3 Reasons to Sell MYPS and 1 Stock to Buy Instead

By:

StockStory

October 22, 2025 at 00:01 AM EDT

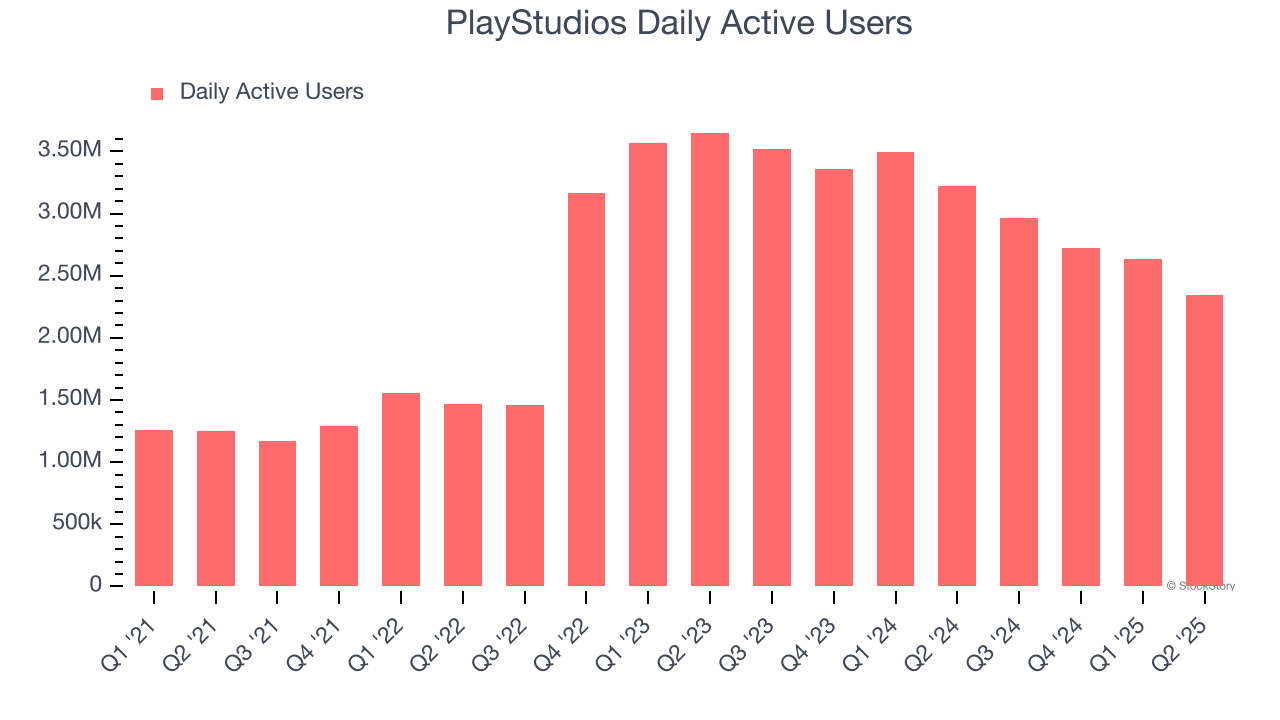

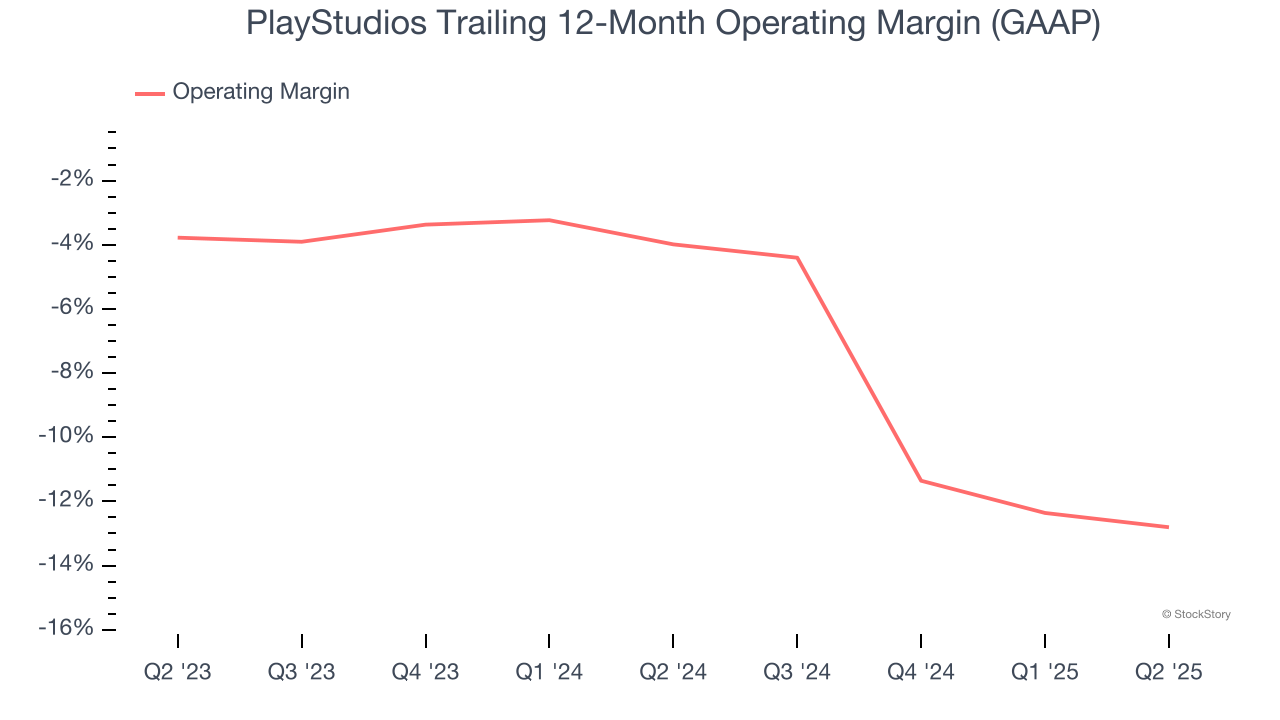

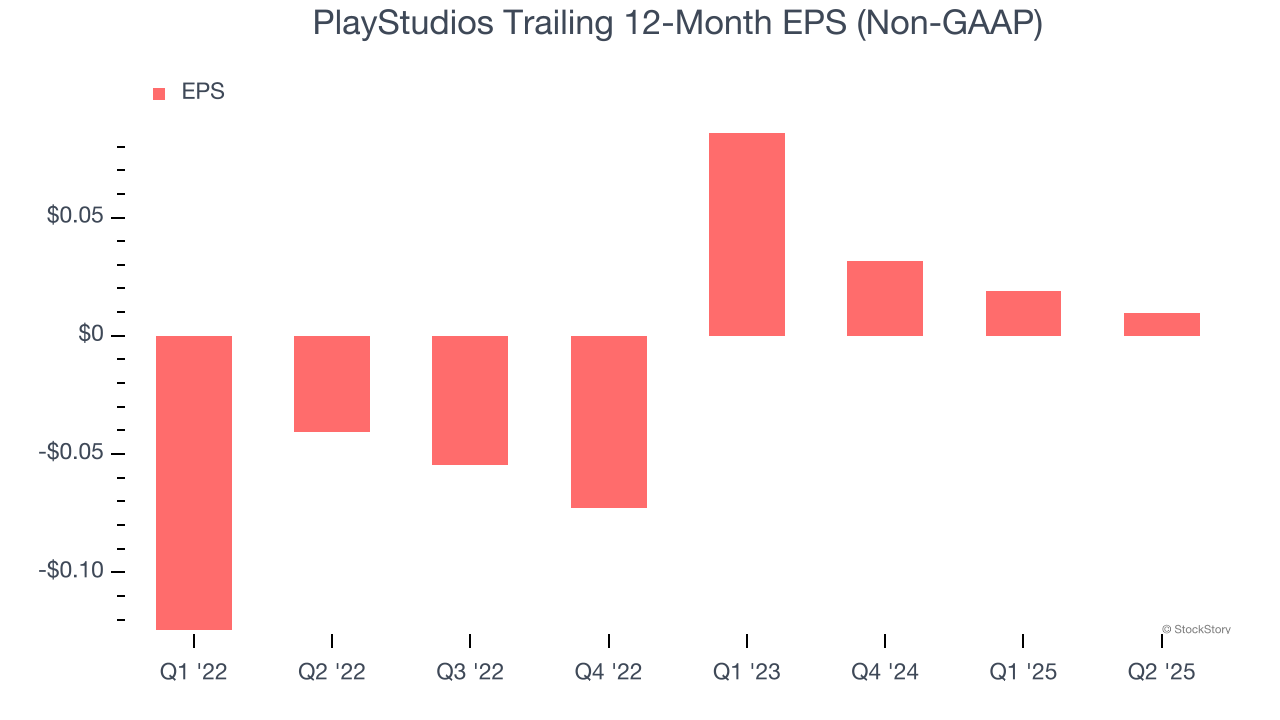

PlayStudios has gotten torched over the last six months - since April 2025, its stock price has dropped 25.4% to $0.94 per share. This might have investors contemplating their next move. Is now the time to buy PlayStudios, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members. Why Do We Think PlayStudios Will Underperform?Even though the stock has become cheaper, we don't have much confidence in PlayStudios. Here are three reasons you should be careful with MYPS and a stock we'd rather own. 1. Weak Growth in Daily Active Users Points to Soft DemandRevenue growth can be broken down into changes in price and volume (for companies like PlayStudios, our preferred volume metric is daily active users). While both are important, the latter is the most critical to analyze because prices have a ceiling. PlayStudios’s daily active users came in at 2.35 million in the latest quarter, and over the last two years, averaged 5.8% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability. 2. Operating Losses Sound the AlarmsOperating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes. PlayStudios’s operating margin has been trending down over the last 12 months and averaged negative 8.1% over the last two years. Unprofitable consumer discretionary companies with falling margins deserve extra scrutiny because they’re spending loads of money to stay relevant, an unsustainable practice.  3. EPS Trending DownWe track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable. PlayStudios’s full-year EPS dropped 42.7%, or 12.6% annually, over the last three years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, PlayStudios’s low margin of safety could leave its stock price susceptible to large downswings.  Final JudgmentWe see the value of companies helping consumers, but in the case of PlayStudios, we’re out. Following the recent decline, the stock trades at 2.7× forward EV-to-EBITDA (or $0.94 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are more exciting stocks to buy at the moment. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy. Stocks We Would Buy Instead of PlayStudiosWhen Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses. Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025). Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today. StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here. More NewsView More

Ulta’s Stock May Be Set for a Glow-Up—20% Upside Ahead? ↗

December 06, 2025

Via MarketBeat

Tickers

ULTA

Gates Foundation Sells MSFT Stock—Should Investors Be Worried? ↗

December 06, 2025

Via MarketBeat

Tickers

MSFT

MarketBeat Week in Review – 12/1 - 12/5 ↗

December 06, 2025

Rocket Lab’s Big Rebound? Analysts Suggest the Dip's a Gift ↗

December 05, 2025

Via MarketBeat

Tickers

RKLB

Meta’s AI Moment? New SAM 3 Model Has Wall Street Turning Bullish ↗

December 05, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|