While there is no such thing as a perfect hedge, we’ve covered many ways to use stock options to help protect your stocks in a falling market, including strategies to hedge your portfolio with options. On the flip side, what if you want to protect your options positions? Could you reverse engineer the situation and hedge your options positions with stock? The answer is yes, but there is an easier way that requires very little calculating: Delta hedging.

What Is Delta?

To understand Delta hedging, you need to first to understand what Delta is and how it applies in options trading. One of the mostly commonly used Greeks, Delta is a measure of how much the price of an option is expected to change for a $1 change in the price of the underlying stock. Delta value ranges from negative 1 to positive 1 (-1 to +1) or 100 and -100, depending on your platform.

Call options have positive Delta, and put options have negative Delta. At-the-money (ATM) puts have a Delta near -50, while ATM calls have a Delta near +50. For example, an XYZ $50 put may have a -60 Delta, while an XYZ $55 call may have a +50 Delta. As the underlying stock gets deeper in the money (ITM), the Delta will move closer to -1 for puts and +1 for calls.

What is Position Delta?

The total Delta of all your options and stock positions is referred to as position Delta. Each share of a stock is 1 Delta. A 500 share stock position moving up $1 results in a $500 profit; therefore, the position Delta is 500. The position Delta refers to how much total profit/loss the position makes on a $1 price swing.

What is Delta Hedging?

Delta hedging is a defensive strategy used to temporarily reduce the directional exposure of your option or stock position to the price move in the underlying asset. This protects your position from being impacted by short-term price volatility until you decide to unload the hedge.

The most common Delta hedge is to take an offsetting position in the underlying stock and bring the Delta down to zero, so Delta neutral hedging or no risk. However, exposure can be adjusted to any level you want. In this article, we’ll assume Delta hedging examples imply a Delta neutral position.

How to Apply a Delta Hedge

To apply a Delta hedge on your options position, you will need to take an opposite position with the underlying stock to reduce the Delta to zero. Remember that each share of stock will always equal 1 Delta. If your position is call options, then you would short the underlying stock. If you have put options, then you would buy shares of the underlying stock to offset the Delta.

For example, if your ABC put options have a -500 position Delta, then you need to add +500 Delta to bring the Delta to zero. This would entail buying 500 shares of ABC.

When to Use Delta Hedging

If your options position is profitable, but you expect near-term volatility before the trend resumes in your direction, you could Delta hedge your options until the pullback passes and then reduce or close the hedge when the trend resumes.

Be aware that as the value of the underlying stock changes, the Delta can also change. This will require you to adjust your Delta hedging along with the changing Delta. This can be labor-intensive and costly if you have to pay commissions or transaction costs with your broker. This is why Delta hedging is not a common practice by casual options traders.

Example of Delta Hedging on AMD Stock

Let’s use an example of a Delta hedge on computer and technology sector stock Applied Micro Devices Inc. (NASDAQ: AMD).

The daily candlestick chart on AMD had a bullish ascending triangle pattern that you were hoping would breakout. Unfortunately, AMD is losing strength as it fell under the ascending trendline support. The daily RSI is also falling back down through the 50-band. This doesn’t look good for your position, but you still believe AMD will hit $200 in the coming months and want to keep the position.

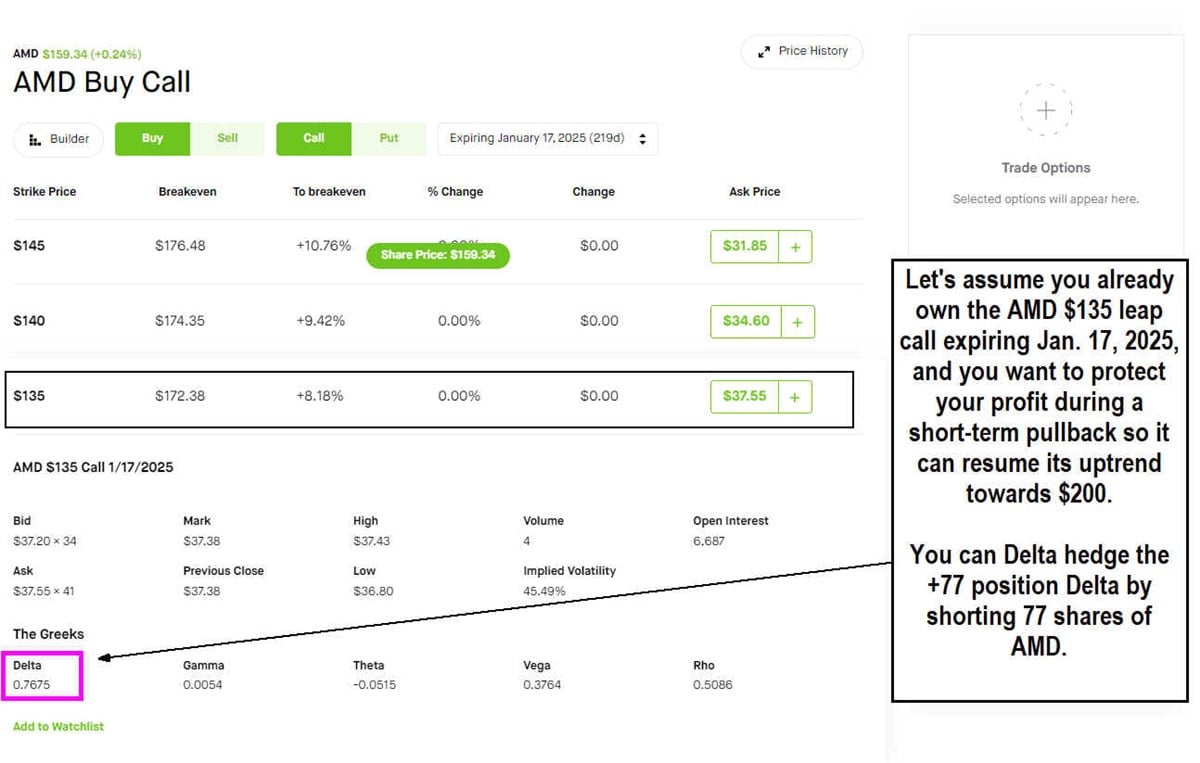

Let’s assume that you’re bullish on AMD and already hold 1 AMD $135 leap call position, expiring 219 days out on Jan. 17, 2025. The position Delta on your 1-call option is +77. To offset the +77 position Delta, you would short 77 shares of AMD.

To short-sell 77 shares of AMD at $159.33, you would need $12,269 in capital. Once you have the short position in place, then you will establish your Delta hedge. Remember that you will have to adjust the hedge by covering or shorting AMD shares as the Delta changes. Once the coast is clear and AMD resumes its uptrend, you can trim down your hedge or remove it completely. Be aware that your long call position continues to experience time decay, and you are paying margin interest on your short stock position.

A Cheaper Way to Delta Hedge Options with Options

Delta hedging your options is expensive because you have to buy shares in the underlying stock. A less costly method would involve buying call options to bring the position Delta down. However, be aware that Theta is not your friend when you're long any options as they will lose value on a daily basis and faster as expiration gets closer. When you have long options positions on both sides (calls and puts), the Theta exposure increases, and time is not on your side.

The Upsides and Downsides of Delta Hedging

The benefit of Delta hedging is that you can temporarily hedge your position to protect your gains or cap losses during short-term price volatility. A Delta hedge is a way to buy your position some time until it moves back in your direction without having to close the position or sit through extensive volatility and value depreciation. Remember, it takes constant monitoring and adjusting to keep your share sizing at Delta neutral. Delta hedging is not a set-it-and-forget-it strategy. It can be labor-intensive and costly. However, when you are looking to protect your options positions, it can be viable if you have the time and capital.