All News about WT Offshore

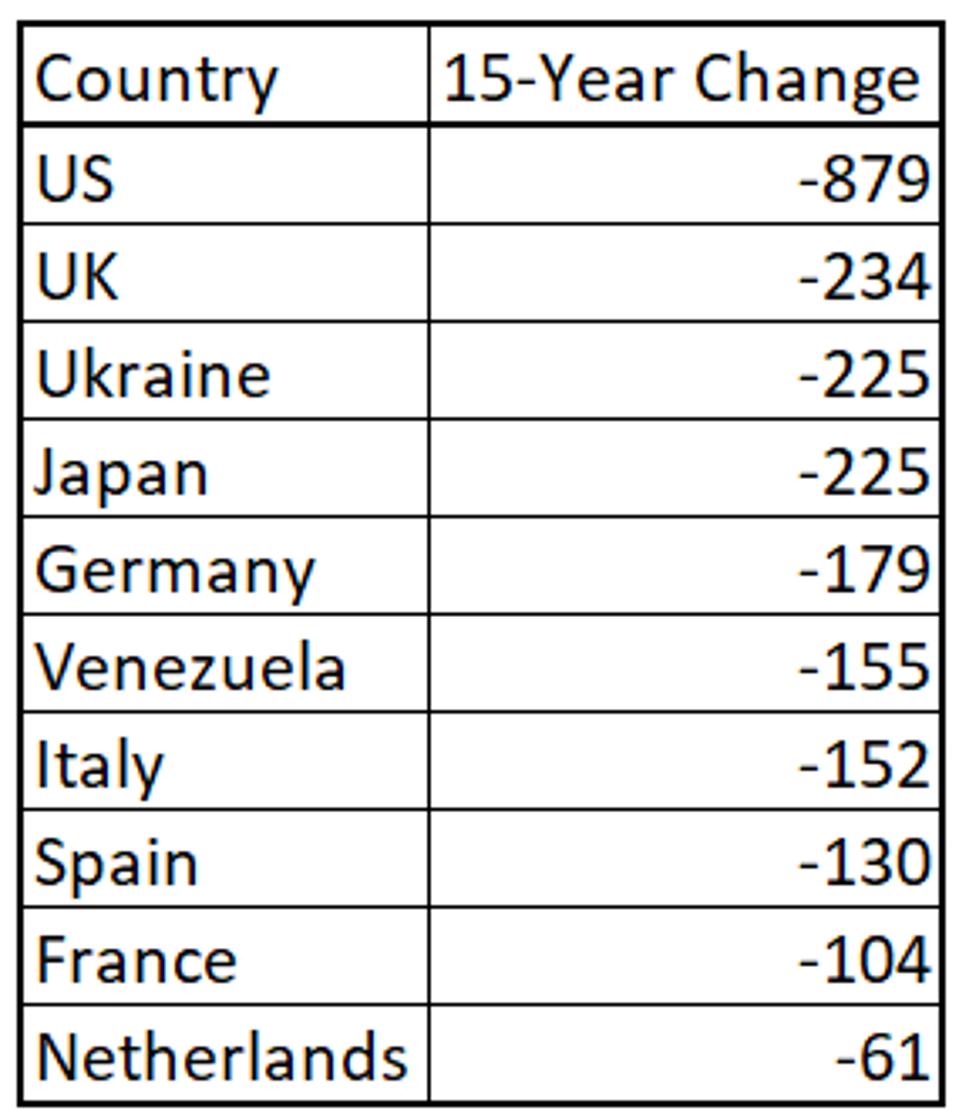

The US Leads The World In Reducing Carbon Emissions

February 20, 2024

Via Talk Markets

Exposures

Fossil Fuels

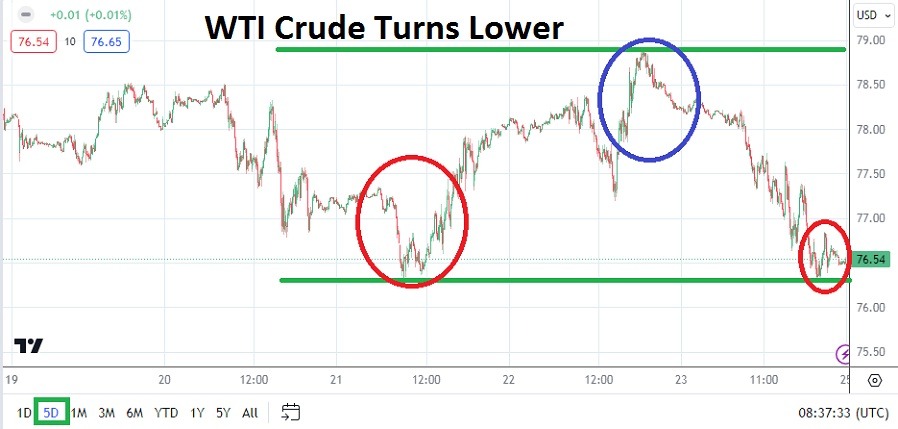

Oil Market Update: What’s Going On At The $76.50 Level?

February 12, 2024

Via Talk Markets

Topics

Energy

Exposures

Fossil Fuels

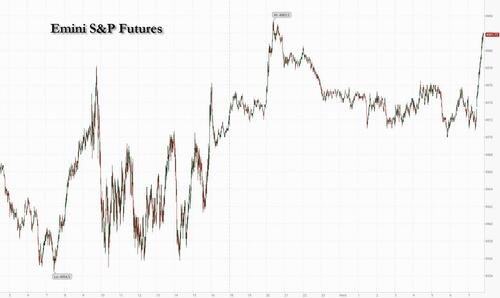

Futures Rebound To Session High After NY Community Bank Reverses Overnight Rout; Record 10Y Auction Looms

February 07, 2024

Via Talk Markets

Topics

Bonds

Exposures

Debt Markets

-638412576829226962.png)

Via Talk Markets

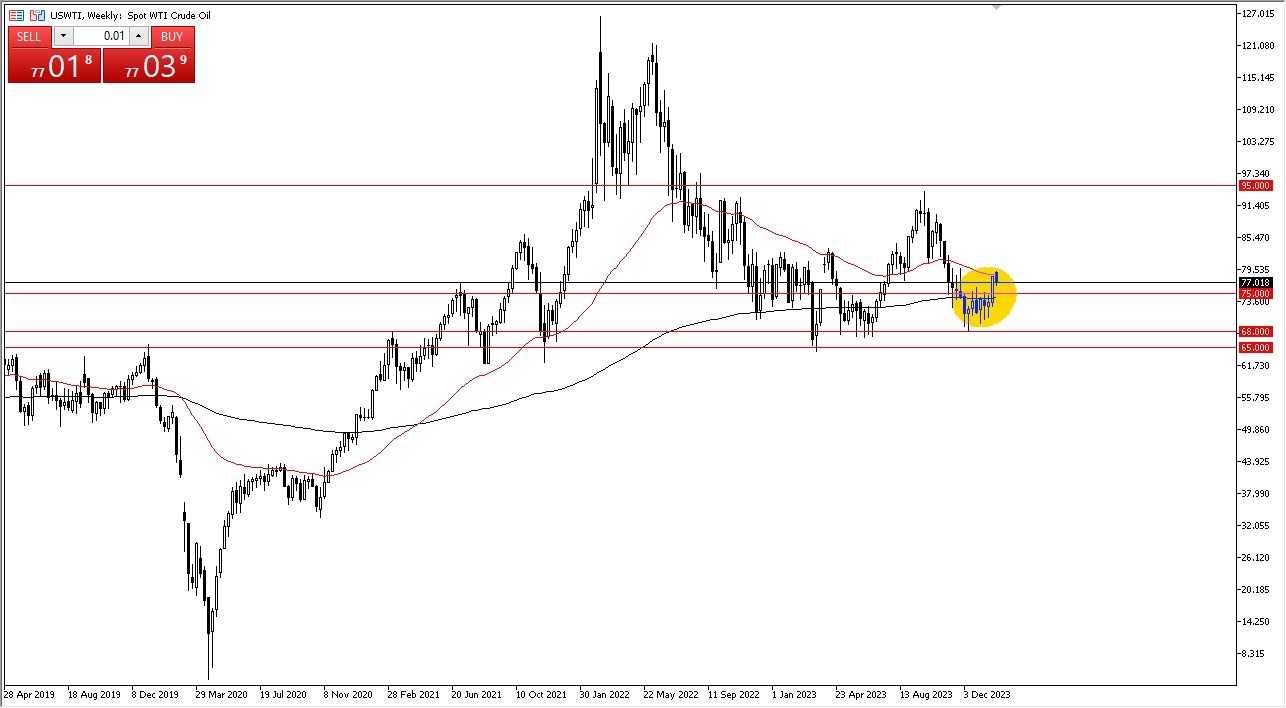

The Commodities Feed: US Natural Gas Prices Spike Higher

January 14, 2024

Via Talk Markets

Topics

Energy

Exposures

Fossil Fuels

Via Talk Markets

Exposures

Fossil Fuels

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.