The computer and technology sector is constantly evolving as companies rise and fall with each new trend and innovation. It's common to see former leaders and high flyers flame out as new leaders emerge and take over the reins. It's much less common to see former leaders emerge from the ashes and soar to the delight of diehard loyal shareholders. Here are two iconic companies that were leaders on the cutting edge of technology whose stocks have risen from the grave like a phoenix.

Xerox Holdings Co. (NYSE: XRX)

Had it not been for Xerox's cutting-edge innovations, Steve Jobs, co-founder of Apple Inc. (NASDAQ: AAPL), and Bill Gates, co-founder of Microsoft Co. (NASDAQ: MSFT), may have never become the tech titans and legends they are known as today. It all started with the graphic user interface (GUI) created by engineers at Xerox. This block of wood was the prototype of the computer mouse, which led to the creation of the Apple Macintosh, which led to the creation of Microsoft Windows. Xerox invented it, then scratched it when the bean counters were told it would cost $10,000 to produce a home computer (Xerox Alto) with it.

Spawning the computer era

Luckily, one of the engineers invited Steve Jobs to take a gander before they canned the project. He envisioned that the future of mainstream computing would need a simple interface relying on a simple point-and-click device, which he coined the "mouse." Jobs went on to develop the Apple Macintosh, and Gates would copy that to create Microsoft Windows.

Yes, Xerox fumbled the ball, and Steve Jobs ran with it. The rest is history. Xerox has had a history of fumbles. Xerox was also one of the pioneers of artificial intelligence (AI). Xerox invented the photocopier and electronic document management (EDM) and has run with them. Xerox stock reached its pinnacle in 1999 at $168.45 and collapsed to $9.88 a year later. Shares have fluctuated in a 30-point range two decades since then.

Reinventing itself

Xerox still makes photocopiers and printers but has streamlined its operations with a focus on digital transformation and services, including document, marketing, business process and workflow automation. The evolution of the cloud and digitization has forced Xerox to adapt and innovate, focusing on areas like the internet-of-things (IoT), AI and cybersecurity. Check out the sector heatmap on MarketBeat.

Profitability overgrowth

Xerox results were a vast improvement from the year-ago period. Xerox reported Q3 2023 EPS of 46 cents, beating consensus analyst estimates for 35 cents by 11 cents. GAAP net income was $49 million, up $432 million from the year-ago period. Adjusted operating margin rose 40 bps to 4.1%. Revenues fell 5.7% YoY to $1.65 billion versus $1.73 billion consensus analyst estimates. Free cash flow rose to $112 million, up $130 million. The company announced Reinvention, which is expected to deliver at least $300 million in improvement to adjusted operating income by 2026.

CEO Insights

Xerox CEO Steve Bandrowczak noted strong demand for its Digital Services and products in the Americas. Still, a mild softening of demand started to occur in Europe due to macroeconomic conditions. Revenues are expected to come in at the lower range as a result. Headwinds affecting post-sales revenue are expected to continue in Q4 2023. Full-year 2023 revenues are expected to be flat-to-down low single digits.

Bandrowczak commented, "Growth in adjusted profit, EPS and free cash flow reflects solid execution of our strategic priorities amid a challenging macro backdrop. As we continue simplifying and focusing our operations, Reinvention will reposition our business to enable sustainable profit improvement and revenue growth through the expansion of services that best serve our clients' needs."

Xerox Holdings analyst ratings and price targets are at MarketBeat. Xerox Holdings peers and competitor stocks can be found with the MarketBeat stock screener. XRX shares trade at 9.5X forward earnings with a 9% short interest.

Monthly descending triangle breakout

The monthly candlestick chart on XRX illustrates the formation of a descending triangle breakout. The descending upper trendline formed at the peak at $24.14 in January 2022. Shares continued to make lower highs on bounces as XRX formed the lower flat-bottom trendline around $12.06. The daily market structure low (MSL) trigger formed at $14.98. XRX failed an initial attempt to break out of the triangle in September 2023 as shares peaked at $17.12, and the rug pulled back down to retest the flat-bottom trendline at $12.06.

The monthly relative strength index (RSI) is attempting to break out of its multi-year range to rise through the 60-band as XRX sufficiently breaks off the triangle in December 2023, triggering the MSL as it rises towards the monthly 200-period moving average resistance at $18.57. Pullback support levels are at $17.12, $14.93, $13.59 and $12.06.

Unisys Inc. (NYSE: UIS)

Unisys was one of the first IT companies in the world, formed in 1986 from the merger of Burroughs Co. and Sperry Co. Sperry-Rand Co. co-developed UNIVAC (universal automatic computer), one of the first commercial mainframe computers available in 1951 weighing around 13,000 pounds with the main unit being 25 feet by 50 feet using vacuum tubes and magnetic tapes. The first UNIVAC was delivered to the U.S. Census Bureau in 1951. Unisys has contributed to the development of integrated circuits (IC) and cybersecurity, pioneering intrusion detections and secure computing systems. Today, the company is a multi-faceted global IT company specializing in digital workspace solutions covering areas including cloud computing, digital transformation, infrastructure, application services and data analytics. \

Top and bottom line beats

Unisys reported a Q3 2023 EPS loss of 33 cents, beating consensus analyst estimates for a loss of 52 cents by 19 cents. Revenues grew 0.7% YoY to $464.6 million versus $439.67 million consensus analyst estimates. Unisys raised full-year 2023 guidance for revenues to grow from 0% to 1.5%, up from down 7% to 3%. Non-GAAP operating margin was increased from 5% to 6%, up from 2% to 4%.

Quantum computing for cargo logistics

The company unveiled Unisys Logistics Optimization, a quantum-powered solution. It leverages quantum computing, advanced analytics and proprietary AI models to solve complex logistics optimization challenges in a matter of seconds. The product enables quicker decision-making to solve logistics planning for optimal packing, storing and routing shipping across multiple vehicles for optimum efficiency and cost savings. The service is catered to airlines, ground handlers and freight forwarders.

Unisys CEO Peter Altabef commented, "Our pipeline is robust, with a significant portion of Next-Gen Solutions opportunities such as applications, cloud, data and artificial intelligence, and employee experience. We are also excited by the initial market reception to our new Unisys Logistics Optimization solution, which we believe has the potential to advance cargo logistics,"

Unisys analyst ratings and price targets are at MarketBeat. Unisys peers and competitor stocks can be found with the MarketBeat stock screener.

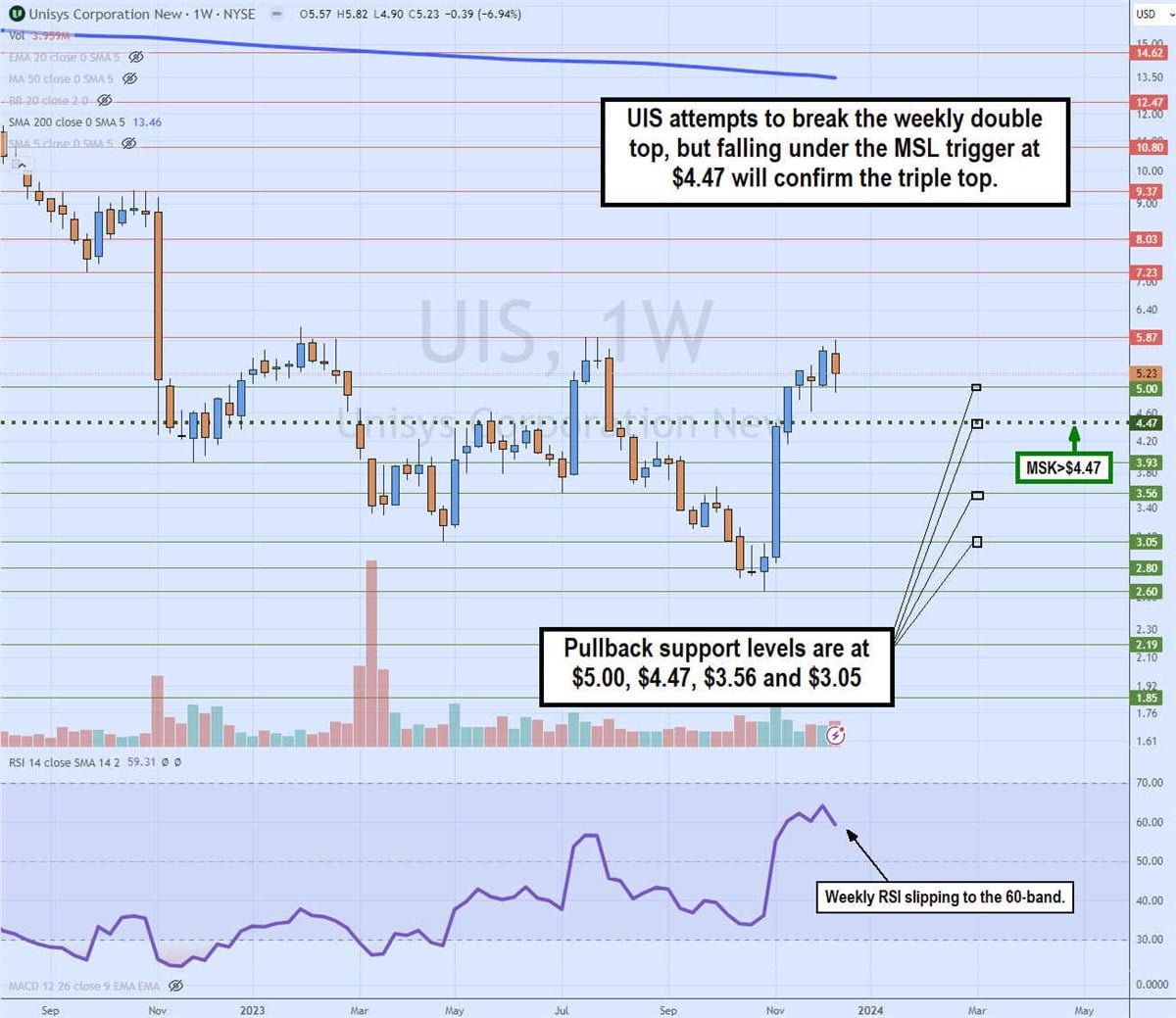

Weekly triple top

The weekly candlestick chart on UIS illustrates a weekly triple top formation at $5.87. The third attempt to break has started to fade, with the weekly RSI slipping back under the 60-band. The weekly MSL triggered at $4.47 and now acts as a support level. The weekly 200-period MA sits at $13.46. If UIS falls back under the MSL trigger, then a triple top will be confirmed. Pullback support levels are at $5.00, $4.47, $3.56 and $3.05.