All News about Japanese Yen Trust Currencyshares

Via Talk Markets

FX Daily: Fed Minutes Keep Dollar Supported

October 10, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

USD/JPY Analysis: Poised for Action: Will 150 Hold Or Break?

October 09, 2024

Via Talk Markets

Via Talk Markets

.thumb.png.6a755305b402a613884b23771acec73e.png)

.thumb.png.da962dea4dfb468784e7b51033382c16.png)

De-Dollarization: Could A Petroyuan Usurp The Petrodollar?

October 09, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Via Talk Markets

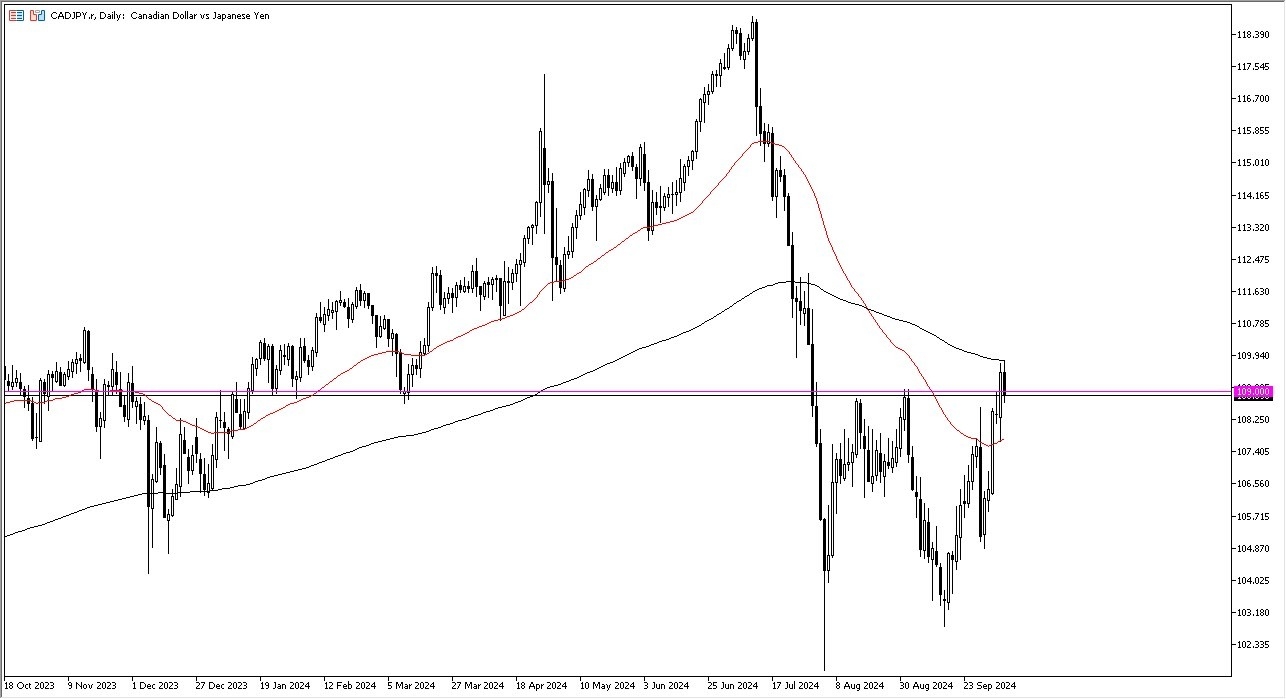

Analytical Overview of the Main Currency Pairs - Friday, October 4

October 04, 2024

Via Talk Markets

Topics

Economy

Exposures

Interest Rates

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.