Traditional TV advertising spending in the U.S. is forecast to reach $56.00 billion in 2025, but the market is expected to shrink by about 3.81% per year through 2030 as more viewing and ad budgets move toward digital platforms.

Despite this slow decline, broadcast television still throws off a lot of cash, especially for operators that have built up income from areas beyond just traditional ad slots. In this kind of backdrop, many investors are now zeroing in on broadcast names that can stay financially steady and keep lifting their dividends over time.

Nexstar Media Group (NXST), the nation’s largest local television and media company, stands out in that group. On Nov. 18, Wolfe Research featured Nexstar on a focused list of companies known for strong dividend growth and solid cash generation, with balance sheets sturdy enough to keep raising payouts even as the industry cools.

With its annual dividend yielding 3.9%, Nexstar already looks attractive for income-focused investors. But with the broader traditional TV advertising market in decline and streaming platforms reshaping viewing habits, can Nexstar truly sustain its dividend momentum, or is this the calm before an industry-wide storm? Let’s find out.

Nexstar’s Financial Pulse

Nexstar Media Group runs the largest local broadcasting network in the U.S., combining traditional TV and digital platforms to deliver news and entertainment while bringing in most of its revenue from advertising and retransmission fees.

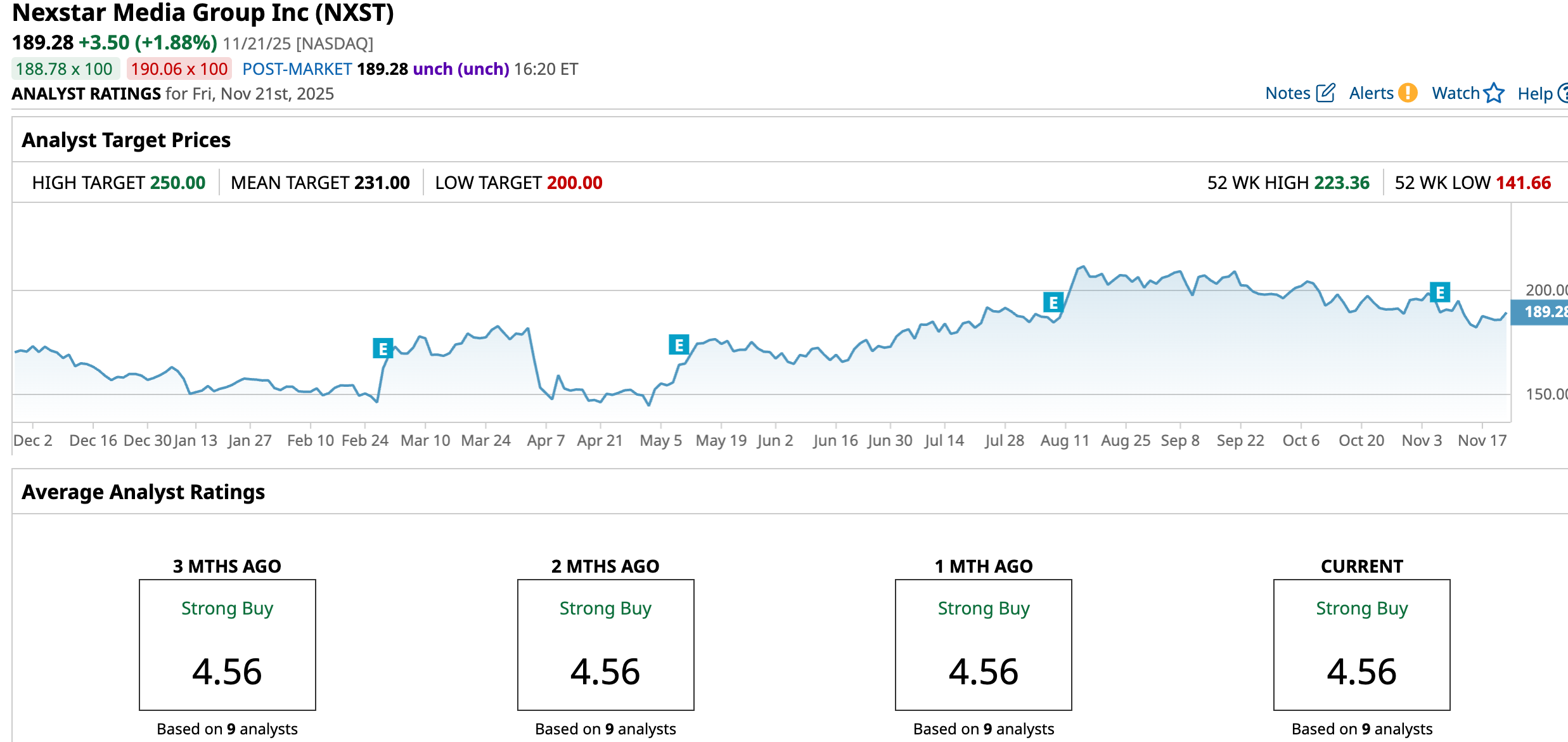

Over the past 52 weeks, the stock has gained 10.4%, and year-to-date (YTD) it is up 19.3%, a solid move that reflects growing interest in its steady cash generation.

On valuation, Nexstar’s forward price-earnings is 15x, not too far from the sector’s 16.58x, which suggests the stock is not expensive relative to peers.

What really stands out for income-focused investors is that 3.9% dividend yield, well above the sector average of 2.62%.

The latest financials add more color. Q3 net revenue came in at $1.2 billion, down 12.3% YOY, mainly because the political advertising surge from the prior election period rolled off. Earnings did come under pressure as a result.

Net quarterly income was $65 million, a 63.9% drop, hurt by weaker political advertising, one-time corporate costs tied to the pending TEGNA (TGNA) deal, and lower contributions from equity investments.

Adjusted EBITDA was $358 million, down about 29.8%, and adjusted free cash flow was $166 million, nearly 50% lower YOY, reflecting the same set of factors. These declines are tied to the normal election cycle and some one-off items rather than a structural break in the model. With annual net income of $722 million and ongoing free cash flow generation, Nexstar still looks well-positioned to support its dividend and keep rewarding long-term shareholders.

The Engines Driving Nexstar Forward

Nexstar is set to make a big move with its $6.2 billion deal to buy TEGNA. This all-cash offer pays $22 per share, which is 31% higher than TEGNA’s average share price over the past month. Once the deal is done, Nexstar will reach about 80% of U.S. TV households and operate 265 full-power stations across 132 markets. This will strengthen Nexstar’s position in local news and give advertisers a broader and more varied platform. The combined company is expected to boost adjusted free cash flow by more than 40% in the first year after the deal closes, with $300 million in annual cost savings mostly realized within a year.

In addition to this acquisition, Nexstar teamed up with Salesforce (CRM) in June to launch new AI tools (Media Cloud and Agentforce) which help automate much of the advertising sales process. This means Nexstar’s 1,600+ ad sales employees can spend about 30% less time on routine tasks and more time building relationships and closing deals. CTO Brett Jenkins points out that this smart automation isn’t just about small improvements. It could expand the way NXST runs its ad sales.

What Wall Street Expects Next for NXST

For the current quarter ending December, the average earnings estimate is $4.01 per share, a sharp YOY drop of 46.96%, as the boost from the last political cycle fades. Looking ahead to the March 2026 quarter, forecasts turn more positive, with analysts calling for earnings of $$5.01 per share versus 3.37 a year earlier, a solid 48.66% growth rate as the TEGNA deal and Nexstar’s operating scale start to have more impact on results.

Stepping back, the overall message from analysts is very clear. The nine covering the stock have a consensus “Strong Buy” rating, and their average price target of $231.00 suggests about 22% upside from current levels.

Conclusion

Nexstar appears buy-worthy for investors who want a high, growing dividend backed by real free cash flow rather than financial engineering, especially with Wolfe Research flagging its capacity to keep hiking payouts while much of traditional TV is stuck in reverse. The combination of a nearly 4% yield, a manageable payout ratio, TEGNA-driven cash flow growth, and a consensus “Strong Buy” tilt the risk reward in favor of stepping in at current levels. Over the next few years, the odds favor the stock grinding higher toward those consensus targets rather than breaking down, albeit with the usual bumps from ad cycles and regulatory noise.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart