Is Cisco Systems Stock Outperforming the Nasdaq?

By:

Barchart.com

November 26, 2025 at 04:45 AM EST

San Jose, California-based Cisco Systems, Inc. (CSCO) is an IP-based networking company offering products and services to service providers, companies, commercial users, and individuals. With a market cap of $301.2 billion, Cisco’s operations span the Americas, Indo-Pacific, Europe, the Middle East, and Africa. Companies worth $200 billion or more are generally described as "mega-cap stocks." CSCO fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the communication equipment industry. More Top Stocks Daily: Go behind Wall Street’s hottest headlines with Barchart’s Active Investor newsletter.

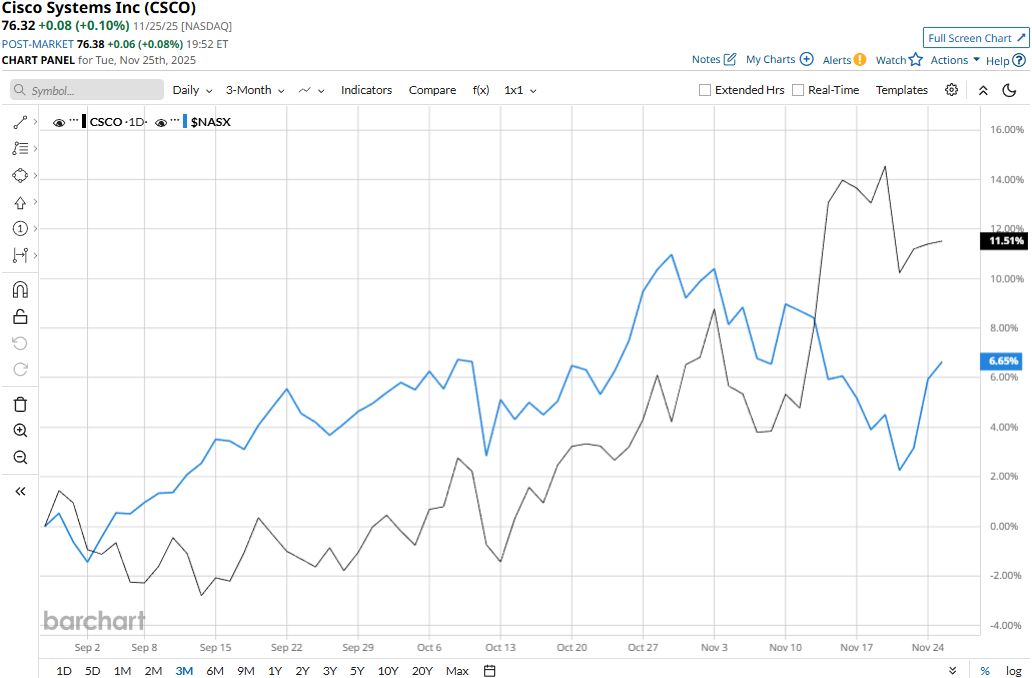

Cisco touched its all-time high of $80.06 on Nov. 20 and is currently trading 4.7% below that peak. Meanwhile, CSCO stock prices have surged 13.7% over the past three months, outperforming the Nasdaq Composite’s ($NASX) 7.4% uptick during the same time frame.

Over the longer term, Cisco’s performance looks even more impressive. CSCO stock prices have soared 28.9% on a YTD basis and 29.9% over the past 52 weeks, outpacing SPX’s 19.2% gains in 2025 and 20.8% surge over the past year. CSCO stock has traded consistently above its 200-day moving average since April and above its 50-day moving average since mid-October, underscoring its bullish trend.

Cisco Systems’ stock prices surged 4.6% in the trading session following the release of its better-than-expected Q1 results on Nov. 12. Driven by a continued surge in demand for its products, Cisco’s overall revenues for the quarter grew 7.5% year-over-year to $14.9 billion, surpassing the Street’s expectations by 71 bps. Further, its adjusted EPS increased by a notable 9.9% year-over-year to $1, exceeding the consensus estimates by 2%. On a more positive note, Cisco has also outperformed its peer, Hewlett Packard Enterprise Company’s (HPE) 3.8% decline over the past 52 weeks and a marginal 5 bps uptick in 2025. Among the 23 analysts covering the CSCO stock, the consensus rating is a “Moderate Buy.” As of writing, Cisco’s mean price target of $86.31 suggests a 13.1% upside potential from current price levels. On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

More NewsView More

Up Over 20% in 2025, These 3 Stocks Are Boosting Buyback Capacity ↗

December 01, 2025

Via MarketBeat

Congress Beat the Market Again—Here Are the 3 Stocks They Bought ↗

December 01, 2025

Via MarketBeat

Go on a Shopping Spree With 3 Top Retail ETFs ↗

December 01, 2025

3 Fresh Dividend Hikes That Might Be Telling You Something ↗

December 01, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|