Electricity generation and hydrogen production company Bloom Energy (NYSE:BE) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 17.5% year on year to $330.4 million. On the other hand, the company’s full-year revenue guidance of $1.5 billion at the midpoint came in 3.5% above analysts’ estimates. Its non-GAAP loss of $0.01 per share was also 112% below analysts’ consensus estimates.

Is now the time to buy Bloom Energy? Find out by accessing our full research report, it’s free.

Bloom Energy (BE) Q3 CY2024 Highlights:

- Revenue: $330.4 million vs analyst estimates of $383.2 million (13.8% miss)

- Adjusted EPS: -$0.01 vs analyst estimates of $0.09

- EBITDA: $21.34 million vs analyst estimates of $44.79 million (52.3% miss)

- The company reconfirmed its revenue guidance for the full year of $1.5 billion at the midpoint

- Gross Margin (GAAP): 23.8%, up from -1.1% in the same quarter last year

- Operating Margin: -2.9%, up from -25.9% in the same quarter last year

- EBITDA Margin: 6.5%, down from 16.6% in the same quarter last year

- Free Cash Flow was -$83.76 million compared to -$154.5 million in the same quarter last year

- Market Capitalization: $2.50 billion

Company Overview

Working in stealth mode for eight years, Bloom Energy (NYSE:BE) designs, manufactures, and markets solid oxide fuel cell systems for on-site power generation.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Sales Growth

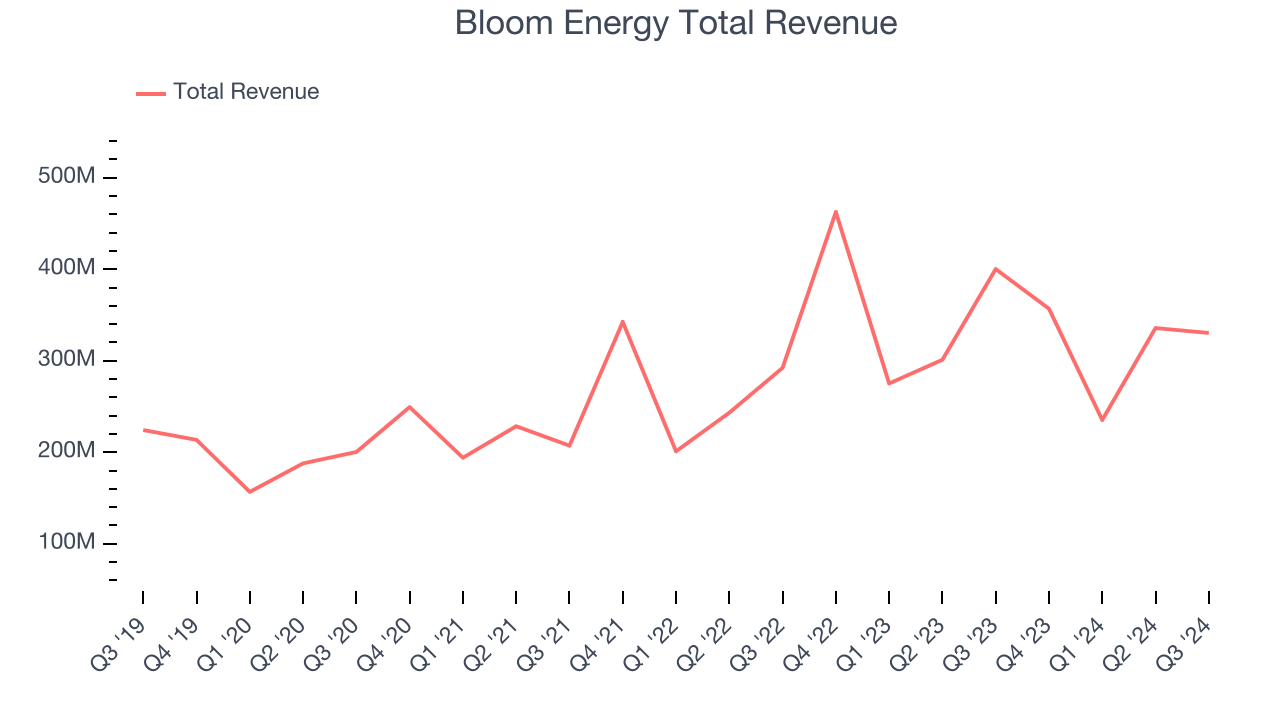

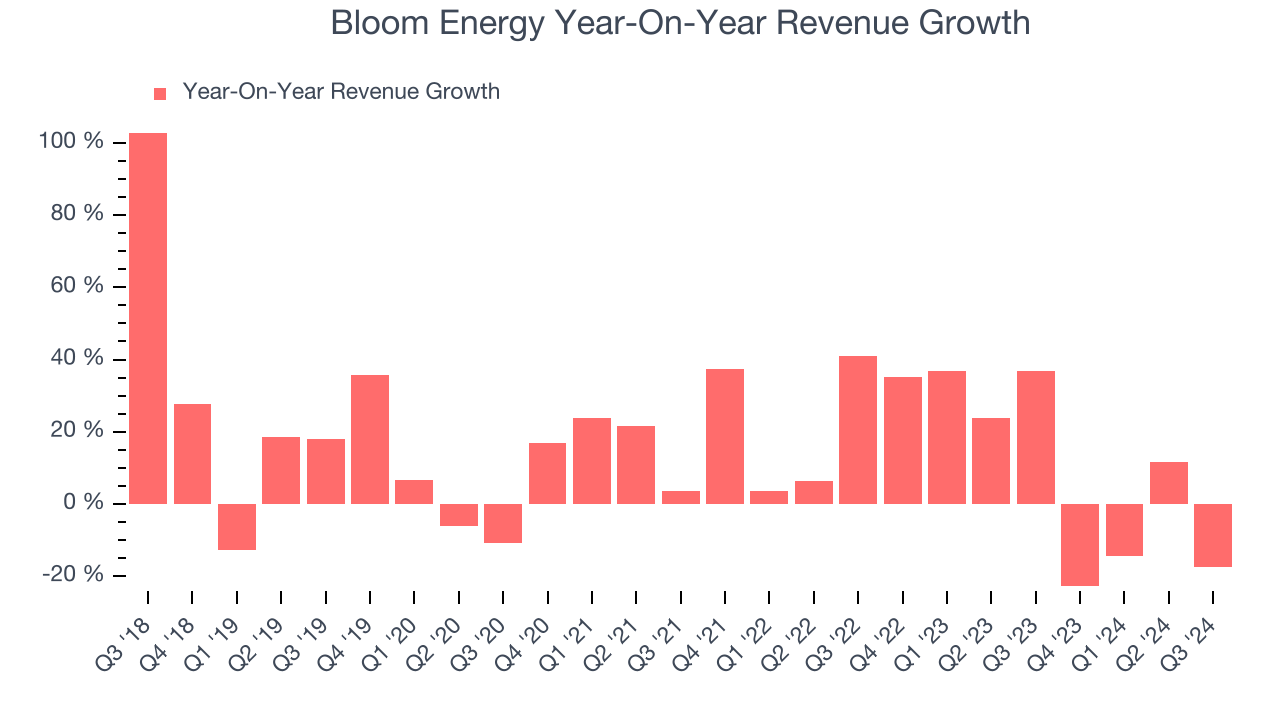

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Bloom Energy’s 11.5% annualized revenue growth over the last five years was impressive. This is encouraging because it shows Bloom Energy’s offerings resonate with customers, a helpful starting point.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Bloom Energy’s annualized revenue growth of 8% over the last two years is below its five-year trend, but we still think the results were respectable.

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Product and Service, which are 70.8% and 15.4% of revenue. Over the last two years, Bloom Energy’s Product revenue (energy servers and electrolyzers) averaged 11.2% year-on-year growth while its Service revenue (operations and maintenance agreements) averaged 22% growth.

This quarter, Bloom Energy missed Wall Street’s estimates and reported a rather uninspiring 17.5% year-on-year revenue decline, generating $330.4 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 30% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and indicates the market thinks its newer products and services will catalyze higher growth rates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

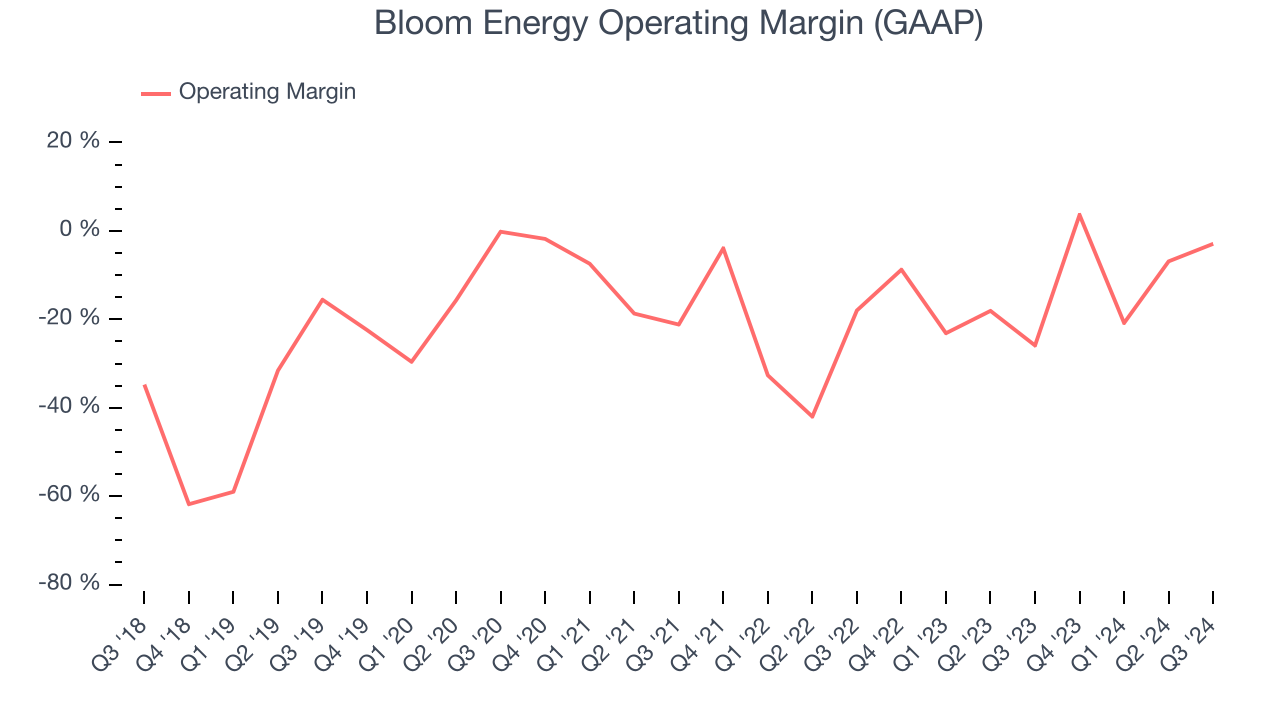

Bloom Energy’s high expenses have contributed to an average operating margin of negative 14.7% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Bloom Energy’s annual operating margin rose by 10.9 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

This quarter, Bloom Energy generated a negative 2.9% operating margin. The company's lack of profits raise a flag.

Earnings Per Share

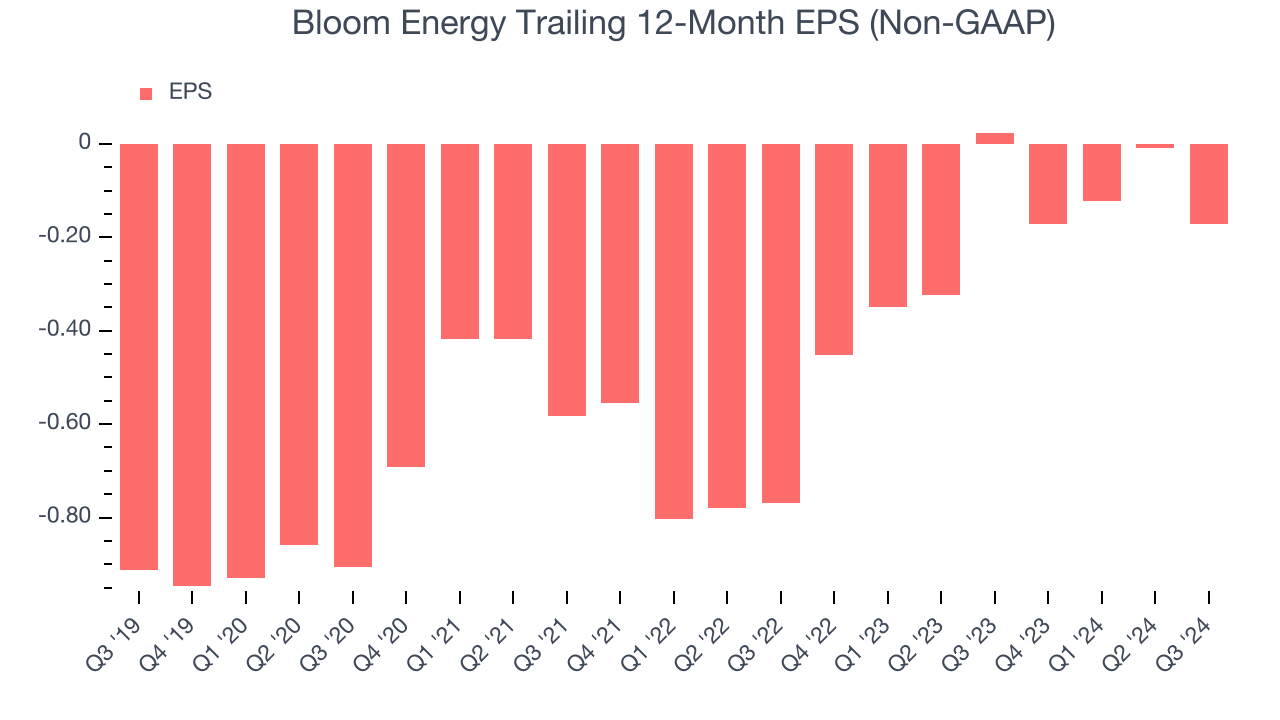

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Although Bloom Energy’s full-year earnings are still negative, it reduced its losses and improved its EPS by 28.4% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Bloom Energy, its two-year annual EPS growth of 52.9% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.In Q3, Bloom Energy reported EPS at negative $0.01, down from $0.15 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Bloom Energy’s full-year EPS of negative $0.17 will reach break even.

Key Takeaways from Bloom Energy’s Q3 Results

We were impressed by Bloom Energy’s optimistic full-year revenue guidance, which blew past analysts’ expectations. On the other hand, its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter was quite mixed. The stock remained flat at $10.65 immediately following the results.

Big picture, is Bloom Energy a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.