WD-40 (WDFC) Reports Q3: Everything You Need To Know Ahead Of Earnings

By:

StockStory

October 20, 2025 at 23:06 PM EDT

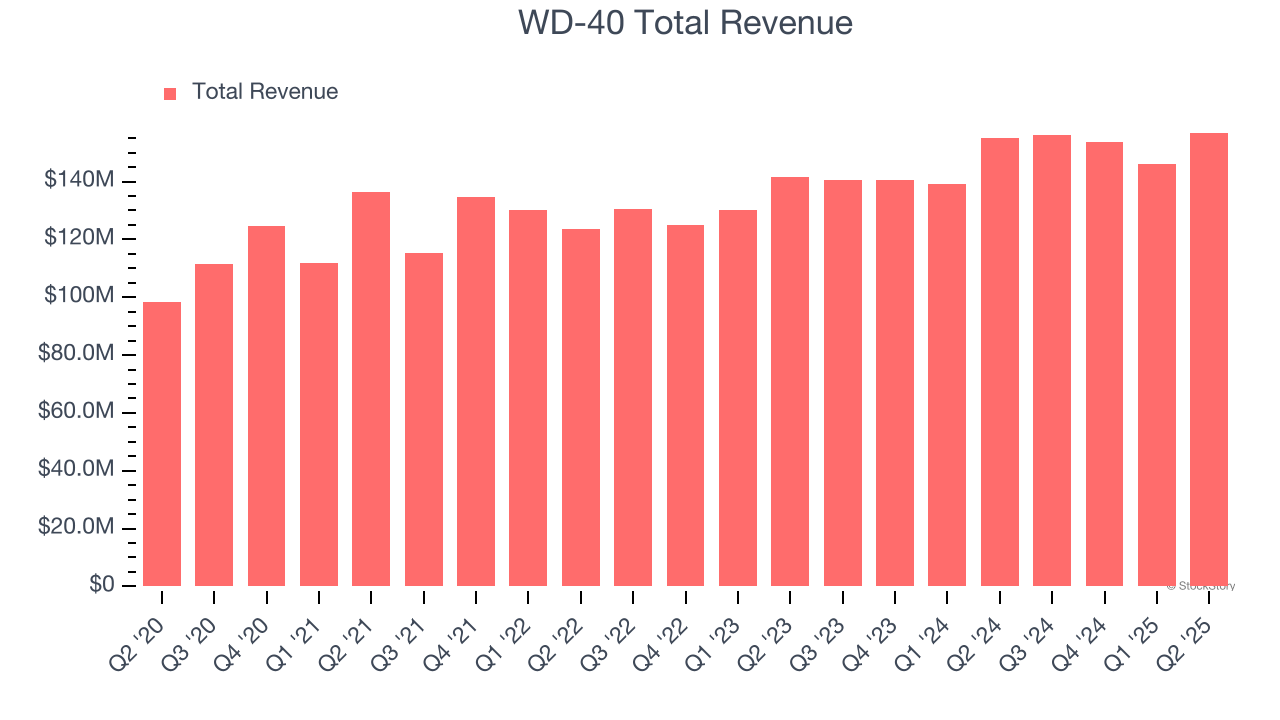

Household products company WD-40 (NASDAQ: WDFC) will be reporting results this Wednesday after market hours. Here’s what investors should know. WD-40 missed analysts’ revenue expectations by 2.3% last quarter, reporting revenues of $156.9 million, up 1.2% year on year. It was a slower quarter for the company, with full-year revenue guidance missing analysts’ expectations and a miss of analysts’ revenue estimates. Is WD-40 a buy or sell going into earnings? Read our full analysis here, it’s free for active Edge members. This quarter, analysts are expecting WD-40’s revenue to decline 1.3% year on year to $153.9 million, a reversal from the 11.1% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.82 per share.  Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. WD-40 has missed Wall Street’s revenue estimates twice since going public. Looking at WD-40’s peers in the consumer staples segment, some have already reported their Q3 results, giving us a hint as to what we can expect. Lamb Weston posted flat year-on-year revenue, beating analysts’ expectations by 2.6%, and Conagra reported a revenue decline of 5.8%, topping estimates by 0.7%. Lamb Weston traded up 11.4% following the results while Conagra was also up 5%. Read our full analysis of Lamb Weston’s results here and Conagra’s results here. Investors in the consumer staples segment have had fairly steady hands going into earnings, with share prices down 1.9% on average over the last month. WD-40 is down 7.1% during the same time and is heading into earnings with an average analyst price target of $277.50 (compared to the current share price of $193.07). P.S. While everyone's chasing Nvidia, we found a hidden AI semiconductor winner trading at a fraction of the price. See our #1 pick before Wall Street catches on. StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here. More NewsView More

Ulta’s Stock May Be Set for a Glow-Up—20% Upside Ahead? ↗

December 06, 2025

Via MarketBeat

Tickers

ULTA

Gates Foundation Sells MSFT Stock—Should Investors Be Worried? ↗

December 06, 2025

Via MarketBeat

Tickers

MSFT

MarketBeat Week in Review – 12/1 - 12/5 ↗

December 06, 2025

Rocket Lab’s Big Rebound? Analysts Suggest the Dip's a Gift ↗

December 05, 2025

Via MarketBeat

Tickers

RKLB

Meta’s AI Moment? New SAM 3 Model Has Wall Street Turning Bullish ↗

December 05, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|