3 Reasons to Sell PEGA and 1 Stock to Buy Instead

By:

StockStory

December 04, 2025 at 23:03 PM EST

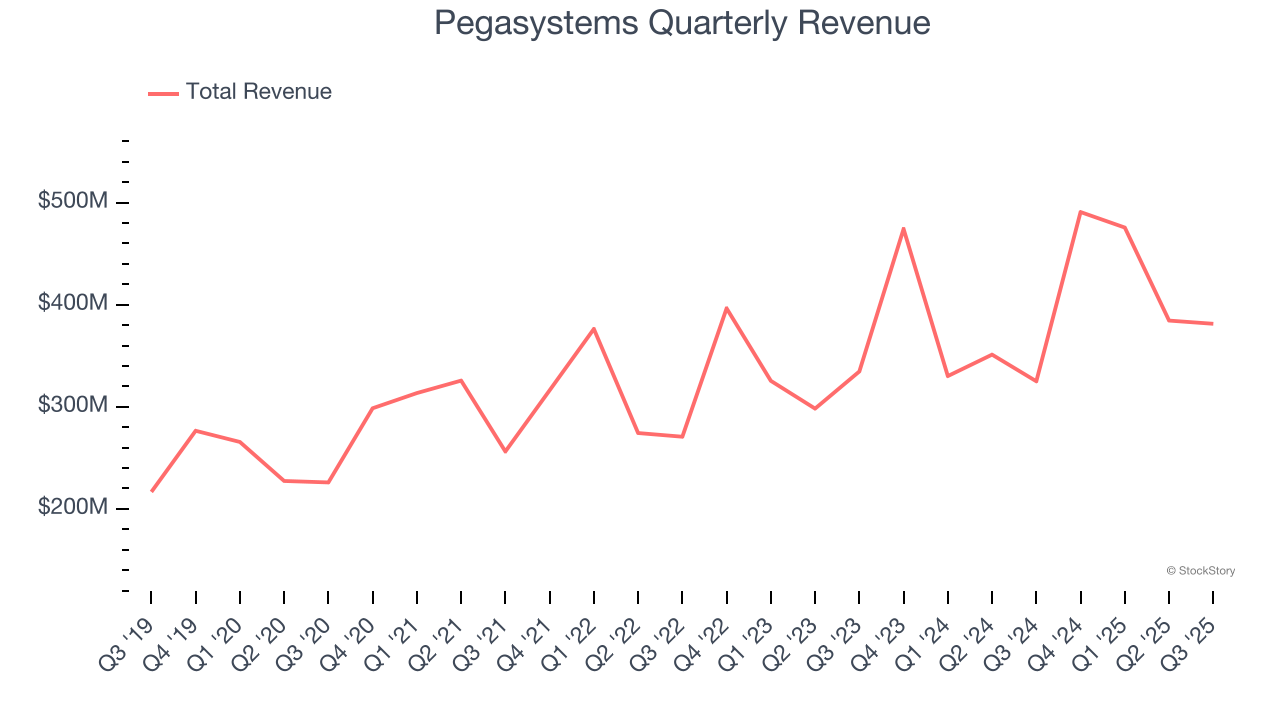

Pegasystems trades at $57.03 per share and has stayed right on track with the overall market, gaining 12% over the last six months. At the same time, the S&P 500 has returned 15.3%. Is now the time to buy Pegasystems, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members. Why Is Pegasystems Not Exciting?We don't have much confidence in Pegasystems. Here are three reasons why PEGA doesn't excite us and a stock we'd rather own. 1. Long-Term Revenue Growth DisappointsA company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Pegasystems grew its sales at a 11.7% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.  2. Projected Revenue Growth Is SlimForecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite. Over the next 12 months, sell-side analysts expect Pegasystems’s revenue to rise by 4.2%, a deceleration versus its 11.7% annualized growth for the past five years. This projection is underwhelming and indicates its products and services will face some demand challenges. 3. Long Payback Periods Delay ReturnsThe customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments. Pegasystems’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow. Final JudgmentPegasystems isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 5.6× forward price-to-sales (or $57.03 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d recommend looking at the most dominant software business in the world. High-Quality Stocks for All Market ConditionsYour portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily. The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025). Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today. StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here. More NewsView More

Ulta’s Stock May Be Set for a Glow-Up—20% Upside Ahead? ↗

December 06, 2025

Via MarketBeat

Tickers

ULTA

Gates Foundation Sells MSFT Stock—Should Investors Be Worried? ↗

December 06, 2025

Via MarketBeat

Tickers

MSFT

MarketBeat Week in Review – 12/1 - 12/5 ↗

December 06, 2025

Rocket Lab’s Big Rebound? Analysts Suggest the Dip's a Gift ↗

December 05, 2025

Via MarketBeat

Tickers

RKLB

Meta’s AI Moment? New SAM 3 Model Has Wall Street Turning Bullish ↗

December 05, 2025

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|