Growth stocks can turbocharge long-term wealth by compounding revenue and earnings at a faster pace than the overall market. If you're looking for a high-potential opportunity in today’s AI-driven market, one standout growth stock, CoreWeave (CRWV), trading under $100, is capturing explosive demand, strengthening its fundamentals, and rapidly emerging as a leader in its industry.

Demand Surges as Revenue Backlog Explodes

CoreWeave is an AI-focused cloud computing company. It manages data centers and provides powerful GPU-based infrastructure to enterprises that build, train, or run AI models and other compute-intensive tasks. Instead of spending massive capital to build their own GPU data centers, clients can employ CoreWeave to train, deploy, and scale AI models rapidly and efficiently. This led to a demand boom in the third quarter, contributing to an explosive 134% year-over-year (YoY) growth in revenue to $1.4 billion, exceeding expectations.

But what was truly remarkable was that CoreWeave accumulated almost $25 billion in backlog in Q3 alone, bringing its backlog to over $55 billion. The company claims that this figure almost doubled from Q2 and reached $50 billion more quickly than any cloud provider in history. Adjusted EBITDA surged to $838 million with a strong 61% margin. Net loss fell dramatically to 0.22 per share, compared to $1.82 in the year-ago period, reflecting better efficiencies and scale. Importantly, no single client currently makes up more than 35% of this backlog. Over 60% of the backlog now originates from investment-grade customers, showing better revenue sustainability.

Deepening Customer Relationships Across Industries

To meet this overwhelming demand, CoreWeave is aggressively expanding its infrastructure footprint. During the quarter, the company's contractual power surged to 2.9 gigawatts, while its active power increased by 120 megawatts to around 590 MW. The company has more than 1 GW available for sale, scheduled to come online over the next 12 to 24 months.

During the quarter, CoreWeave expanded internationally, including a significant project in Scotland, and built eight additional data centers in the U.S. The company has signed significant compute contracts with Meta Platforms (META), OpenAI, and a top hyperscaler to deepen relationships with key AI inventors. Nine of the company’s top ten customers expanded their commitments this year. To speed up AI development and deployment, management emphasized that AI-native businesses like Jasper, scientific research platforms like Periodic Labs, and multinational corporations like CrowdStrike (CRWD) and Rakuten are increasingly utilizing CoreWeave's infrastructure.

Interestingly, the company also launched CoreWeave Federal, winning early traction with public-sector entities, including NASA’s Jet Propulsion Lab. While capital expenditures totaled $1.9 billion, CoreWeave ended the quarter with $3 billion in liquidity. The company has secured $14 billion in debt and equity financing year-to-date (YTD), while significantly cutting its cost of capital through new, more favorable lending facilities.

Due to data center delivery delays, the company now expects $5.05 billion to $5.15 billion in revenue for the full year, in line with the consensus estimates. Analysts predict revenue to climb by 136% in 2026 to $12 billion. Capital expenditures for 2025 are expected to be $12 billion to $14 billion, with much of the delayed spending shifting into early 2026. Management forecasts 2026 capital investment to exceed 2025, "well in excess of double," citing significant, sustained AI demand. With a record $55 billion backlog, a growing global presence, and a leadership position in high-performance AI infrastructure, CoreWeave anticipates years of rapid expansion that will result in long-term profitability.

CoreWeave is growing faster than ever, thanks to diverse demand and superior technology. Its expanding product portfolio and solid customer relationships position it to grab more AI infrastructure spending as adoption spreads across industries, making it one of the smartest AI stocks to buy under $100 now.

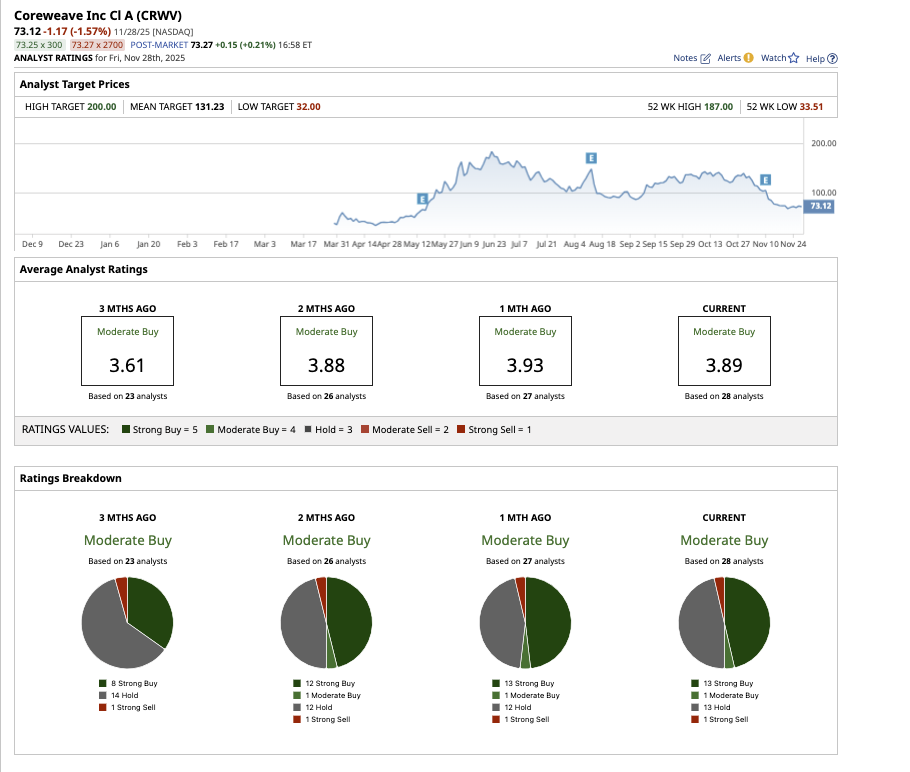

What Does Wall Street Say About CRWV Stock?

Overall, Wall Street believes CRWV stock is a “Moderate Buy.” Out of the 28 analysts covering the stock, 13 have a “Strong Buy” recommendation, one rates it a “Moderate Buy,” 13 rate it a “Hold,” and one says it is a “Strong Sell.” CRWV has gained 82% YTD. Nonetheless, the average analyst target price of $131.23 for CRWV implies a 79.4% increase over current levels. Furthermore, analysts have set a high price target of $200, implying that the stock could rise as much as 173.5% over the next year.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart