We all know why the market is rallying. Dovish tilt by the Fed solidifies the likelihood for a soft landing before they lower rates and economy picks up steam. That is about as bullish of a recipe as you can have.

With that stocks are sprinting towards their all time highs to close out 2023. Thus, I thought it might be interesting to review the 3 key stock indices to see how far away from their all time highs...and what that might tell us about price action going into 2024.

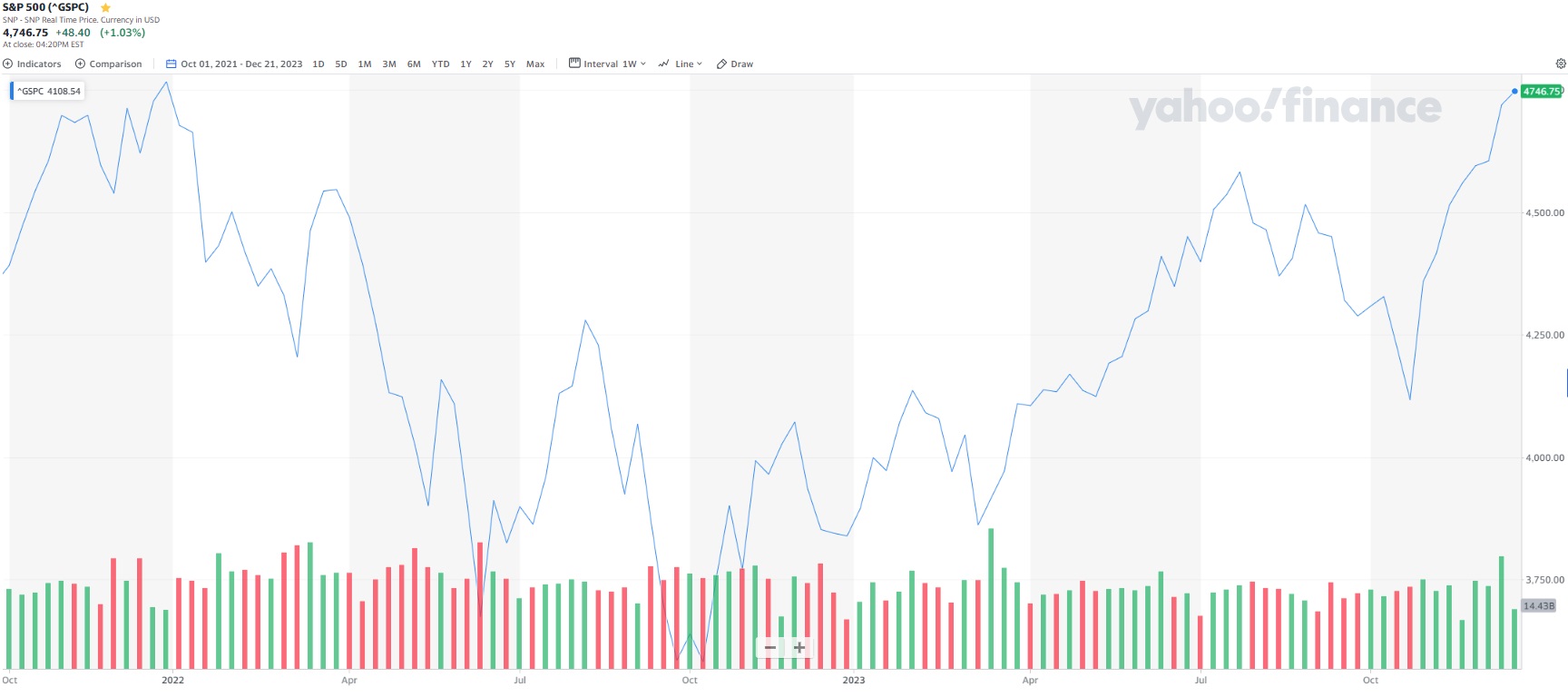

Let’s start with the S&P 500 (SPY) focused on large cap stocks:

Here the index peaked on January 3, 2022 with a closing high of 4,796. Stocks were flirted with that level on Wednesday before dramatic intraday sell off ensued. Yet on Thursday once again investors bought that dip leading to closing the Thursday session at 4,746.

The point is that this is the healthiest looking index rising +23.63% this year and only about 1% away from the all time highs. No doubt we will eclipse that mark fairly soon. Just a question of whether that happens by the end of 2023 or early in the New Year.

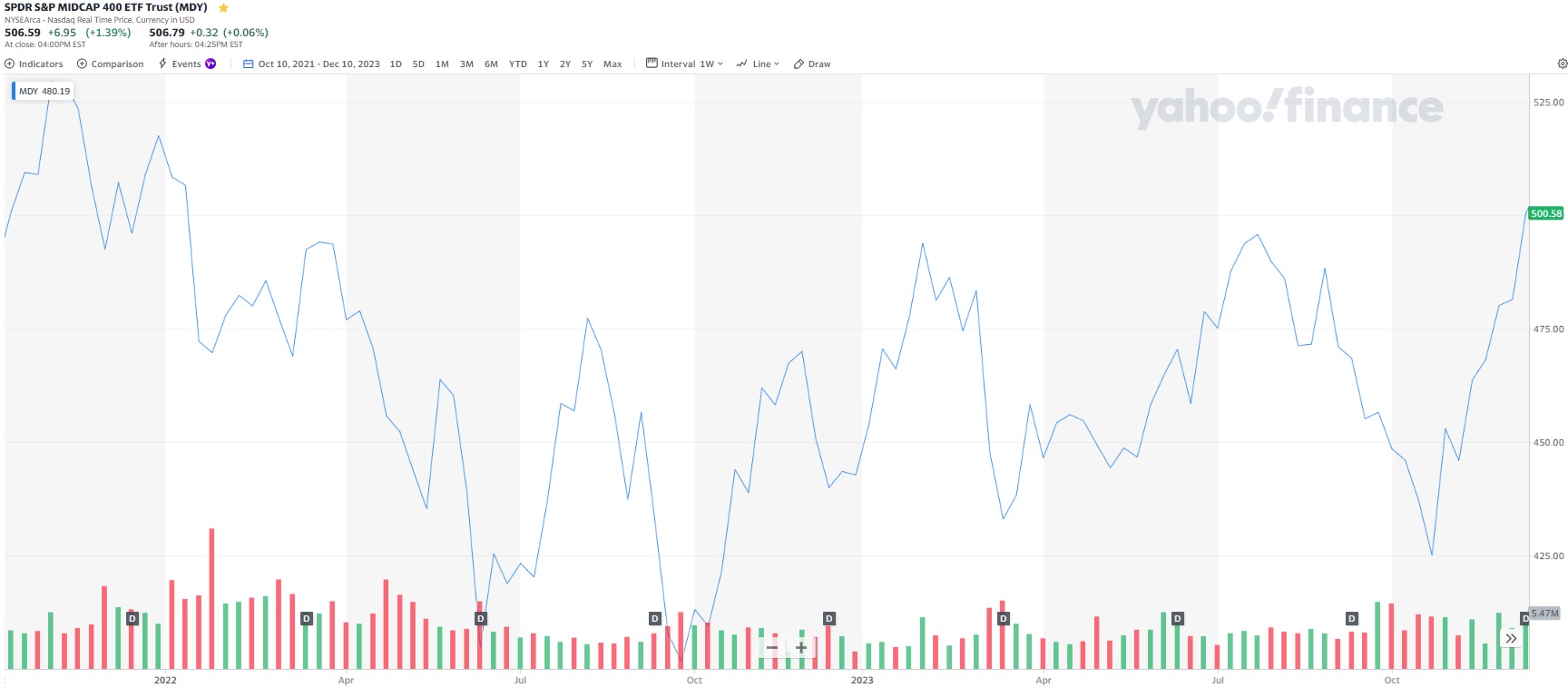

Next let’s downshift to a view of the midcap stocks as represented by S&P 500 Midcap ETF (MDY).

Here we have a closing high made about 2 months before the large caps on November 16, 2021 at 515.53. MDY was well below that mark most of the year, but has played a lot of catch up since the November 1st Fed meeting that sparked this end of the year rally that broadened out beyond the large caps.

This index is just less than 2% below its all time highs. Good odds to eclipse in the days remaining in 2023. But if not then easy hurdle to make early in 2024.

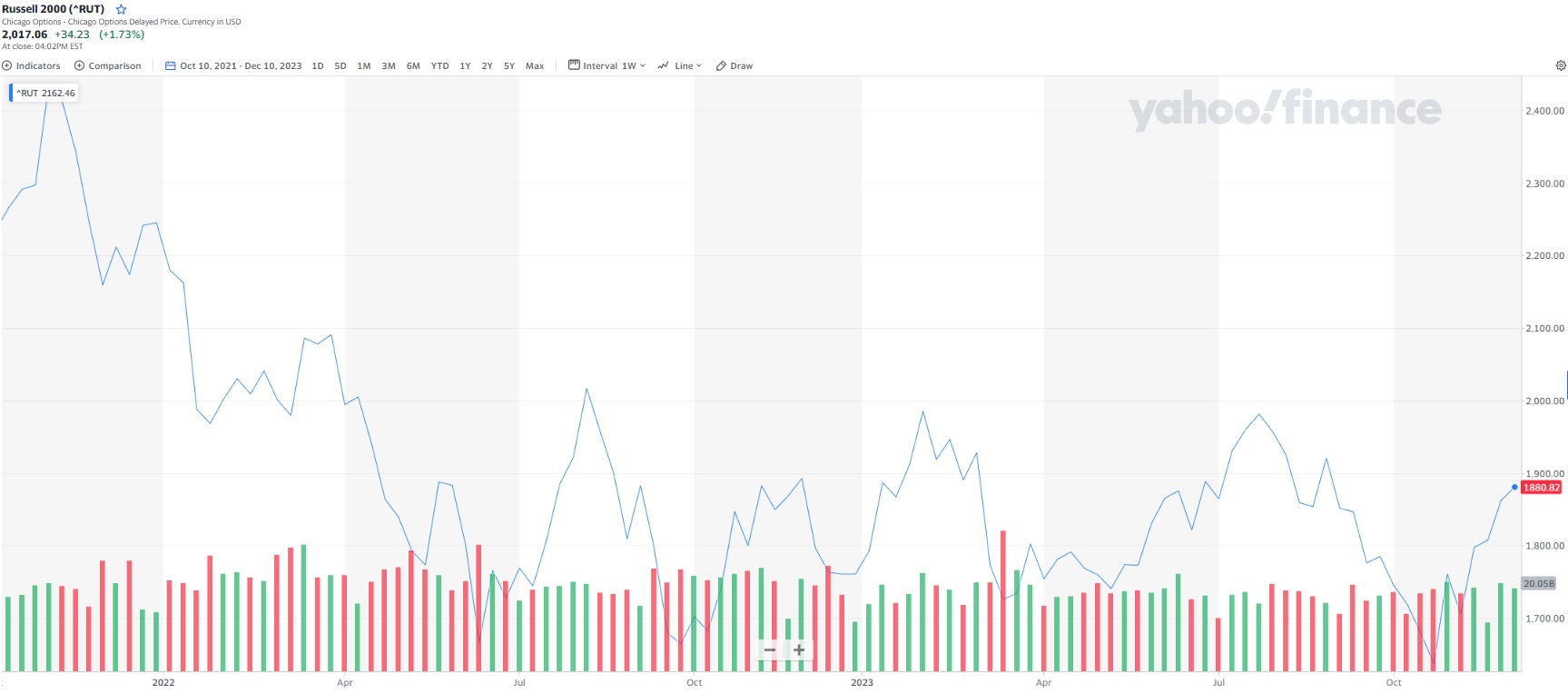

Lastly, we will take a gander at the small cap stocks best represented by the Russell 2000 index:

This index topped out at 2,442 all the way back on November 8, 2021. Even with the rotation to small caps of late, the index only closed at 2,017 on Thursday. That means we are still 17% below the all time highs.

This underperformance by small caps is not a recent phenomenon. Rather you could really go back 4 years with fairly consistent outperformance of large cap stocks.

Yet the further we go back in time...the more we understand that small caps typically outperform large caps by a nice margin. Especially true during bull markets as investors focus on growth and upside potential.

The point being that this recent rotation to small stocks has legs and not too late to join the party. The key is WHICH small caps have the best opportunity to outperform?

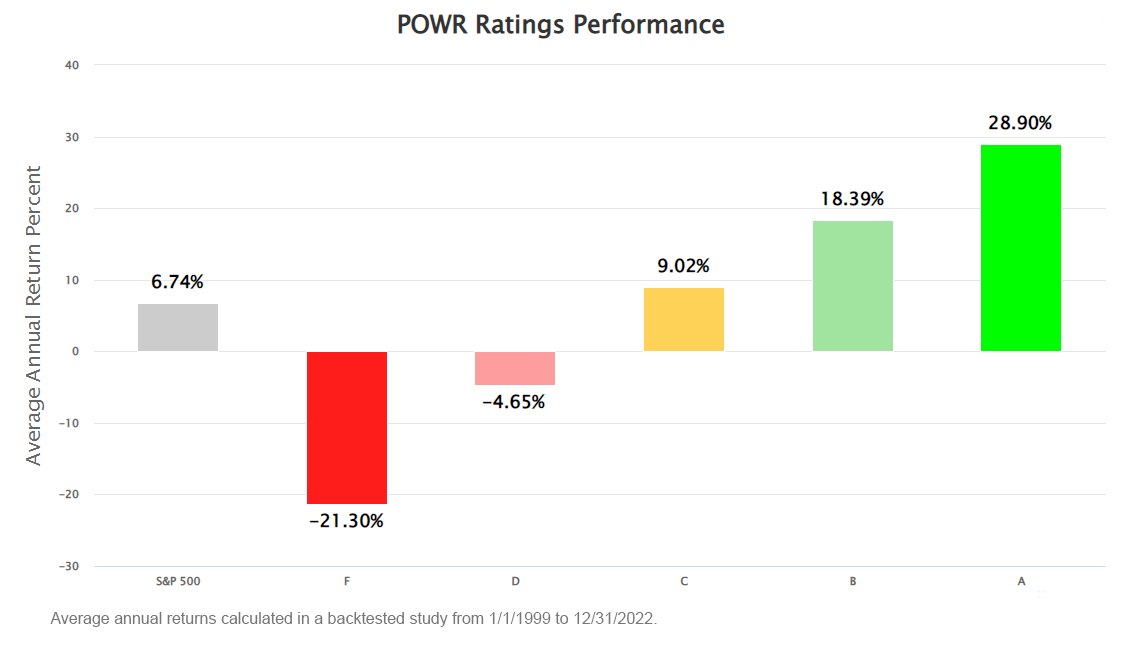

That is a tremendous advantage we have with the POWR Ratings system that analyzes 118 factors for every stock. Meaning it does as deep of a dive on a mega cap like Apple as it does on a hidden gem under $1 billion market cap.

Having these 118 factors of the company in our favor is what leads to tremendous outperformance. Like 4X better than the S&P 500 for our A rated POWR Stocks going all the way back to 1999.

Long story short, you will want to lever up on small caps with the best POWR Ratings. And that is precisely what you will find in the next section...

What To Do Next?

Discover my current portfolio of 11 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model.

This includes 4 small caps recently added with tremendous upside potential.

Plus I have added 2 special ETFs that are all in sectors well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets...bear markets...and everything between.

If you are curious to learn more, and want to see these 13 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares rose $0.15 (+0.03%) in after-hours trading Thursday. Year-to-date, SPY has gained 25.48%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post When Will Stocks Break to New Highs? appeared first on StockNews.com