Arlo Technologies (ARLO): Buy, Sell, or Hold Post Q2 Earnings?

By:

StockStory

September 10, 2025 at 00:01 AM EDT

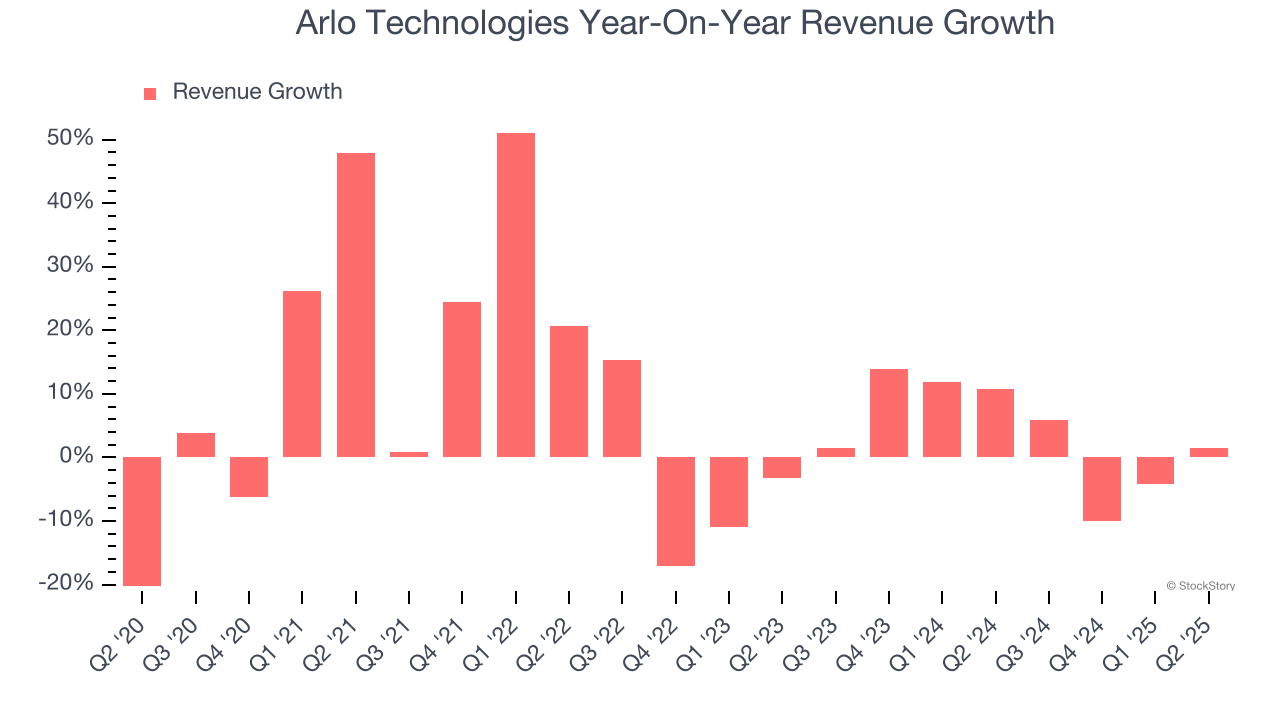

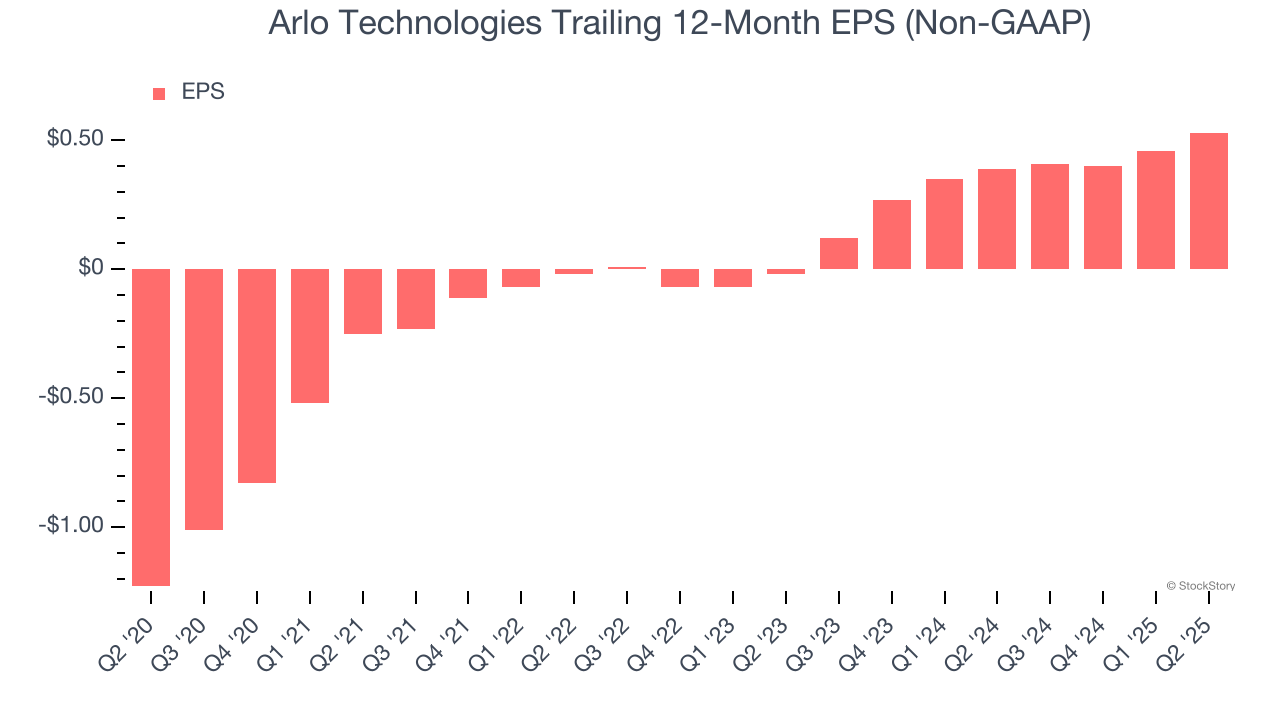

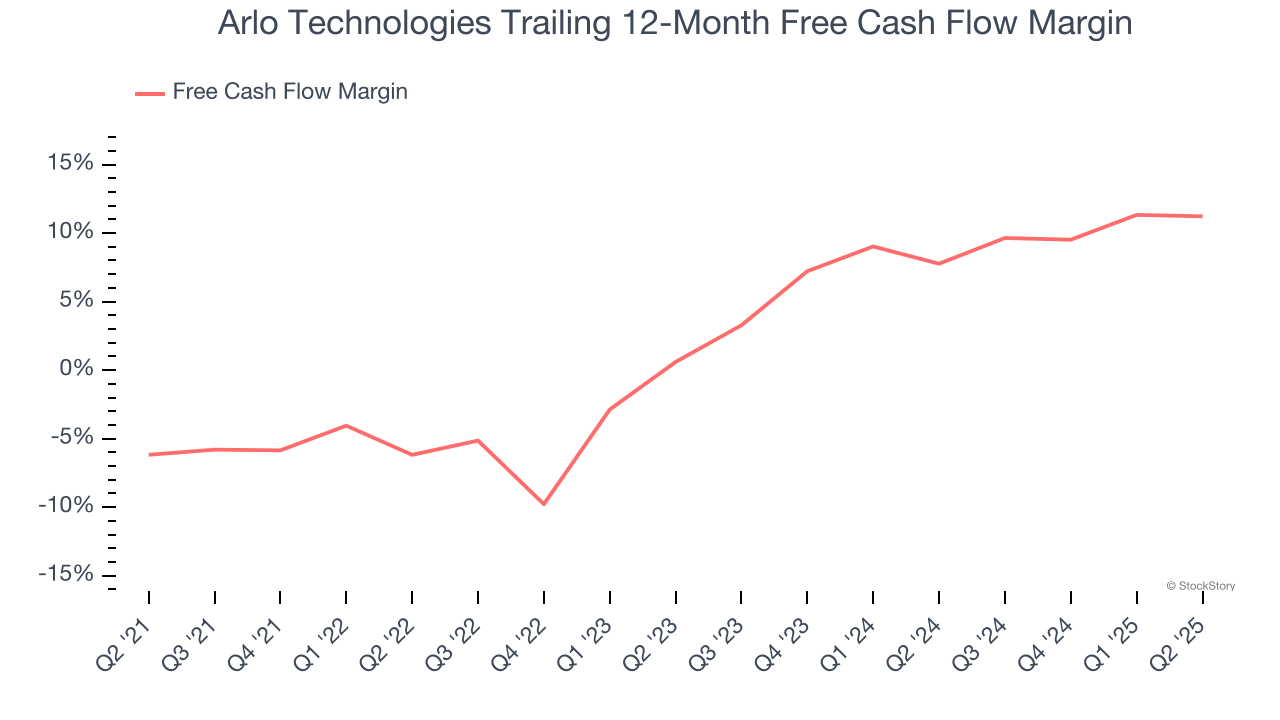

Arlo Technologies has been on fire lately. In the past six months alone, the company’s stock price has rocketed 57.7%, reaching $17.30 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation. Is now still a good time to buy ARLO? Or are investors being too optimistic? Find out in our full research report, it’s free. Why Does Arlo Technologies Spark Debate?Originally spun off from networking equipment maker Netgear in 2018, Arlo Technologies (NYSE: ARLO) provides cloud-based smart security devices and subscription services that help consumers and businesses monitor and protect their homes, properties, and loved ones. Two Positive Attributes:1. Outstanding Long-Term EPS GrowthWe track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable. Arlo Technologies’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.  2. Increasing Free Cash Flow Margin Juices FinancialsIf you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills. As you can see below, Arlo Technologies’s margin expanded by 17.4 percentage points over the last five years. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Arlo Technologies’s free cash flow margin for the trailing 12 months was 11.2%.  One Reason to be Careful:Lackluster Revenue GrowthLong-term growth is the most important, but within business services, a stretched historical view may miss new innovations or demand cycles. Arlo Technologies’s recent performance shows its demand has slowed as its annualized revenue growth of 3.6% over the last two years was below its five-year trend. Final JudgmentArlo Technologies’s merits more than compensate for its flaws, and with the recent surge, the stock trades at 26× forward P/E (or $17.30 per share). Is now a good time to buy? See for yourself in our full research report, it’s free. High-Quality Stocks for All Market ConditionsDonald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities. The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025). Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today. StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here. More NewsView More

Worried About Mag 7 Concentration Risk? This ETF Could Help ↗

Today 16:16 EST

Via MarketBeat

Here's Who Wins If Trump's 50-Year Mortgages Come to Market ↗

Today 13:00 EST

NVIDIA’s $2B Power Play: Securing the Future of Chip Design ↗

Today 12:12 EST

Recent QuotesView More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes. By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

|