2 Reasons to Like ARLO and 1 to Stay Skeptical

By:

StockStory

June 10, 2025 at 00:01 AM EDT

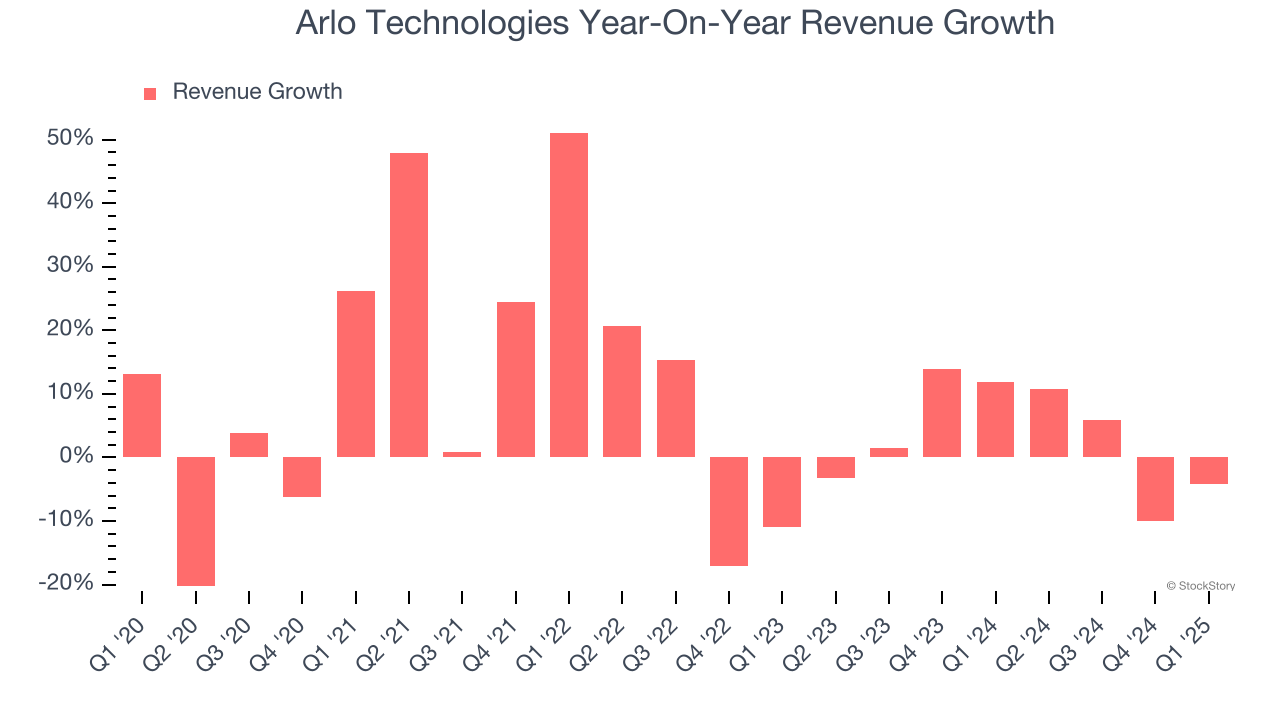

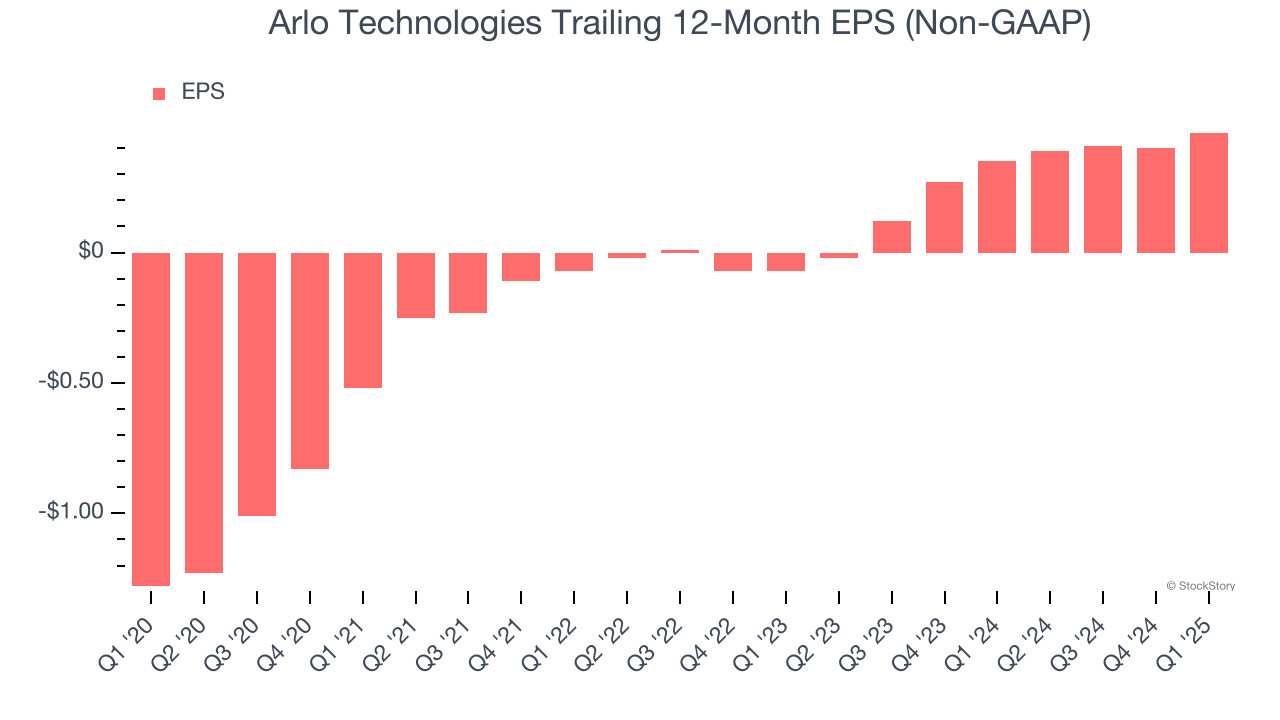

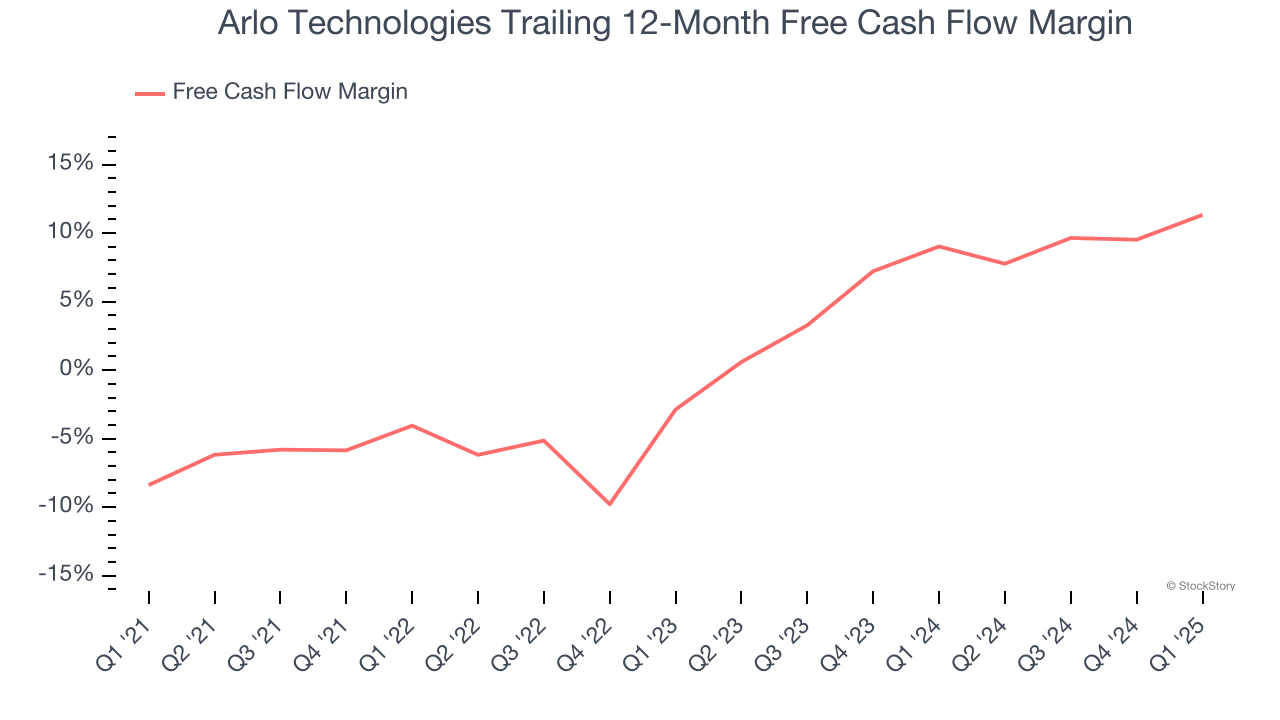

Arlo Technologies currently trades at $17.34 and has been a dream stock for shareholders. It’s returned 594% since June 2020, blowing past the S&P 500’s 88% gain. The company has also beaten the index over the past six months as its stock price is up 31.5% thanks to its solid quarterly results. Is now still a good time to buy ARLO? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free. Why Does ARLO Stock Spark Debate?Originally spun off from networking equipment maker Netgear in 2018, Arlo Technologies (NYSE: ARLO) provides cloud-based smart security devices and subscription services that help consumers and businesses monitor and protect their homes, properties, and loved ones. Two Things to Like:1. Outstanding Long-Term EPS GrowthAnalyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions. Arlo Technologies’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.  2. Increasing Free Cash Flow Margin Juices FinancialsIf you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills. As you can see below, Arlo Technologies’s margin expanded by 19.7 percentage points over the last five years. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Arlo Technologies’s free cash flow margin for the trailing 12 months was 11.3%.  One Reason to be Careful:Lackluster Revenue GrowthLong-term growth is the most important, but within business services, a stretched historical view may miss new innovations or demand cycles. Arlo Technologies’s recent performance shows its demand has slowed as its annualized revenue growth of 3% over the last two years was below its five-year trend. Final JudgmentArlo Technologies has huge potential even though it has some open questions, and with its shares beating the market recently, the stock trades at 27× forward P/E (or $17.34 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free. Stocks We Like Even More Than Arlo TechnologiesDonald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs. While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025). Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today. More NewsView More

These Are the Hottest Upgrades From the Q3 Reporting Cycle ↗

Today 9:06 EST

Why Bitcoin ETFs Like IBIT May Be Set to Surge in 2026 ↗

Today 7:38 EST

Up Over 20% in 2025, These 3 Stocks Are Boosting Buyback Capacity ↗

December 01, 2025

Via MarketBeat

Congress Beat the Market Again—Here Are the 3 Stocks They Bought ↗

December 01, 2025

Via MarketBeat

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|