Shareholders of Baxter would probably like to forget the past six months even happened. The stock dropped 43.3% and now trades at $18.09. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Baxter, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Do We Think Baxter Will Underperform?

Even with the cheaper entry price, we don't have much confidence in Baxter. Here are three reasons we avoid BAX and a stock we'd rather own.

1. Weak Constant Currency Growth Points to Soft Demand

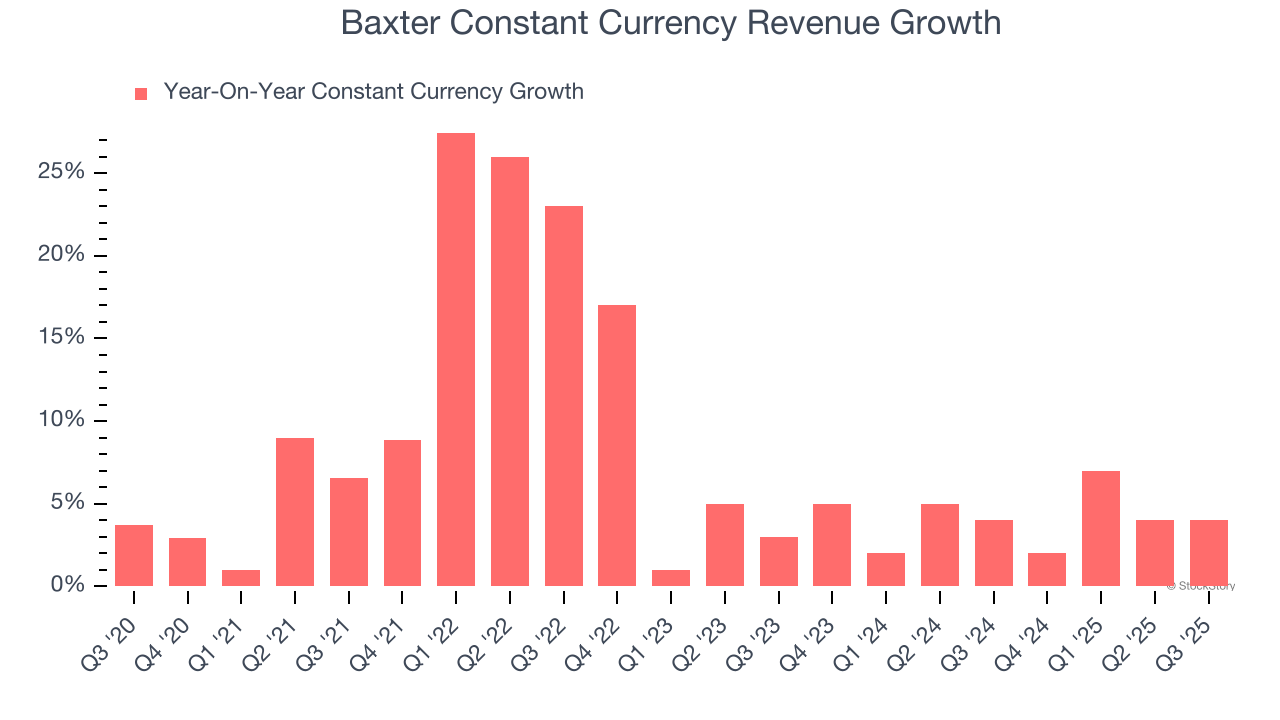

In addition to reported revenue, constant currency revenue is a useful data point for analyzing Medical Devices & Supplies - Diversified companies. This metric excludes currency movements, which are outside of Baxter’s control and are not indicative of underlying demand.

Over the last two years, Baxter’s constant currency revenue averaged 4.1% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Baxter, its EPS declined by 4.3% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Baxter historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 1.1%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

Final Judgment

We see the value of companies making people healthier, but in the case of Baxter, we’re out. After the recent drawdown, the stock trades at 8.3× forward P/E (or $18.09 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. We’d recommend looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than Baxter

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.