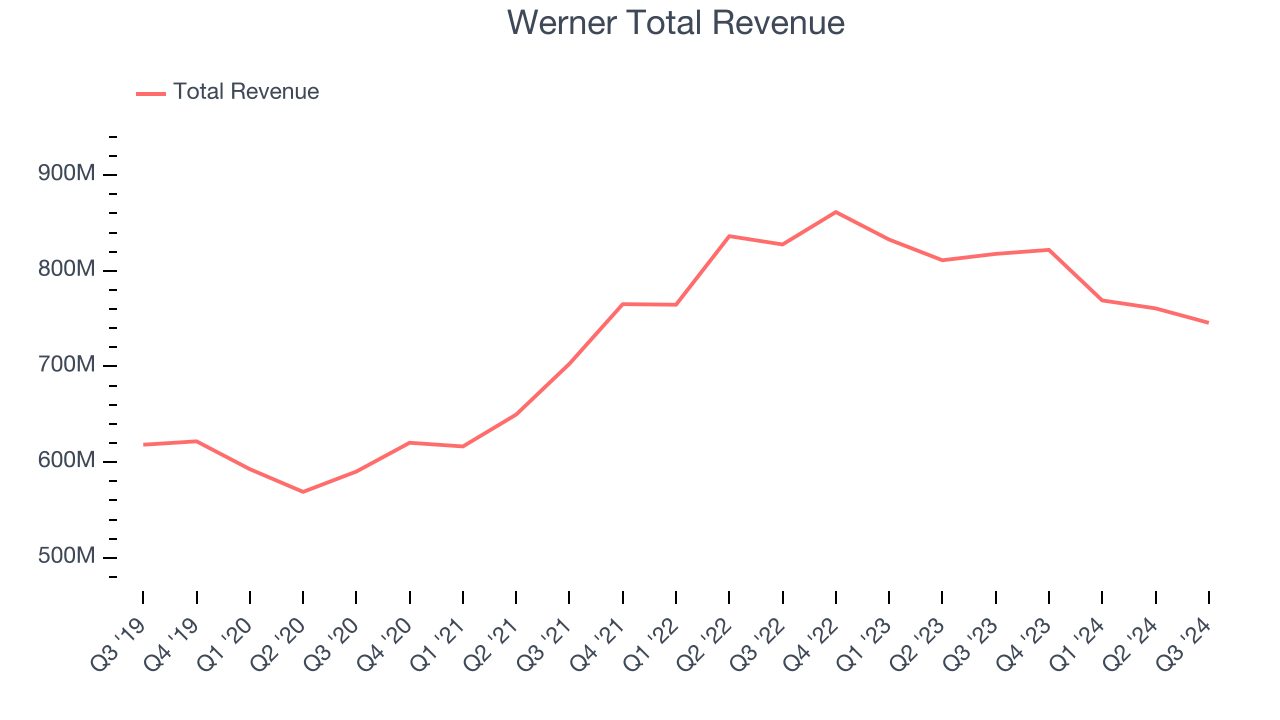

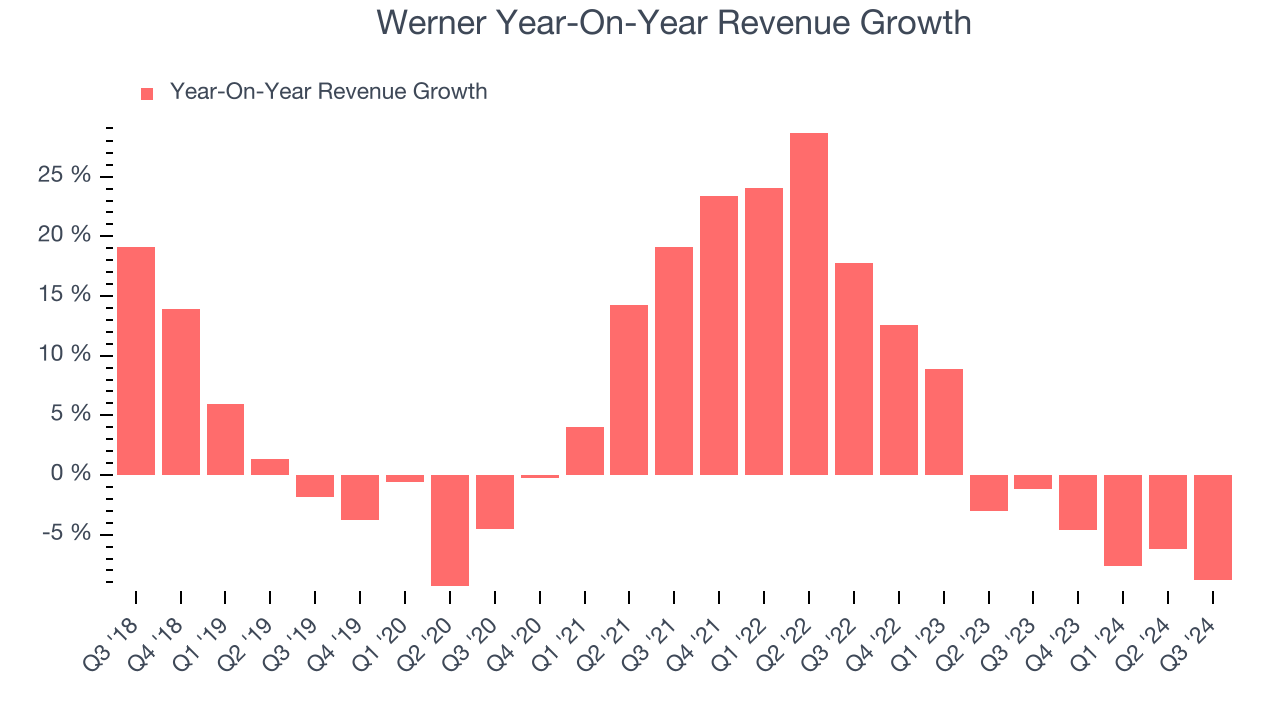

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Werner grew its sales at a sluggish 4.5% compounded annual growth rate. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Werner’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.5% annually. Werner isn’t alone in its struggles as the Ground Transportation industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

Werner also breaks out the revenue for its most important segments, Truckload Transportation and Logistics, which are 70.1% and 27.7% of revenue. Over the last two years, Werner’s Truckload Transportation revenue (deliveries made with Werner's fleet) averaged 3.3% year-on-year declines. On the other hand, its Logistics revenue (brokered deliveries using third-party fleets) averaged 5.9% growth.

This quarter, Werner missed Wall Street’s estimates and reported a rather uninspiring 8.8% year-on-year revenue decline, generating $745.7 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.4% over the next 12 months. Although this projection illustrates the market believes its newer products and services will spur better performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

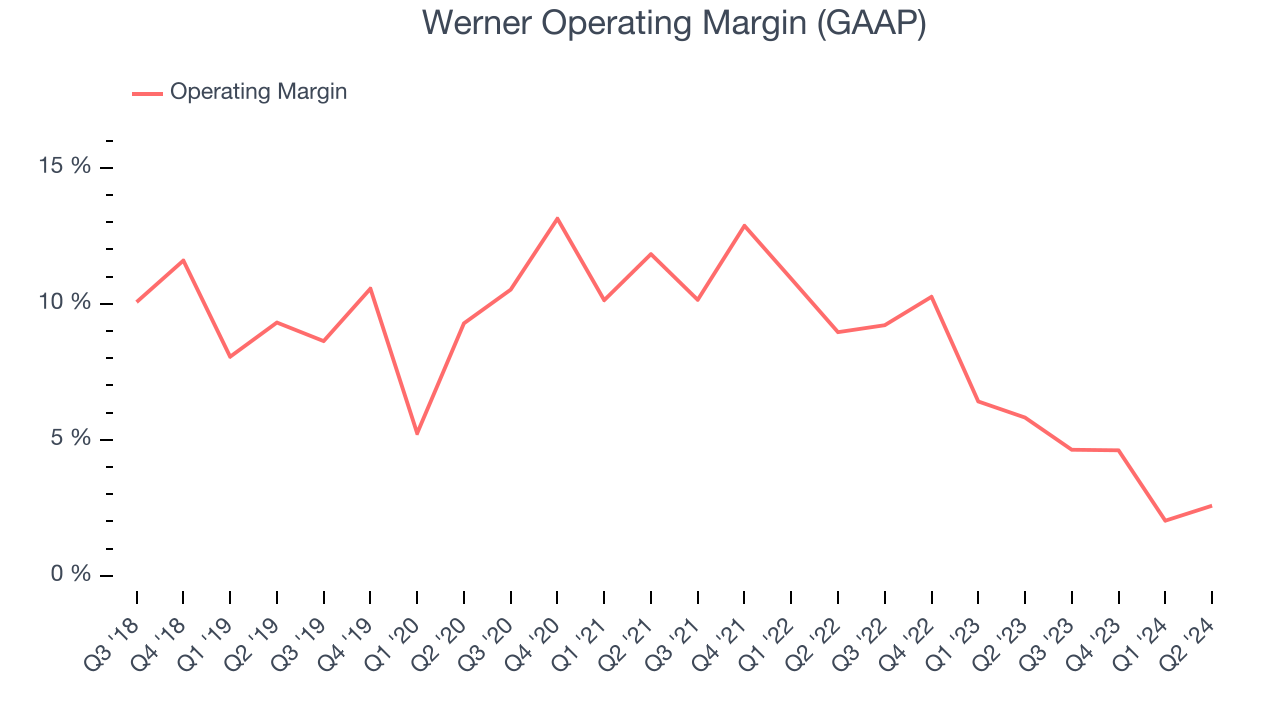

Werner has done a decent job managing its cost base over the last five years. The company produced an average operating margin of 8.2%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Werner’s annual operating margin decreased by 5.3 percentage points over the last five years. Even though its margin is still high, shareholders will want to see Werner become more profitable in the future.

Earnings Per Share

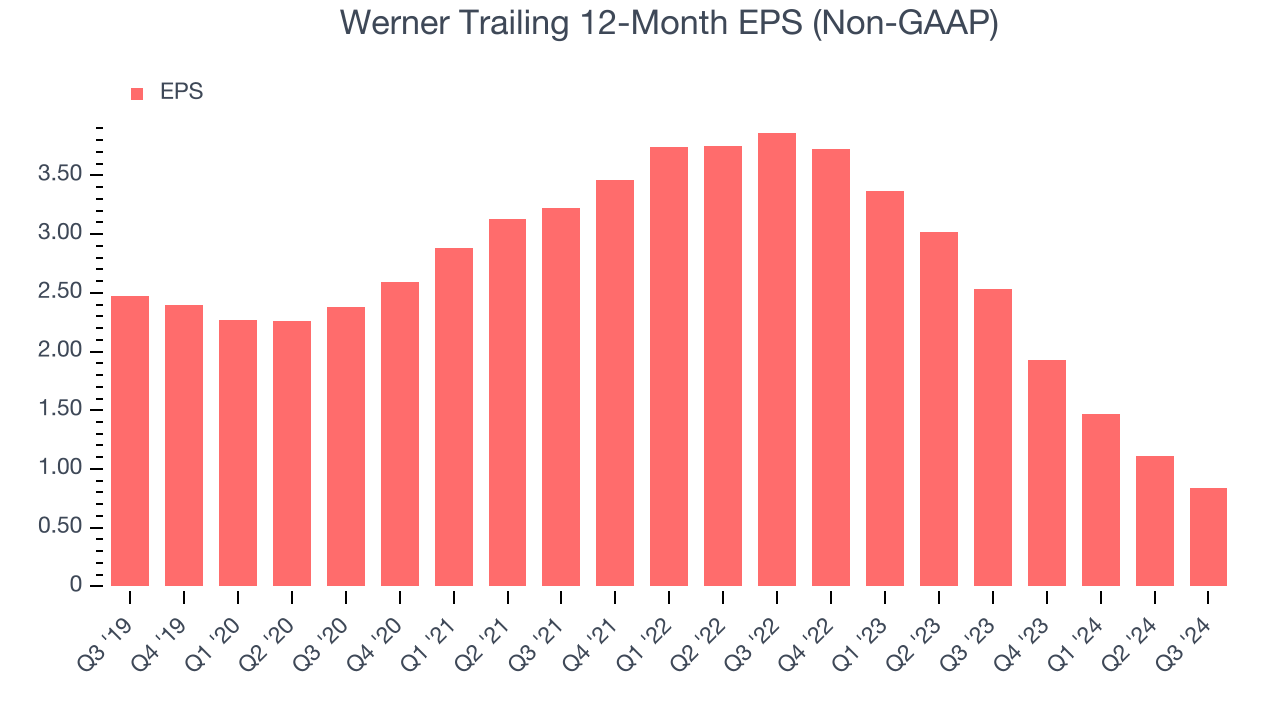

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Sadly for Werner, its EPS declined by 19.4% annually over the last five years while its revenue grew by 4.5%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Werner’s earnings can give us a better understanding of its performance. As we mentioned earlier, Werner’s operating margin declined by 5.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Werner, its two-year annual EPS declines of 53.3% show it’s continued to underperform. These results were bad no matter how you slice the data.In Q3, Werner reported EPS at $0.15, down from $0.42 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Werner’s full-year EPS of $0.84 to grow by 63.4%.

Key Takeaways from Werner’s Q3 Results

We struggled to find many strong positives in these results. Its revenue unfortunately missed, leading to fairly large operating profit and EPS misses. Overall, this was a weaker quarter. The stock traded down 4.8% to $36.45 immediately following the results.

Werner didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now?When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.