Eurozone Ishares MSCI ETF (NY: EZU )

49.05

-0.52

(-1.04%)

Streaming Delayed Price

Updated: 12:13 PM EDT, Oct 31, 2024

Add to My Watchlist

All News about Eurozone Ishares MSCI ETF

Thoughts For Thursday: Omicron Panic Or Market Alert?

December 02, 2021

Via Talk Markets

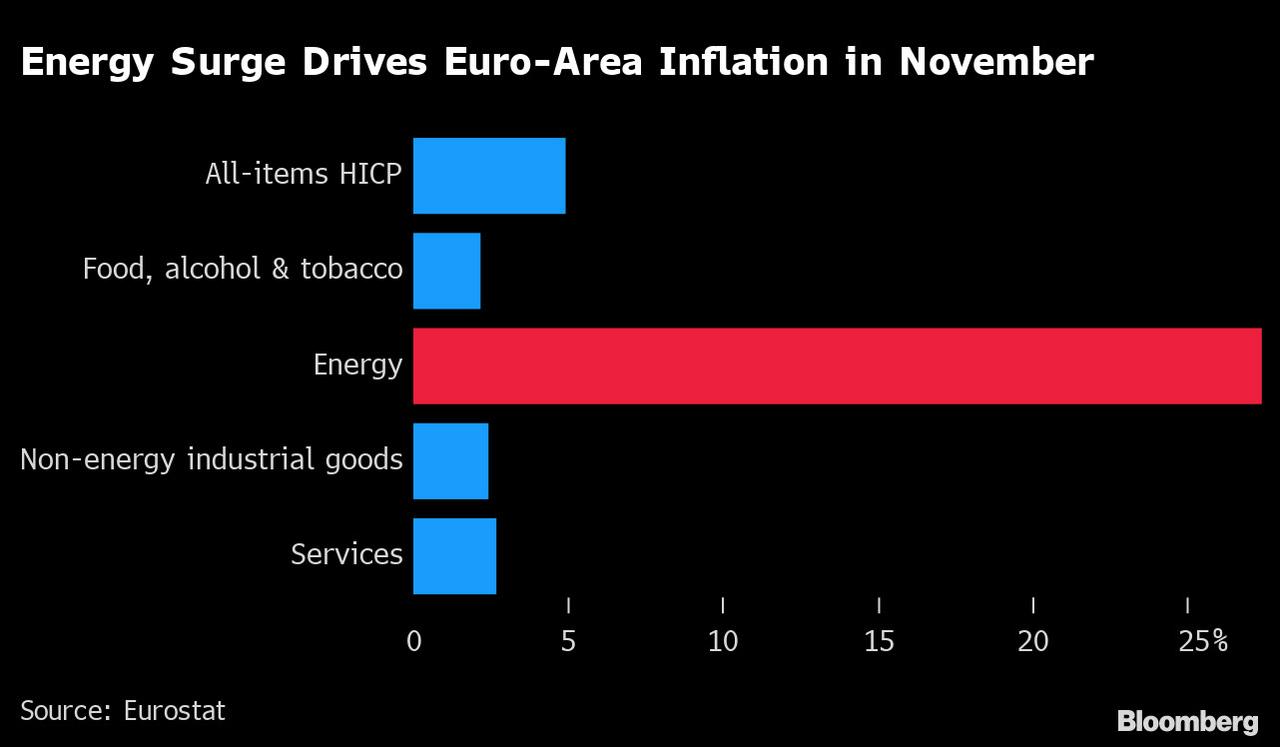

Eurozone Inflation Reached New Multi-decade High Of 5% In December

January 07, 2022

Via Talk Markets

Polish Industry Rebounds Strongly But Omicron Is Casting A Long Shadow

December 20, 2021

Via Talk Markets

Eurozone Mobility Was Already Sliding Ahead Of New Restrictive Measures

November 29, 2021

Via Talk Markets

Topics

Economy

Exposures

Economy

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.