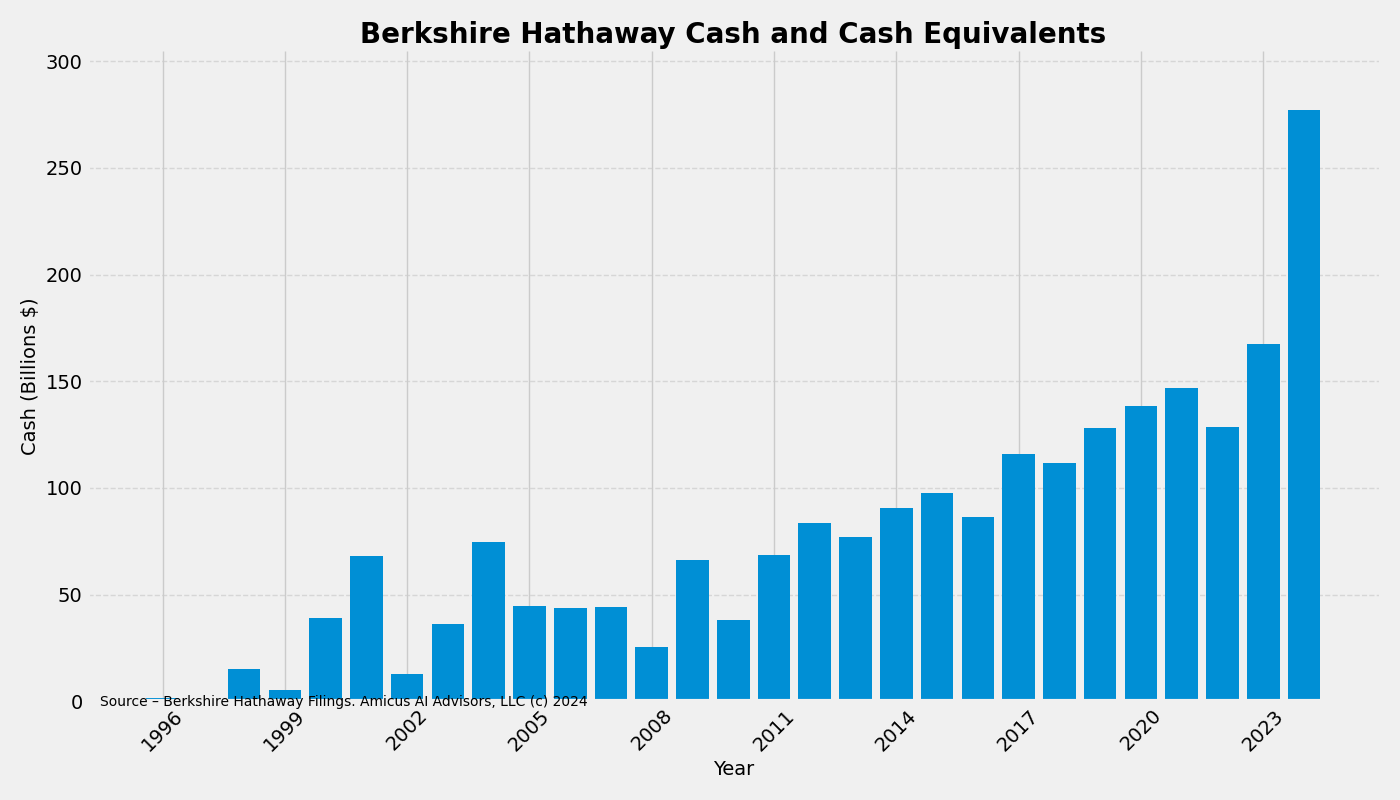

Omaha NE - August 7th, 2024 - In the tumultuous landscape of today’s economy, Warren Buffett’s Berkshire Hathaway stands as a beacon of stability and hope. With a war chest totaling $277 billion, Buffett has a storied history of stepping in during economic downturns to rescue distressed businesses, thus saving jobs and revitalizing industries.

Known for his strategic patience, Buffett famously waits for opportune moments before deploying what he calls his "elephant gun" to acquire struggling companies at favorable prices, all the while minting a return.

"While many see Buffett as a financial hero in times of crisis, he plays a critical role in stabilizing the economy," said Leonidas Tam, PhD., CIO of Amicus Advisors, LLC. "His ability to provide a safety net for distressed firms is unparalleled."

Buffett’s investment criteria often target companies that are over-leveraged, susceptible to market panics, or on the brink of collapse. Recent examples include Yellow, U.S. Logistics, and several less-than-truckload (LTL) transport companies. Berkshire Hathaway’s extensive operations in transportation via BNSF Railway and finance have positioned it as a pivotal player in industry consolidations and economic rescue efforts.

"Buffett’s conservative approach paradoxically supports broader economic stability," continued Tam. "By preventing catastrophic failures and providing capital injections, Berkshire Hathaway helps mitigate the systemic risks that threaten the economy."

Throughout his career, Buffett has earned a reputation for decisive action during financial crises, including rescuing Salomon Brothers and fortifying Bank of America during tumultuous times. His interventions have often been credited with preventing wider financial calamities and maintaining investor confidence.

"As Berkshire Hathaway continues to grow, its role as a guardian of economic stability becomes increasingly significant," concluded Tam. "Oddly, the more conservative a stance Berkshire takes, the more the broader economy avoids calamity."

Media Contact

Company Name: Amicus AI Advisors, LLC

Contact Person: Barrett Williams

Email: Send Email

Country: United States

Website: https://amicus.ai/