Clients can expect to open a checking account in just 3 minutes

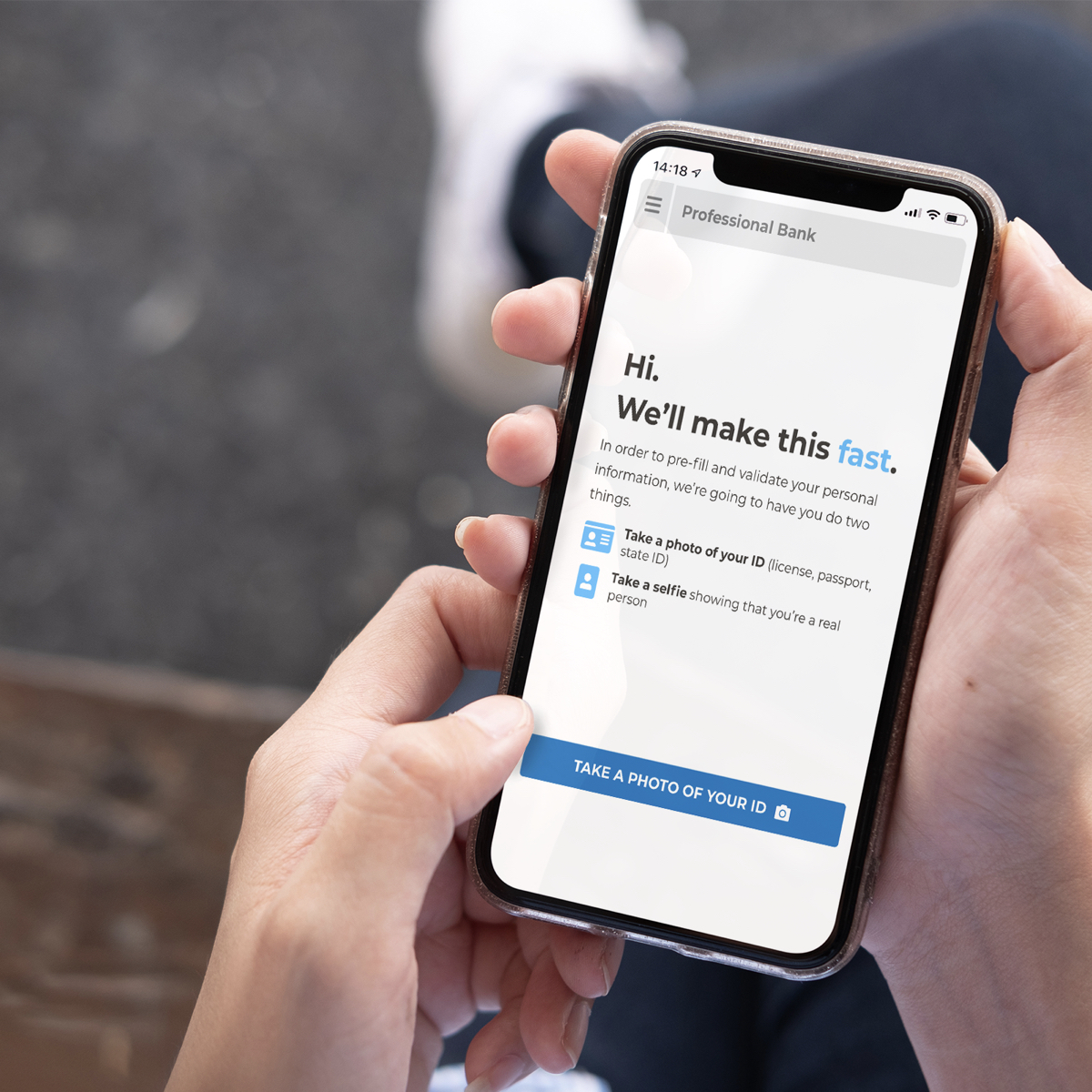

CORAL GABLES, FL / ACCESSWIRE / October 25, 2021 / An innovative, proprietary solution developed in-house by Professional Bank now makes starting a new relationship with the bank as easy as taking a selfie.

Individuals can use their mobile device to open a personal checking account online in about three minutes, saving time and hassle. At the same time, they connect with their personal banker, keeping human interaction very much an important part of the process.

"About 40% of banks allow people to complete an account application using a mobile device," says Daniel R. Sheehan, Chairman & CEO. "As a part of our focus with high-touch concierge service, we are leveraging technology to provide a faster, convenient service to expand the human-to-human interaction using the most popular devices. COVID-19 accelerated market adoption that we were already working on to address."

With more consumers opening accounts online since the pandemic began, Professional Bank is filling the gap between what clients desire and what community banks, with assets less than $25 billion, can typically offer.

"The vast majority of participants in our industry typically ask for anywhere from 30 to 50 pieces of information to open an account, "Sheehan says. "We're functionally accomplishing the same with just a few clicks and use of a mobile phone's camera."

According to one recent study, 75% of the nation's banks say it can take five minutes or more to open an account online, with about 30% reporting the digital process can take over 10 minutes. A third of all banks that offer a digital solution still say customers must visit a branch to finalize the process.

"There is room for improvement," says Sheehan. "We are enabling our clients to move at the relative speed they are used to with other digital product and service providers and avoid the slower pace that comes with additional paper forms, emails and subsequent branch appointments to sign documents."

Professional Bank's online account opening is simple. It only requires a mobile device with photo capabilities, a driver's license, and a minimum of $25 to fund the new account. The bank then takes it a step further by introducing them to their private banker--integrating the digital experience with the human experience.

"Right there, on a phone or tablet, our new client is introduced to a member of our private banking team," Sheehan says. "It's a further enhancement of our philosophy around client experience."

Professional Bank's Digital Innovation Center in Cleveland, which is tasked with finding ways to leverage technology to enhance the client experience, developed the online account opening system when it couldn't find an acceptable solution in the market.

"We took a look at the entire process of becoming a Professional Bank client and determined it could be improved," said EVP/Chief Information Officer Ryan Gorney. "Just like we tailor products and services to a particular client, our new system allows us to tailor the application process seamlessly. We get the information we need in a safe and secure way all while prioritizing the human relationship."

Gorney continued, "We don't want to use technology to replace person-to-person contact, but instead enhance it. That is our goal and what I think makes our system different from competitors. It is built by bankers, for bankers."

Professional Bank was established in 2008 to provide a private banking experience for small-to-medium- size businesses, and individuals. It offers an array of commercial banking products and services through a network of 11 full-service branches and loan production offices (LPOs) located in South Florida, Tampa Bay, Jacksonville and New England.

###

About Professional Bank and Professional Holding Corp.:

Professional Holding Corp. (NASDAQ:PFHD) is the financial holding company for Professional Bank, a Florida state-chartered bank established in 2008 and based in Coral Gables, Florida. Professional Bank focuses on providing creative, relationship-driven commercial banking products and services designed to meet the needs of small- to-medium-size businesses, the owners and operators of these businesses, professionals and entrepreneurs. Professional Bank currently operates its Florida network through nine branch locations and two Loan Production Offices in the regional areas of Miami, Broward, Palm Beach, Duval (Jacksonville), Hillsborough and Pinellas (Tampa Bay) counties. It also has a Digital Innovation Center located in Cleveland, Ohio and a Loan Production Office in New England. For more information, visit www.myprobank.com. Member FDIC. Equal Housing Lender.

Forward Looking Statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements contained in this presentation that are not statements of historical fact may be deemed to be forward-looking statements, including, without limitation, statements preceded by, followed by or including words such as "anticipate," "intend," "believe," "estimate," "plan," "seek," "project" or "expect," "may," "will," "would," "could" or "should" and similar expressions. Forward-looking statements represent the Company's current expectations, plans or forecasts and involve significant risks and uncertainties. Several important factors could cause actual results to differ materially from those in the forward-looking statements. Those factors include, without limitation, current and future economic and market conditions, including those that could impact credit quality and the ability to generate loans and gather deposits; the duration, extent and impact of the COVID-19 pandemic, including the governments' responses to the pandemic, on our and our customers' operations, personnel, and business activity (including developments and volatility), as well as COVID-19's impact on the credit quality of our loan portfolio and financial markets and general economic conditions; the effects of our lack of a diversified loan portfolio and concentration in the South Florida market; the impact of current and future interest rates and expectations concerning the actual timing and amount of interest rate movements; competition; our ability to execute business plans; geopolitical developments; legislative and regulatory developments; inflation or deflation; market fluctuations; natural disasters (including pandemics such as COVID-19); critical accounting estimates; and other factors described in our Form 10-K for the year ended December 31, 2020, Form 10-Q for the quarter ended March 31, 2021, and other filings with the Securities and Exchange Commission. The Company disclaims any obligation to update any of the forward-looking statements included herein to reflect future events or developments or changes in expectations, except as may be required by law.

Media Contact:

Eric Kalis or Todd Templin, BoardroomPR

ekalis@boardroompr.com / ttemplin@boardroompr.com

954-370-8999

SOURCE: Professional Holding Corp.

View source version on accesswire.com:

https://www.accesswire.com/669487/Professional-Bank-Launches-New-Digital-Account-Opening