I am not a technophobe nor luddite…but no one would ever think that a crusty old curmudgeon like me is on the leading edge of technology.

Heck, even my kids make fun of me because I don’t know how to Snapchat properly.

So, imagine my reaction when the team at Magnifi asked me to test their Artificial Intelligence investment assistant Magnifi Personal.

It was about the same reaction I had to the idea of being in a driverless car. HELL NO!

The thought of giving up total control to let a machine drive me sounds downright horrifying. Just the same, the dread of letting the computers be in control of my finances is equally scary.

That leads to an interesting twist that is being taken with Magnifi Personal.

With Magnifi you keep total control and just have this advanced technology assist you with better research and planning. Yet the final decisions are 100% yours.

OK…now you got my attention.

So, let’s go on a journey together. Where I share with you my experience with Magnfii Personal. Then perhaps you consider if you want to start a free trial and take advantage of it yourself (more on that later).

On a Mission

I think the best way to frame what Magnifi Personal can do for you is with the mission statement:

Magnifi Personal is the intuitive investing app helping individuals take control of their financial future.

There is a lot of good stuff to unpack here starting with it being “intuitive”. Remember this is powered by Artificial Intelligence which gets smarter and smarter over time. Like understanding who you are as a unique investor and then dialing its recommendations to be more and more valuable over time.

Now let’s appreciate the importance of it being an “investing app”. Right now far too many of us ask our vital investing questions of Google in the hopes of finding a useful answer.

This is a truly hit or miss endeavor because Google is a general search engine. Like helping you track down weather updates, population of Italy or Sandra Bullocks birthday. But perhaps not so hot when it comes to investment research, planning or finding the right stocks and funds.

Now appreciate that Magnifi Personal ONLY cares about investing. And how all this amazing technology has become laser focused to help you with that all important final part…your financial future.

The back half of the mission is also vital “helping individuals take control of their financial future”. This means it was created for individual investors and their unique needs.

Not financial planners...not advisors...not money managers...not Gordan Gecko.

It is made for every day investors all the way from the complete novice needing guidance on how to start all the way up to experienced investors who are just looking for a quicker way to research and compare investments.

Then you have the part about taking control which taps into my greatest fear shared with you at the top of the article. There is just no way that I am going to allow a computer to have control of my financial future. Just too risky.

However, tapping into a powerful tool that helps me take control of my financial future...now we are on to something special.

My 3 Favorite Features

We don’t have enough time today to review all the amazing things I discovered using Magnifi Personal. So let me share a quick list of my 3 favorite ways to use this tool to enhance, speed up and improve your investing process.

#1: Select an Investment Journey

My strength is creating a macro-outlook for the market followed by a trading plan with appropriate stocks and funds. However, there are some important planning steps that an investor should consider before entertaining that.

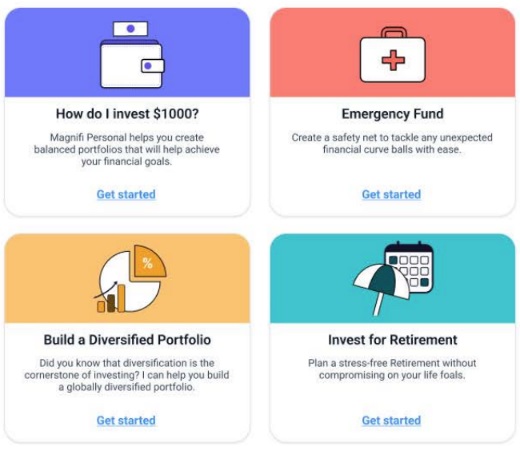

The image below shows you just a few of the possible investment journeys that you can take with Magnifi Personal. Just remember that if you have no destination, then any road will take you there. So, it makes a lot of sense to get on the right investing road such as...

#2: Ask a Question...Any Question

Most everyone I talk to is truly blown away by the incredibly deep reservoir of invest research and data inside Magnifi Personal. And pretty much whatever is on your mind...it will have an answer for you like...

- What are good investments for high inflation?

- What are the top performing energy funds? (or any industry group you want to explore).

- Are there any electric vehicle stocks without exposure to China?

- What are the top performing sectors?

- What is the latest news on AAPL? (or any stock of your choosing)

- Gold stocks with no exposure to Russia?

If you can think of an investment question...likely Magnifi Peronal is prepared to provide a valuable answer quickly and efficiently.

#3: Know Thyself

Magnifi has revolutionary tools to explore your investing personality. That is because each of us is truly unique in terms of what makes us tick as investors.

Not just about how aggressive or conservative we want to be, but what truly matters to us? Low cost funds...performance vs. safety...ESG...how much risk are you willing to take...and much more.

This personality assessment is a must for every investor...especially when coupled with the benefits of AI to customize results specifically FOR YOU.

What To Do Next?

Don’t just take my word for it...time to test drive Magnifi Personal yourself!

Gladly you can do that with a free trial to see all the features I noted above.

Plus go on your own journey to see how Magnifi can improve your investment process.

Just click the link below to get started now!

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares were trading at $406.93 per share on Tuesday afternoon, down $5.70 (-1.38%). Year-to-date, SPY has gained 6.81%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post How AI Improves Your Investing Process appeared first on StockNews.com