Take-Two Interactive Software, Inc. (TTWO) develops, publishes, and markets interactive entertainment solutions for consumers worldwide under the Rockstar Games, 2K, Private Division, and Zynga brands.

The company’s topline improved in the fiscal fourth quarter (ended March 31), with total net revenue increasing 55.5% year-over-year to $1.45 billion. However, its net income and EPS declined significantly from the prior-year quarter to a negative $610.30 million and $3.62, respectively.

Amid this, let’s look at the trends of some of TTWO’s key financial metrics to understand better why the stock might be avoided now.

Take-Two Interactive Software, Inc. (TTWO) Financial Performance: Gross Margin, ROA, and Current Ratio

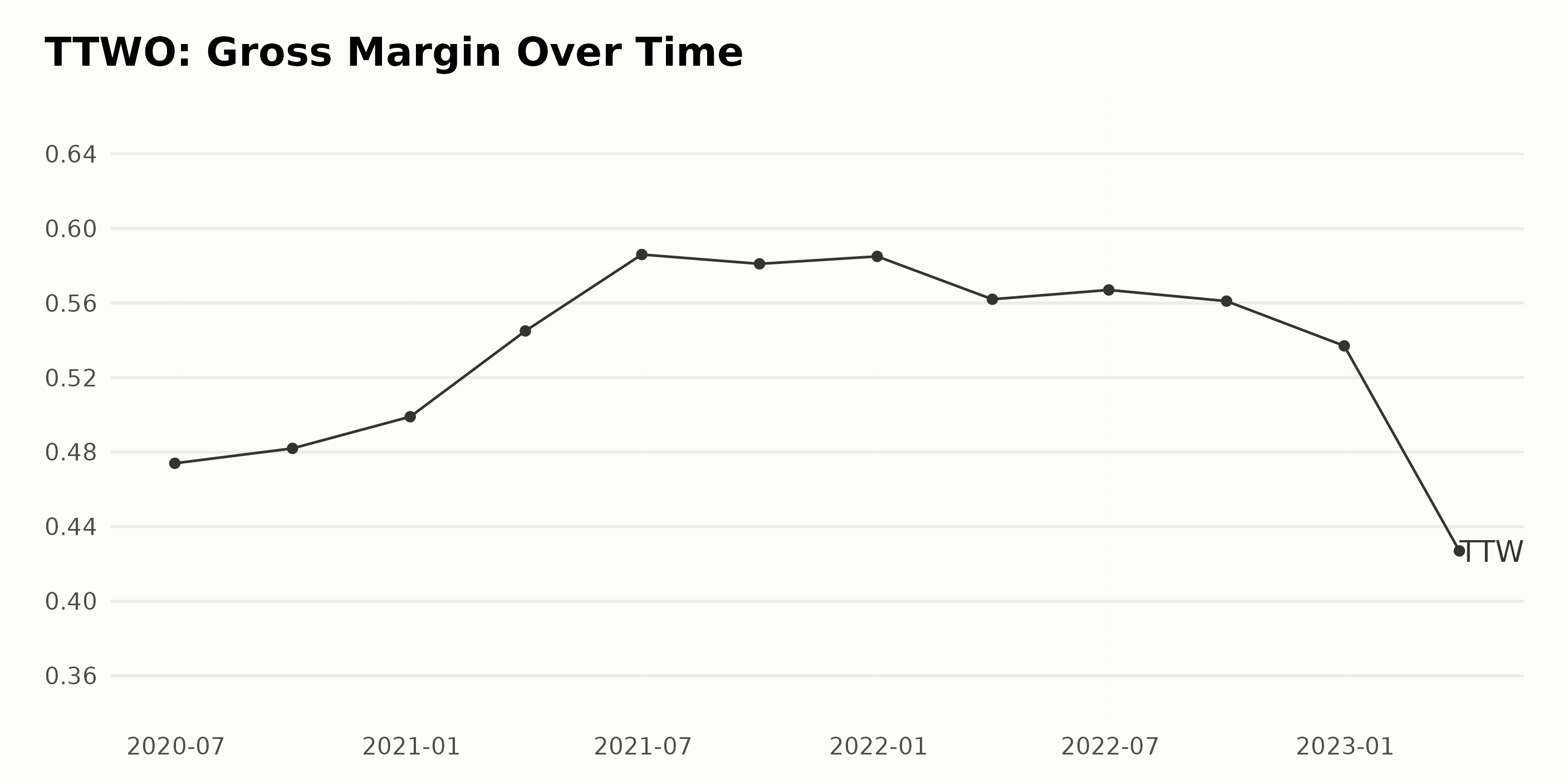

TTWO reported a gross margin of 47.4 % as of June 30, 2020, which saw a growth rate of 21.8 % to 53.7% as of December 31, 2021. This was followed by a slight decline to 58.1 % on September 30, 2021, but sustained at 58.5 % as of December 31, 2021. The gross margin then experienced falling fluctuations, with a significant drop to 43.7 % as of March 31, 2023.

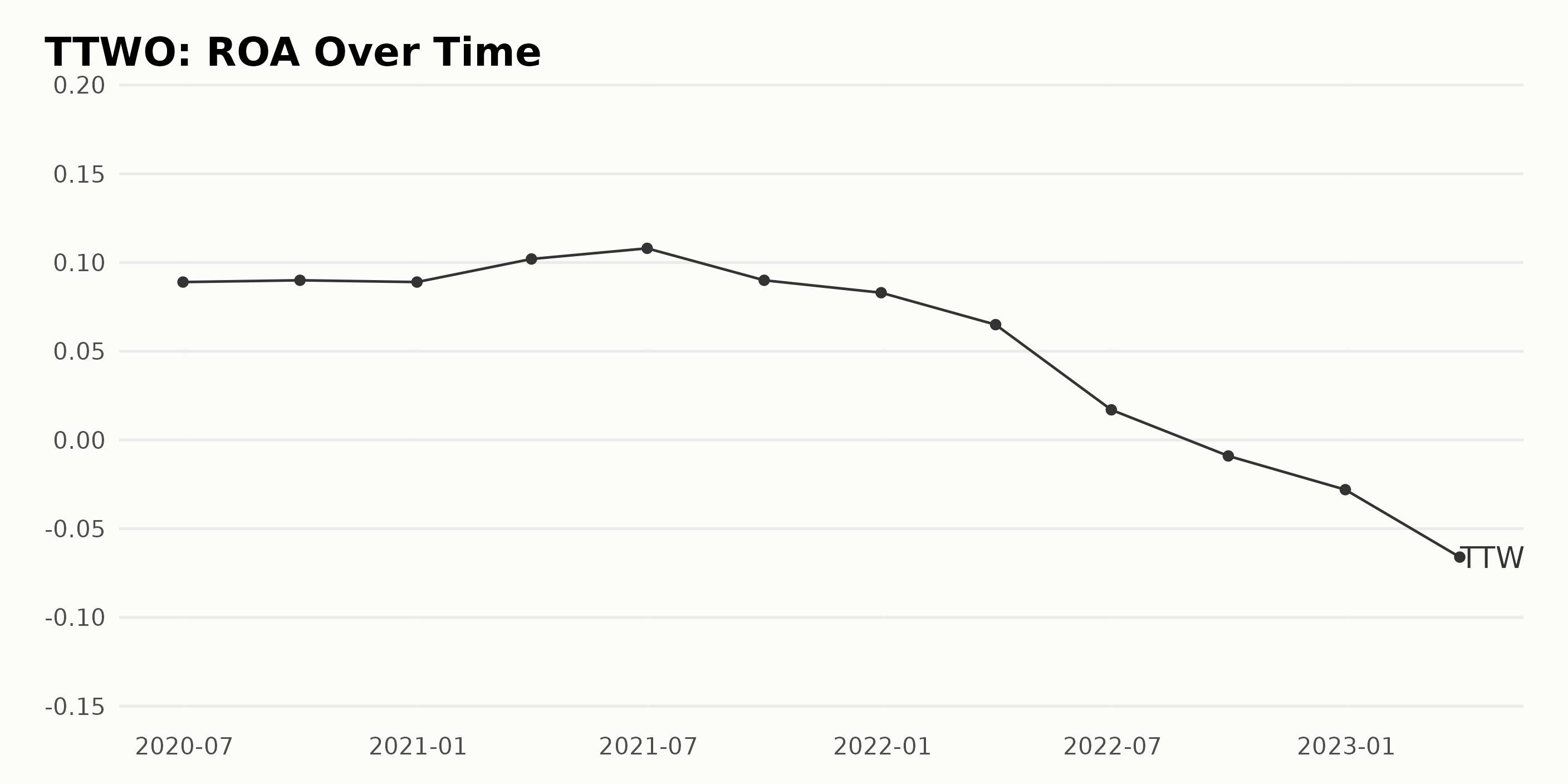

TTWO’s ROA has shown a fluctuating trend over the past three years, with values ranging from -0.028 in December 2022 to 0.108 in June 2021. The growth rate has decreased significantly since June 2020, when the ROA was 0.089, with the latest value in March 2023 (-0.066) representing an overall decrease of 25.8%.

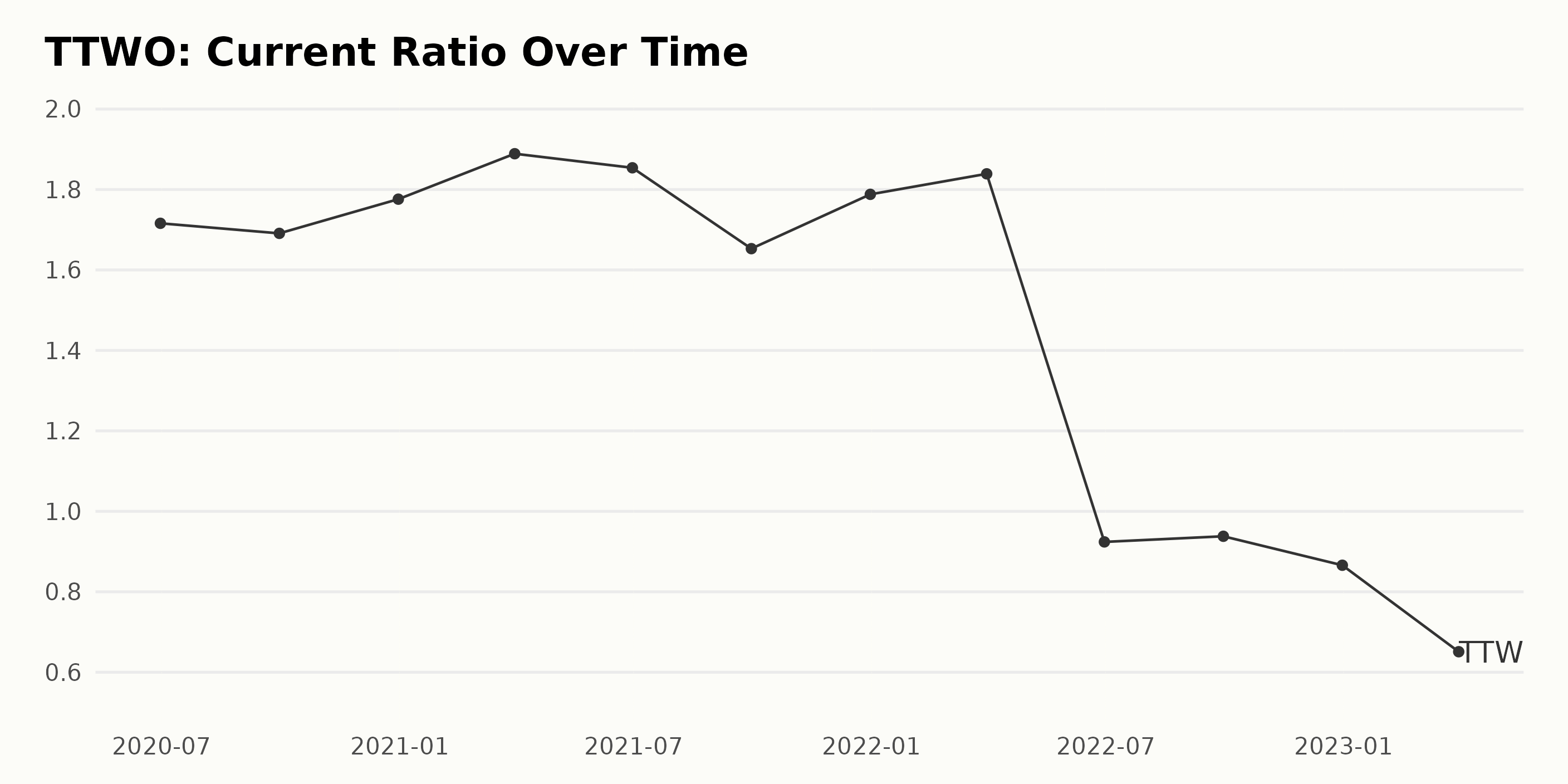

TTWO’s current ratio has fluctuated over the past three years. In June 2020, it was 1.72, reaching a high of 1.89 in March 2021 and then dropping to 1.65 in September 2021. After that, the ratio has seen a general growth trend, reaching 0.86 at the end of 2022. The last value recorded was 0.651 in March 2023. Overall, the current ratio has decreased by 62.37%.

TTWO: Share Price Increase in 6 Months

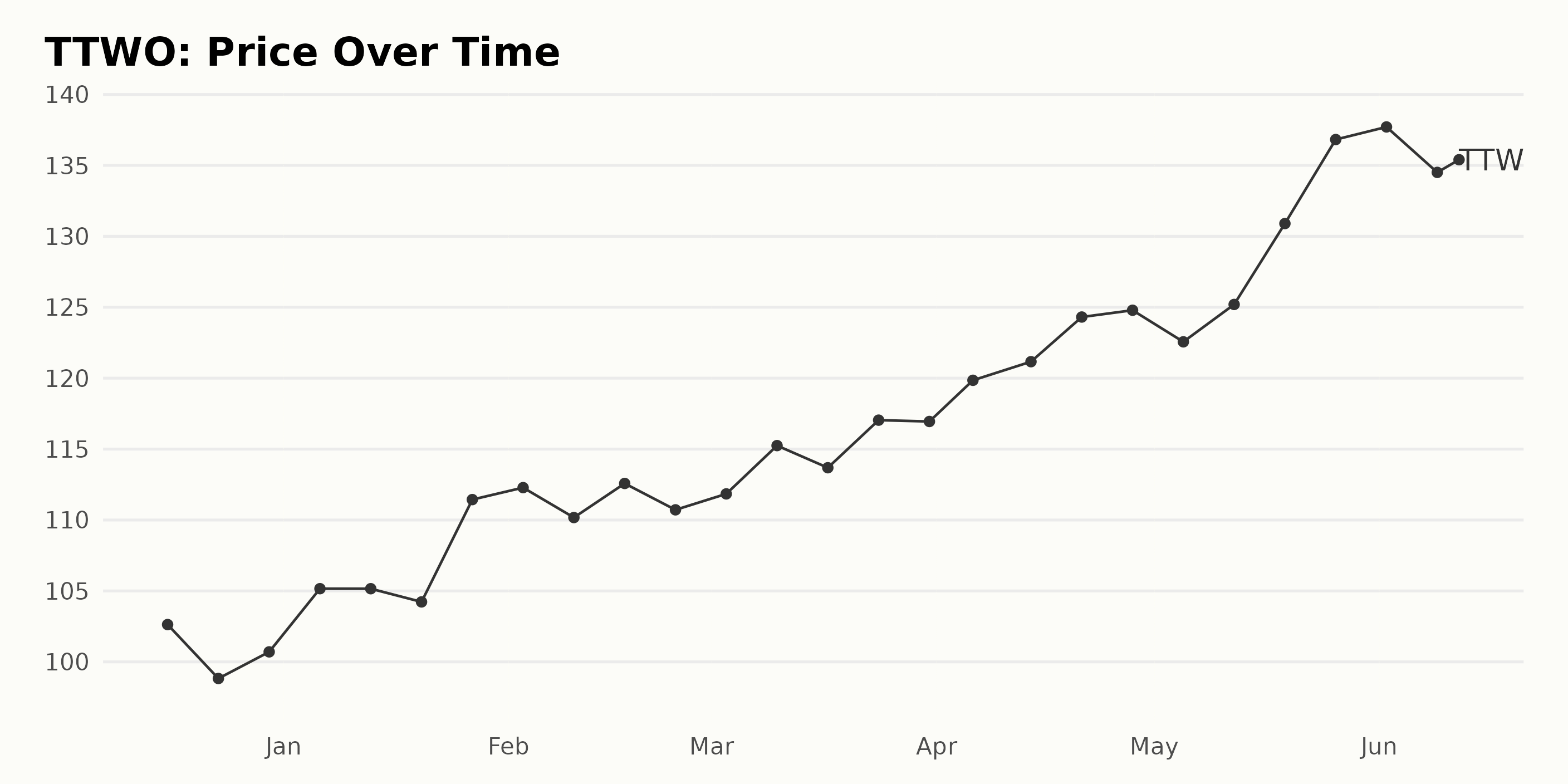

TTWO has seen an overall trend of growth in its share price since December 16, 2022. The share price has grown from $102.63 to $134.03 over the span of six months. This growth rate has been steadily accelerating since March 24, 2023, when the share price was $117.04. Here is a chart of TTWO's price over the past 180 days.

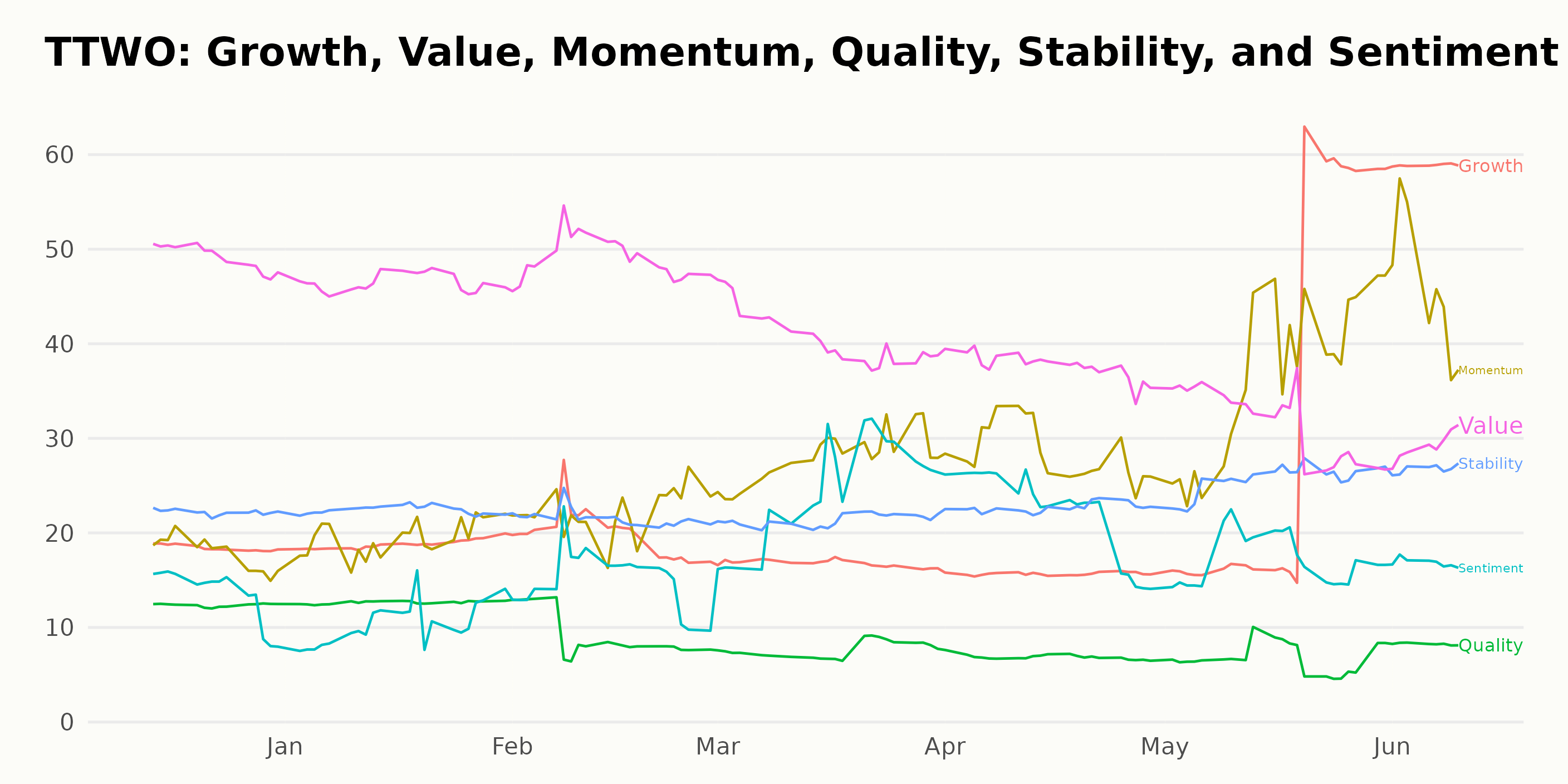

The POWR Ratings of TTWO: Momentum, Growth & Value

TTWO's latest overall POWR Ratings grade is D, which equates to Sell. It has been consistently graded a D since March 2021, and the rank in the industry has fluctuated within the range of #18-#21 out of the 21 stocks in Entertainment - Toys & Video Games. It is currently ranked #19 in the industry.

TTWO has received high ratings for its Growth, Momentum, and Stability dimensions. At the end of December 2022, the ratings for Growth and Momentum were 18 each, while the rating for Stability was 22. By May 2023, these ratings had increased to 32 for Growth, 37 for Momentum, and 26 for Stability.

The highest rating out of all six dimensions was for Value, which was 49 at the end of December 2022 and decreased to 29 by June 10, 2023. Interestingly, the Quality dimension had the lowest ratings for both years, even decreasing to 7 by June 2023. Overall, there appears to have been an overall trend towards higher ratings for TTWO, with a few exceptions.

How does Take-Two Interactive Software, Inc. (TTWO) Stack Up Against its Peers?

Other stocks in the Entertainment - Toys & Video Games sector that may be worth considering are Sega Sammy Holdings Inc. (SGAMY), Playtika Holding Corp. (PLTK), and Nexters Inc. (GDEV) - they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

TTWO shares were trading at $135.66 per share on Monday morning, up $1.63 (+1.22%). Year-to-date, TTWO has gained 30.28%, versus a 13.03% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Is Take-Two Interactive Software (TTWO) a Good Investment? appeared first on StockNews.com