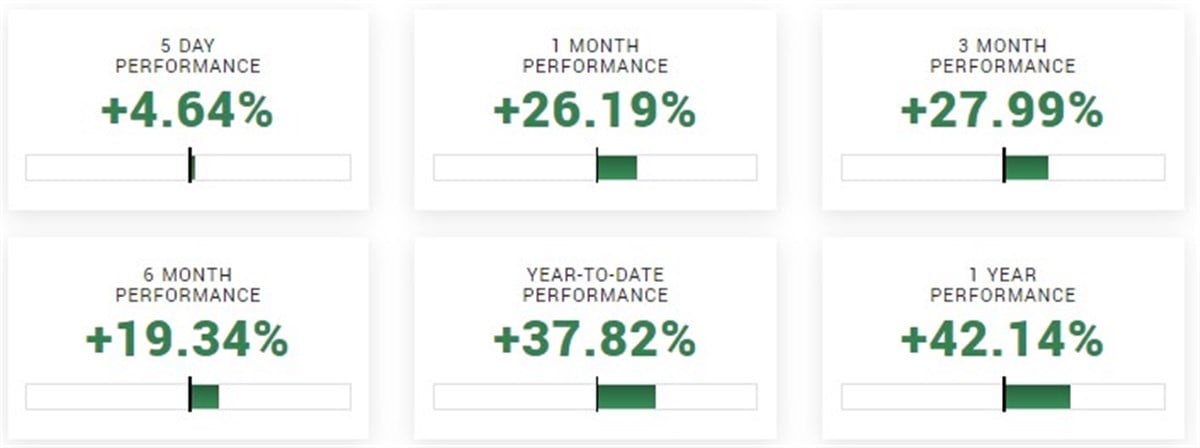

Over the past month and quarter, you'll struggle to find a better-performing, blue-chip industrial stock than the high-flying Boeing (NYSE: BA). The industrial giant's shares have surged almost 27% over the last month and are now up nearly 38% year-to-date (YTD).

Although the overall market’s surge has been impressive lately, closing in on its all-time highs and up almost 5% over the last month, shares of Boeing have vastly outperformed. The airplane manufacturer has also significantly outperformed its sector recently, with the popular Industrial Select Sector SPDR ETF (NYSE: XLI) up 14.57% versus almost 38% YTD for BA stock.

However, as shares of the largest airplane manufacturer in the world have surged almost 50% from its October lows just two months ago, has the stock traveled too far too soon?

A closer look at Boeing

As you likely already know, Boeing is the world's largest airplane manufacturer, dominating over 50% of certain markets and operating across four segments: Commercial Airplanes, Defense, Space and Security, Global Services, and Boeing Capital. The company has a $158 billion market capitalization and is trading at the high end of its 52-week range.

Prior to this remarkable surge higher and the latest uptrend in Boeing's stock, the company reported its quarterly results on October 25. During the quarter, the aircraft manufacturer reported an EPS of ($3.26), slightly below the anticipated ($3.21) by $0.05. The company generated $18.10 billion in revenue for the quarter, surpassing analyst predictions of $18.01 billion. This quarterly revenue marked a 13.5% increase compared to the previous year's period.

So, if the recent uptrend isn't a direct result of the company's earnings, perhaps it's instead a direct result of the shifting market sentiment, with Boeing being the benefactor of the capital reallocation by institutions and fund managers gaining exposure to the industrials sector.

The recent shift has favored Boeing

In a dramatic shift, the market seems to have veered from expecting a severe economic downturn to favoring the Federal Reserve's ability to navigate a gentler economic slowdown.

This unexpected turn appears to have caught many investors off guard. Consequently, the recent price action shows that numerous managers and funds found themselves lagging as they needed to allocate more resources to what's dubbed the 'Magnificent Seven' stocks.

As a result, there's been an impressive surge in stock prices, particularly among those that were previously undervalued and overlooked. These beaten-down stocks, like Boeing, once considered the cheapest and carrying recessionary concerns, are now taking the lead as the market reevaluates and sheds those prior pessimistic expectations.

Has the stock gotten ahead of itself?

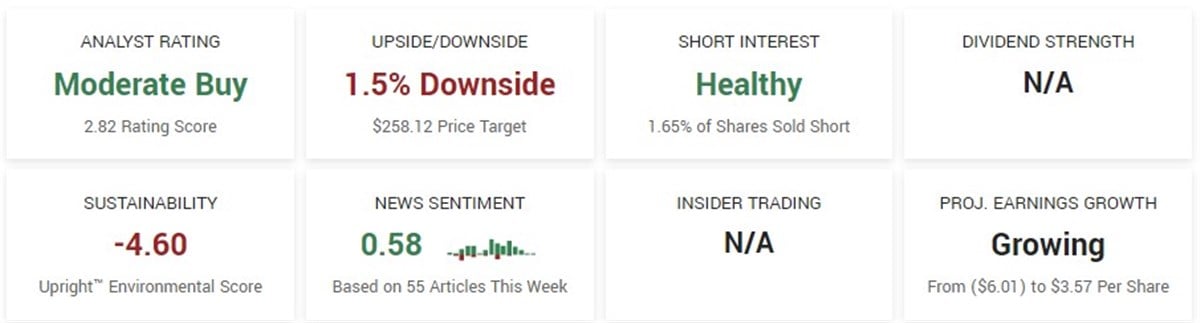

Analysts are bullish, with a consensus rating of Moderate Buy based on seventeen analyst ratings for BA. Of the seventeen, fourteen have BA as a Buy and three as a Hold. However, the consensus price target, although increased month over month, sees a 1.27% downside for the stock. It's not too surprising, given the extent of the recent rally.

Moreover, from a technical analysis perspective, there are indications that it is entering extremely overbought territory. Its price has significantly extended from critical moving averages. Not only has the stock begun to go vertical, but its Relative Strength Index (RSI) is also now 87.07, suggesting the stock is overbought and susceptive to a pullback or correction.