Creative software maker Adobe (NASDAQ:ADBE) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 11.1% year on year to $5.61 billion. On the other hand, next quarter’s revenue guidance of $5.66 billion was less impressive, coming in 1.2% below analysts’ estimates. Its non-GAAP profit of $4.81 per share was 3% above analysts’ consensus estimates.

Is now the time to buy Adobe? Find out by accessing our full research report, it’s free.

Adobe (ADBE) Q4 CY2024 Highlights:

- Revenue: $5.61 billion vs analyst estimates of $5.54 billion (11.1% year-on-year growth, 1.2% beat)

- Net New Digital Media ARR: $578 million vs analyst estimates of $555 million (4.1% beat)

- Adjusted EPS: $4.81 vs analyst estimates of $4.67 (3% beat)

- Adjusted Operating Income: $2.60 billion vs analyst estimates of $2.53 billion (46.3% margin, 2.7% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $23.43 billion at the midpoint, missing analyst estimates by 1.6% and implying 8.9% growth (vs 10.8% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $20.35 at the midpoint, missing analyst estimates by 0.9%

- Operating Margin: 34.9%, in line with the same quarter last year

- Free Cash Flow Margin: 51.2%, up from 36.3% in the previous quarter

- Billings: $5.96 billion at quarter end, up 8.1% year on year

- Market Capitalization: $241.2 billion

“Adobe delivered record FY24 revenue, demonstrating strong demand and the mission-critical role Creative Cloud, Document Cloud and Experience Cloud play in fueling the AI economy,” said Shantanu Narayen, chair and CEO, Adobe.

Company Overview

One of the most well-known Silicon Valley software companies around, Adobe (NASDAQ:ADBE) is a leading provider of software as service in the digital design and document management space.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

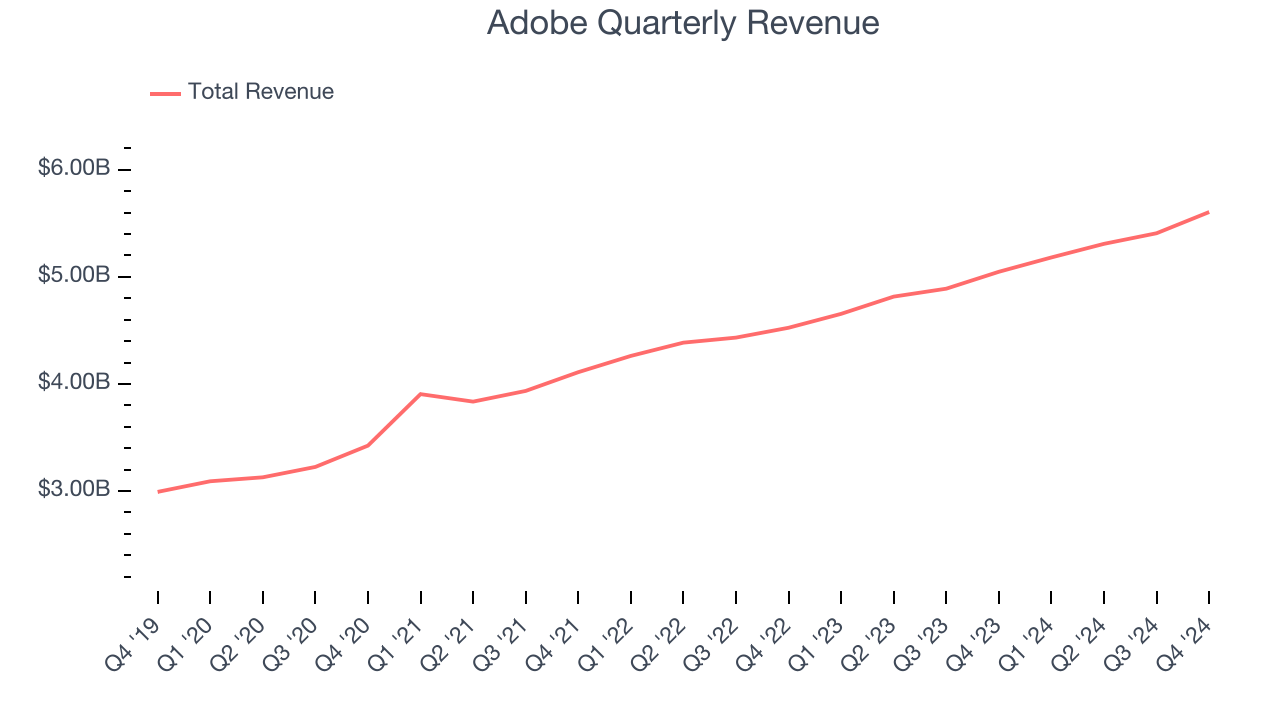

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last three years, Adobe grew its sales at a 10.9% compounded annual growth rate. Although this growth is solid on an absolute basis, it fell short of our benchmark for the software sector. Luckily, there are other things to like about Adobe.

This quarter, Adobe reported year-on-year revenue growth of 11.1%, and its $5.61 billion of revenue exceeded Wall Street’s estimates by 1.2%. Company management is currently guiding for a 9.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.7% over the next 12 months, similar to its three-year rate. This projection is above the sector average and indicates its newer products and services will help maintain its historical top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

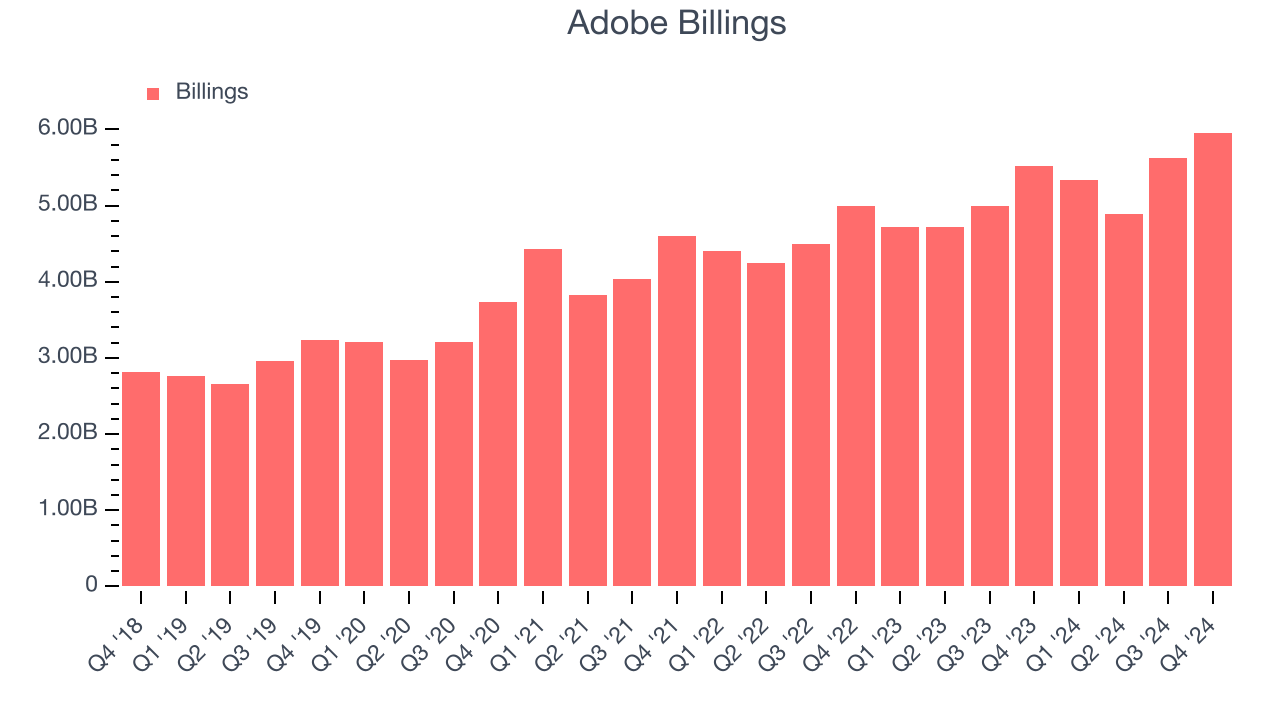

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Adobe’s billings came in at $5.96 billion in Q4, and over the last four quarters, its growth slightly lagged the sector as it averaged 9.4% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

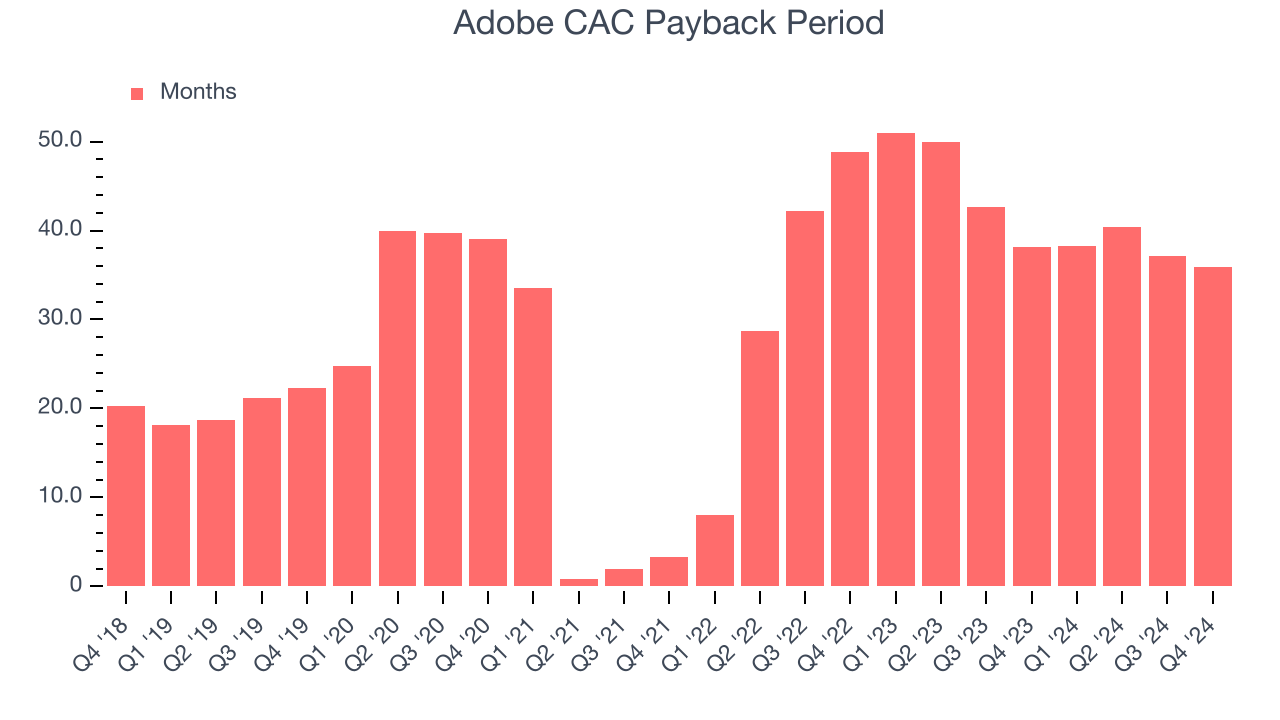

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Adobe is quite efficient at acquiring new customers, and its CAC payback period checked in at 35.9 months this quarter. The company’s performance gives it the freedom to invest its resources into new product initiatives while maintaining optionality.

Key Takeaways from Adobe’s Q4 Results

It was good to see Adobe beat analysts’ revenue, EPS, and adjusted operating income expectations. On the other hand, its full-year revenue and EPS guidance missed Wall Street's estimates. Overall, this was a weaker quarter because of the soft outlook. The stock traded down 5% to $522.32 immediately after reporting.

Adobe may have had a tough quarter, but does that actually create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.