Application performance monitoring software provider Dynatrace (NYSE:DT) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 18.9% year on year to $418.1 million. Guidance for next quarter’s revenue was optimistic at $426.5 million at the midpoint, 2.4% above analysts’ estimates. Its non-GAAP profit of $0.37 per share was also 14.6% above analysts’ consensus estimates.

Is now the time to buy Dynatrace? Find out by accessing our full research report, it’s free.

Dynatrace (DT) Q3 CY2024 Highlights:

- Revenue: $418.1 million vs analyst estimates of $406.4 million (2.9% beat)

- Adjusted EPS: $0.37 vs analyst estimates of $0.32 (14.6% beat)

- Adjusted Operating Income: $130.7 million vs analyst estimates of $114.5 million (14.1% beat)

- The company lifted its revenue guidance for the full year to $1.67 billion at the midpoint from $1.65 billion, a 1.2% increase

- Management raised its full-year Adjusted EPS guidance to $1.32 at the midpoint, a 3.5% increase

- Gross Margin (GAAP): 81.4%, down from 82.8% in the same quarter last year

- Operating Margin: 11.2%, up from 10% in the same quarter last year

- Free Cash Flow Margin: 4.8%, down from 57% in the previous quarter

- Annual Recurring Revenue: $1.62 billion at quarter end, up 20.4% year on year

- Market Capitalization: $16.83 billion

"Our continued out-performance across all of our key metrics is a result of the strength of our platform and ability to execute effectively in a dynamic market," said Rick McConnell, Chief Executive Officer of Dynatrace.

Company Overview

Founded in Austria in 2005, Dynatrace (NYSE:DT) provides companies with software that allows them to monitor the performance of their full technology stack, from software applications to the infrastructure they run on.

Cloud Monitoring

Software is eating the world, increasing organizations’ reliance on digital-only solutions. As more workloads and applications move to the cloud, the reliability of the underlying cloud infrastructure becomes ever more critical and ever more complex. To solve this challenge, companies and their engineering teams have turned to a range of cloud monitoring tools that provide them with the visibility to troubleshoot issues in real-time.

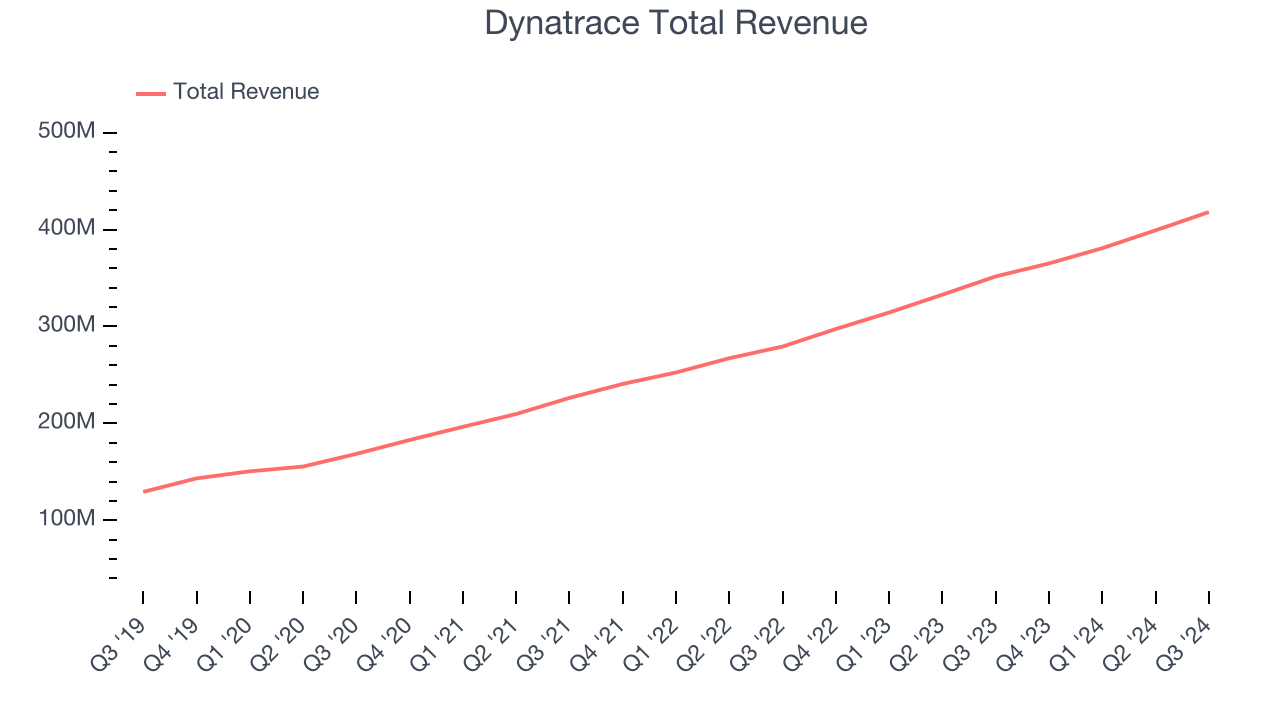

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Dynatrace’s 24.2% annualized revenue growth over the last three years was solid. This is a good starting point for our analysis.

This quarter, Dynatrace reported year-on-year revenue growth of 18.9%, and its $418.1 million of revenue exceeded Wall Street’s estimates by 2.9%. Management is currently guiding for a 16.8% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.4% over the next 12 months, a deceleration versus the last three years. This projection is still noteworthy and illustrates the market is baking in success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

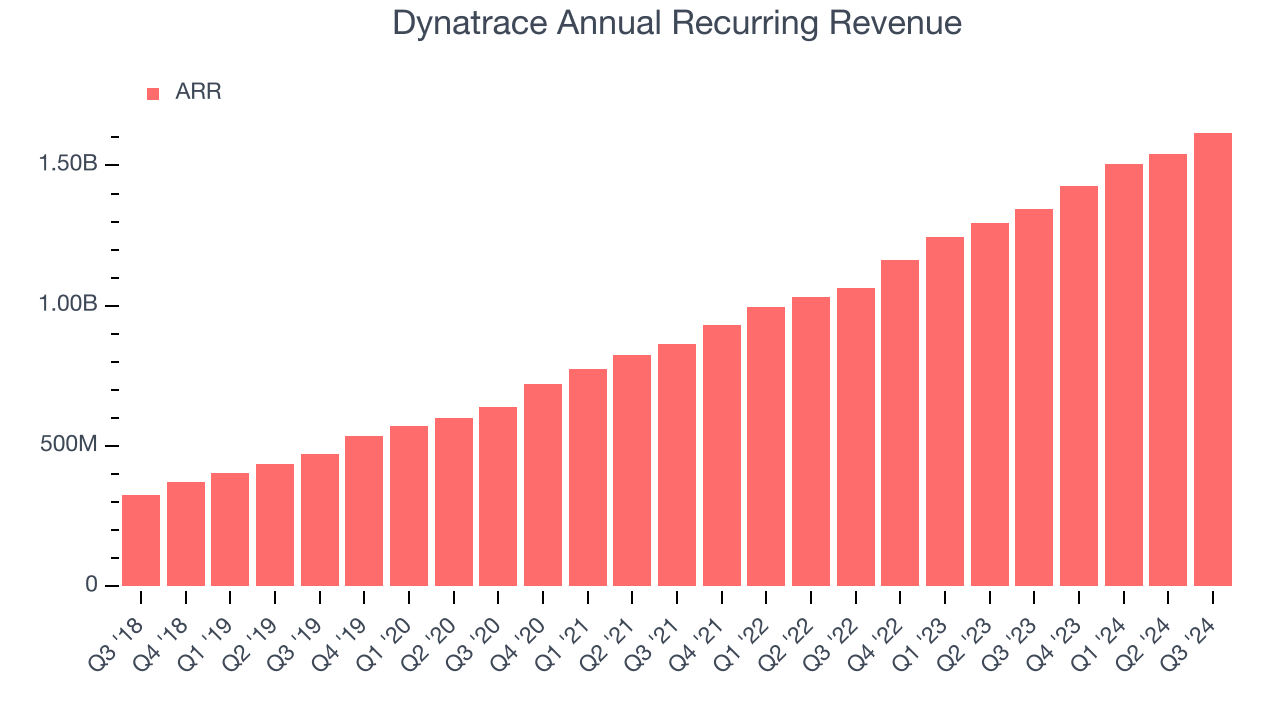

Annual Recurring Revenue

Investors interested in Dynatrace should track its annual recurring revenue (ARR) in addition to reported revenue. While reported revenue for a SaaS company can include low-margin items like implementation fees, ARR is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Over the last year, Dynatrace’s ARR growth has been impressive, averaging 20.7% year-on-year increases and punching in at $1.62 billion in the latest quarter. This performance was in line with its revenue growth and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes Dynatrace a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

Customer Acquisition Efficiency

Customer acquisition cost (CAC) payback represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for marketing and sales investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Dynatrace is quite efficient at acquiring new customers, and its CAC payback period checked in at 30.8 months this quarter. The company’s efficiency indicates that it has a highly differentiated product offering, giving it the freedom to invest its resources into new growth initiatives.

Key Takeaways from Dynatrace’s Q3 Results

It was great to see Dynatrace lift its full-year revenue and EPS guidance. We were also glad its revenue, EPS, and adjusted operating income beat Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The market was likely hoping for more, however, and shares traded down 6% to $53.10 immediately after reporting.

Big picture, is Dynatrace a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.