Wintrust Financial (NASDAQ:WTFC) Posts Better-Than-Expected Sales In Q3

By:

StockStory

October 20, 2025 at 17:09 PM EDT

Regional banking company Wintrust Financial (NASDAQ: WTFC) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 13.3% year on year to $697.8 million. Its non-GAAP profit of $3.06 per share was 12.9% above analysts’ consensus estimates. Is now the time to buy Wintrust Financial? Find out by accessing our full research report, it’s free for active Edge members. Wintrust Financial (WTFC) Q3 CY2025 Highlights:

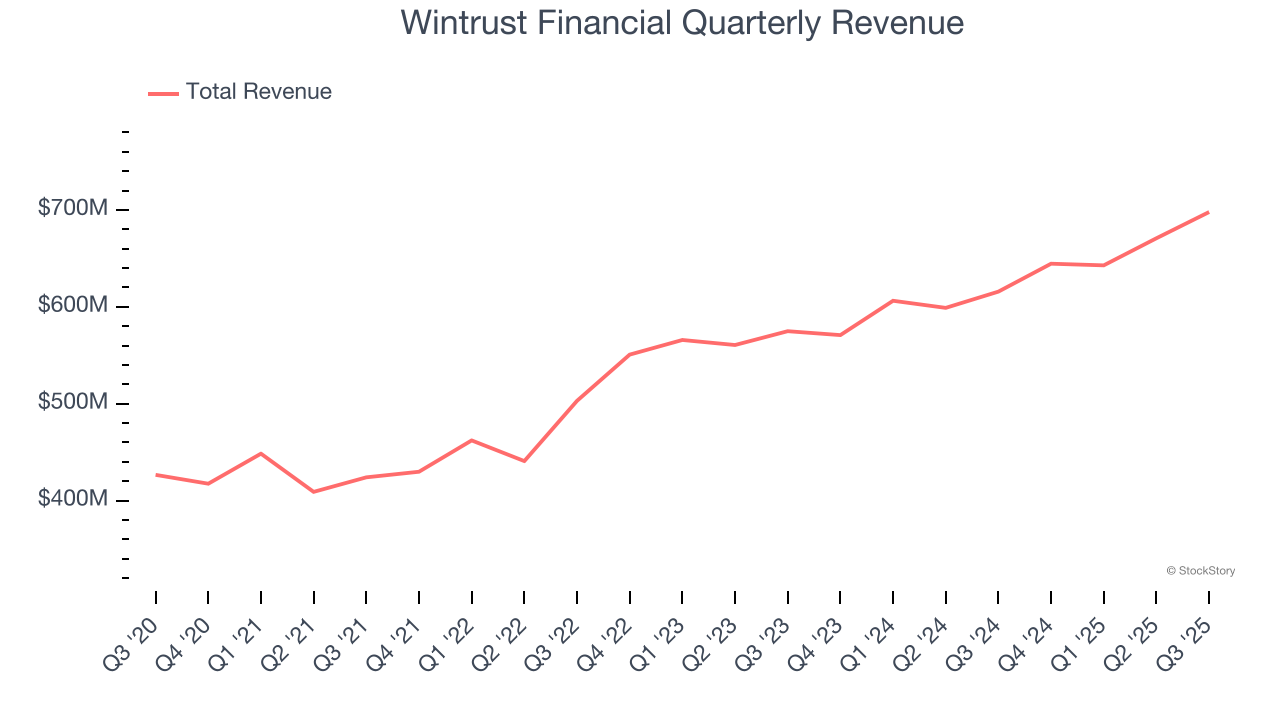

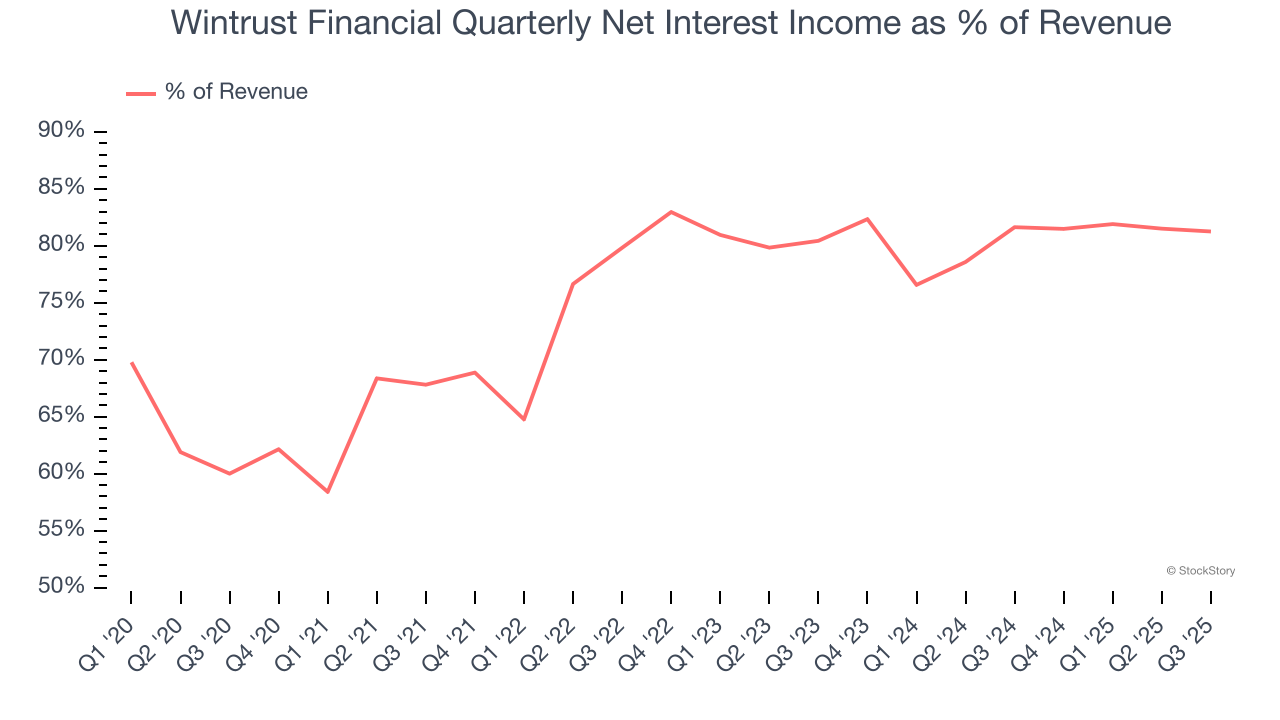

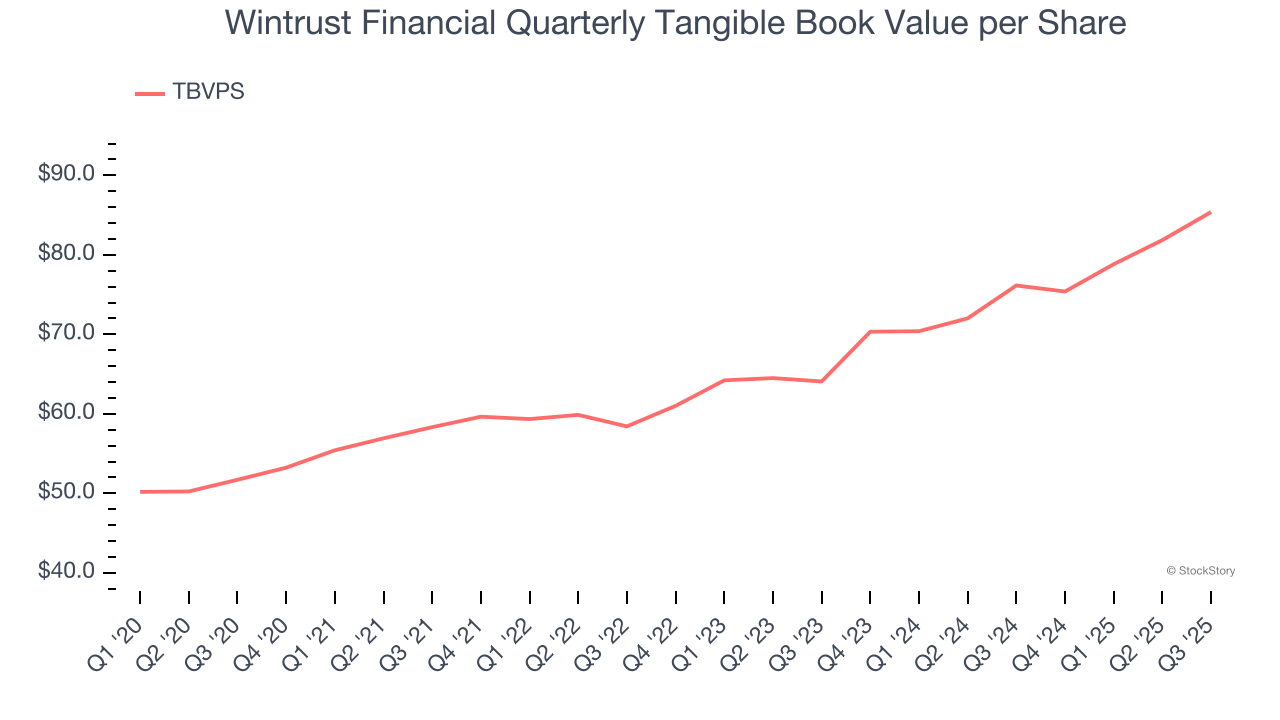

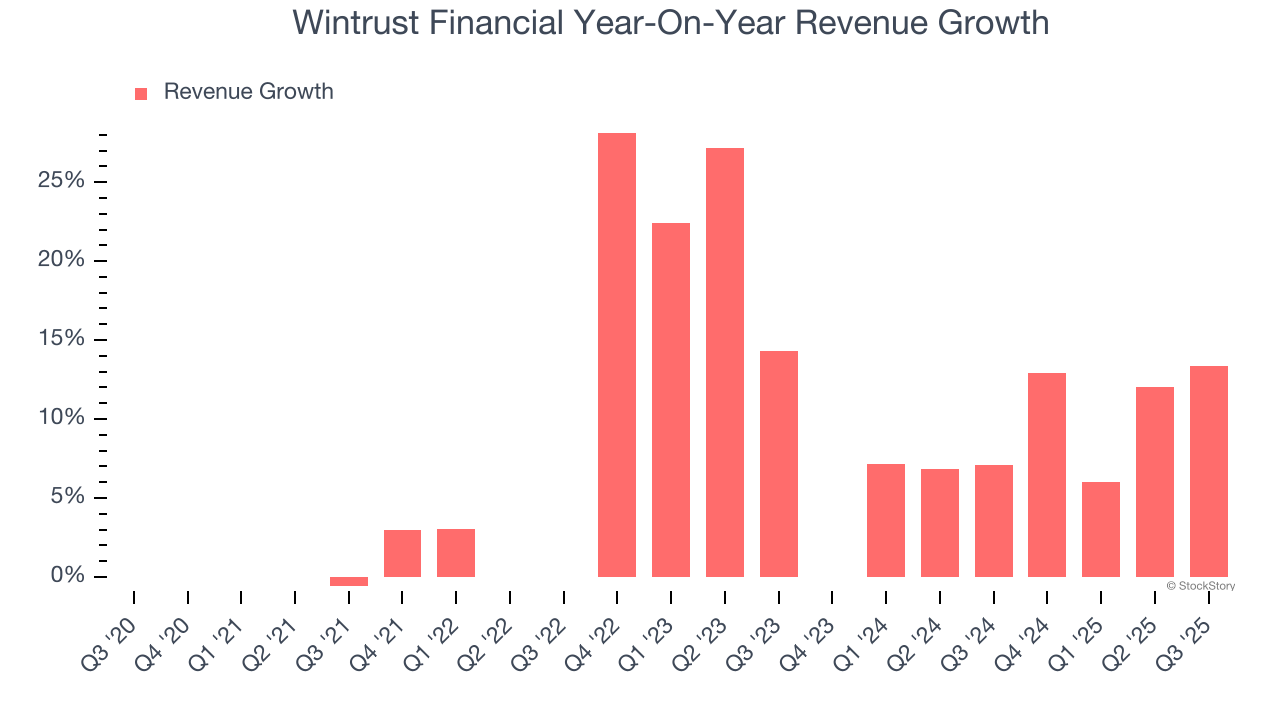

Timothy S. Crane, President and Chief Executive Officer, commented, “We continued to build on the momentum established in our record first half of the year with record net income, net interest income, strong balance sheet growth and prudent management of net interest margin.” Company OverviewFounded in 1991 as a community-focused alternative to big banks in the Chicago area, Wintrust Financial (NASDAQGS:WTFC) operates community banks in the Chicago area and provides specialty finance services including insurance premium financing and wealth management. Sales GrowthFrom lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions. Thankfully, Wintrust Financial’s 10.6% annualized revenue growth over the last five years was impressive. Its growth beat the average banking company and shows its offerings resonate with customers.  Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Wintrust Financial’s annualized revenue growth of 8.6% over the last two years is below its five-year trend, but we still think the results suggest healthy demand. This quarter, Wintrust Financial reported year-on-year revenue growth of 13.3%, and its $697.8 million of revenue exceeded Wall Street’s estimates by 1.2%. Net interest income made up 75.8% of the company’s total revenue during the last five years, meaning lending operations are Wintrust Financial’s largest source of revenue.  Our experience and research show the market cares primarily about a bank’s net interest income growth as non-interest income is considered a lower-quality and non-recurring revenue source. Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link. Tangible Book Value Per Share (TBVPS)Banks operate as balance sheet businesses, with profits generated through borrowing and lending activities. Valuations reflect this reality, emphasizing balance sheet strength and long-term book value compounding ability. This explains why tangible book value per share (TBVPS) stands as the premier banking metric. TBVPS strips away questionable intangible assets, revealing concrete per-share net worth that investors can trust. Other (and more commonly known) per-share metrics like EPS can sometimes be murky due to M&A or accounting rules allowing for loan losses to be spread out. Wintrust Financial’s TBVPS grew at an incredible 10.6% annual clip over the last five years. TBVPS growth has also accelerated recently, growing by 15.4% annually over the last two years from $64.07 to $85.39 per share.  Over the next 12 months, Consensus estimates call for Wintrust Financial’s TBVPS to grow by 9.9% to $93.85, solid growth rate. Key Takeaways from Wintrust Financial’s Q3 ResultsIt was good to see Wintrust Financial beat analysts’ revenue and EPS expectations this quarter. We were also happy its tangible book value per share outperformed Wall Street’s estimates. On the other hand, its net interest income was in line. Overall, this print had some key positives. The stock traded up 1.9% to $129.01 immediately after reporting. Sure, Wintrust Financial had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members. More NewsView More

Ulta’s Stock May Be Set for a Glow-Up—20% Upside Ahead? ↗

December 06, 2025

Via MarketBeat

Tickers

ULTA

Gates Foundation Sells MSFT Stock—Should Investors Be Worried? ↗

December 06, 2025

Via MarketBeat

Tickers

MSFT

MarketBeat Week in Review – 12/1 - 12/5 ↗

December 06, 2025

Rocket Lab’s Big Rebound? Analysts Suggest the Dip's a Gift ↗

December 05, 2025

Via MarketBeat

Tickers

RKLB

Meta’s AI Moment? New SAM 3 Model Has Wall Street Turning Bullish ↗

December 05, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.