Reports Record Q1 Net Sales of $8.1 million

ATLANTA, GA / ACCESSWIRE / November 15, 2022 / Luvu Brands, Inc. (OTCQB:LUVU), a designer, manufacturer and marketer of a portfolio of consumer lifestyle brands, yesterday reported financial results for its fiscal first quarter, which ended September 30, 2022.

Fiscal Third Quarter 2023 Highlights

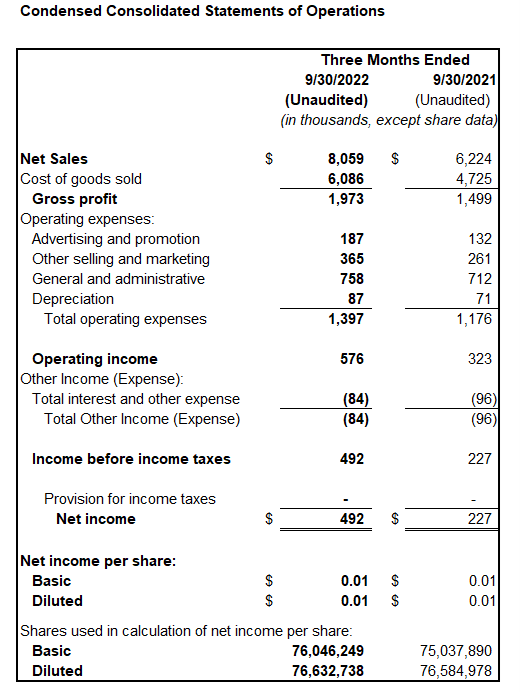

Three months ended September 30, 2022 as compared to the three months ended September 30, 2021

- Net sales increased 29.5% to a record $8.1 million.

- Total gross profit of $2.0 million, an increase from prior year's $1.5 million.

- Gross profit as a percentage of net sales of 24.5% compared to 24.1% in the prior year.

- Operating expenses were $1.4 million compared to $1.2 million in fiscal 2022.

- Net income was $0.5 million, or $0.01 per share, compared to net income of $0.2 million, or $0.00 per share, in 2022.

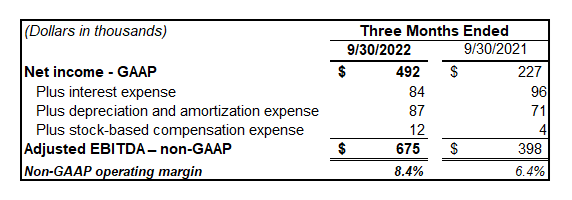

- Adjusted EBITDA of $675,000 compared to $398,000 in the prior fiscal year first three months.

Louis Friedman, Chairman and Chief Executive Officer, commented, "At the end of September, we are encouraged by ongoing business performance as we continue to have strong revenue and gross profit expansion. We continue to be positioned to innovate and make great new products with sustainable materials, while lowering our carbon footprint. Our growth initiatives include a multi-channel marketing approach now adding partnerships that allow us to further expand our brand territory with sexual wellness retailers, Amazon, and mass market e-tailers. Our product placement on Netflix's "How to Build a Sex Room" resulted in an 86% sales increase of Liberator products vs. prior year".

Fiscal Third Quarter 2023 Results

Net sales increased 29.5% to $8.1 million, compared to $6.2 million in the same year-ago quarter. Sales of the Company's flagship Liberator brand increased 86% from the prior year to $5.1 million. Jaxx product sales decreased 5% from the prior year to $1.8 million, and Avana sales decreased 25% to $0.6 million. Net sales of products purchased for resale decreased 26% from the prior year to $0.3 million and Other revenue decreased 30% to $0.3 million.

Total gross profit for the first quarter was $2.0 million, a 31.6% increase from $1.5 million in the prior-year first quarter. Gross profit as a percentage of net sales increased to 24.5% from 24.1% in the prior fiscal year.

Operating expenses were approximately 17% of net sales, or approximately $1,397,000, compared to 19% of net sales, or approximately $1,176,000, for the same period in the prior year.

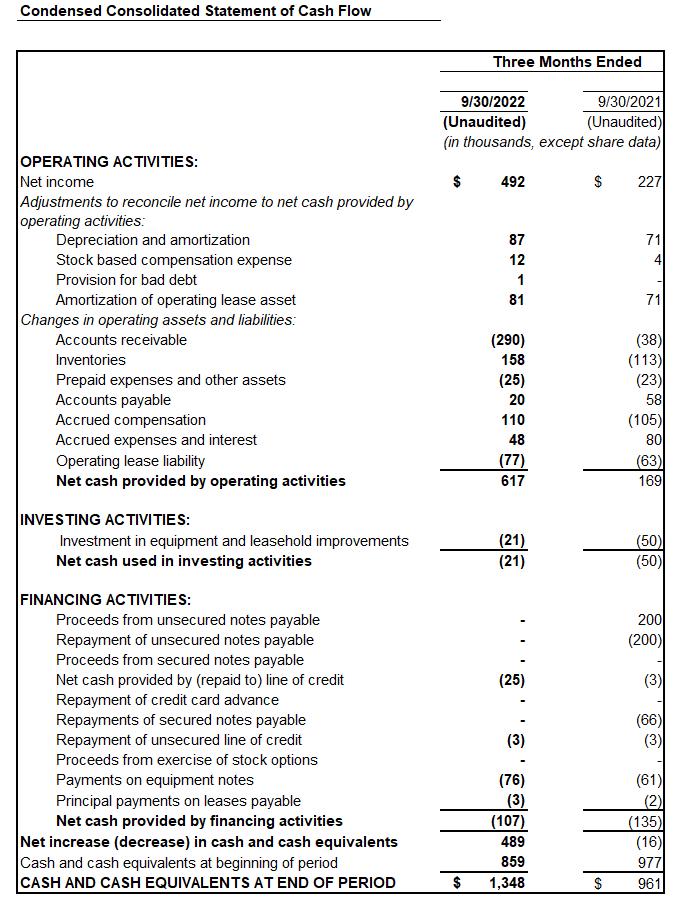

Net income for the quarter was $492,000, or $0.01 per share, compared to net income of $227,000, or $0.00 per share in the prior-year first quarter.

Adjusted EBITDA for the three months ended September 30, 2022, was $675,000, compared to $398,000 in the prior fiscal year.

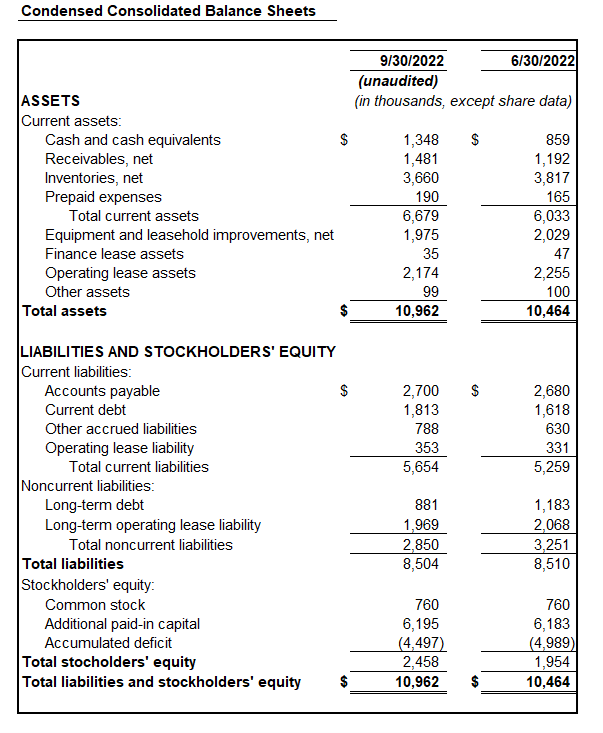

Cash and cash equivalents on September 30, 2022 totaled $1.3 million compared to $0.9 million at June 30, 2022.

Conference Call

Management will host a conference call at 11:00 a.m. EST (10:00 a.m. CST; 8:00 a.m. PST) on Friday, November 18, 2022. To listen and participate in the call, please register on this weblink: https://www.webcaster4.com/Webcast/Page/2527/47147

A Q&A session will take place after the formal presentation, which shareholders and other interested parties can partake in through the aforementioned weblink or by dialing 888-506-0062 (international: 973-528-0011) using the participant access code 895731.

Forward-Looking Statements

Certain matters discussed in this press release may be forward-looking statements. Such forward-looking statements can be identified by the use of words such as ''should,'' ''may,'' ''intends,'' ''anticipates,'' ''believes,'' ''estimates,'' ''projects,'' ''forecasts,'' ''expects,'' ''plans,'' and ''proposes.'' These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. You are urged to carefully review and consider any cautionary statements and other disclosures in our Annual Report on Form 10-K for the fiscal year ended June 30, 2022 as filed with the Securities and Exchange Commission (the "SEC") on October 12, 2022 and our other filings with the SEC. All forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements, many of which are generally outside the control of Luvu Brands, Inc. and are difficult to predict. Luvu Brands, Inc. does not undertake any duty to update any forward-looking statements except as may be required by law. The information which appears on our websites and our social media platforms is not part of this press release.

Use of Non-GAAP Financial Measures

Luvu Brands' management evaluates and makes operating decisions using various financial metrics.In addition to the Company's GAAP results, management also considers the non-GAAP measure of Adjusted EBITDA and Non-GAAP Operating Margin. As used herein, Adjusted EBITDA represents net income before interest income, interest expense, income taxes, depreciation, amortization, and stock-based compensation expense, and Non-GAAP Operating Margin means Adjusted EBITDA divided by net sales. Management believes that these non-GAAP measures provide useful information about the Company's operating results. Neither Adjusted EBITDA nor Non-GAAP Operating Margin have been prepared in accordance with GAAP. These non-GAAP financial measures should not be considered as alternatives to, or more meaningful than, gross profit and net income as indicators of the Company's operating performance. Further, these non-GAAP financial measures, as presented by the Company, may not be comparable to similarly titled measures reported by other companies. The Company has attached to this press release a reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures.

About Luvu Brands

Luvu Brands, Inc. designs, manufactures and markets a portfolio of consumer lifestyle brands through the Company's websites, online mass merchants and specialty retail stores worldwide. Brands include: Liberator®, a brand category of iconic products for enhancing sexual performance; Avana®, inclined bed therapy products, assistive in relieving medical conditions associated with acid reflux and surgery recovery; and Jaxx®, a diverse range of casual fashion daybeds, sofas and beanbags made from polyurethane foam and repurposed polyurethane foam trim. Headquartered in Atlanta, Georgia, the Company occupies a 140,000 square foot vertically-integrated manufacturing facility and employs over 200 people. The Company's brand sites include: www.liberator.com, www.jaxxbeanbags.com, www.avanacomfort.com plus other global e-commerce sites. For more information about Luvu Brands, please visit www.luvubrands.com.

Company Contact:

Luvu Brands, Inc.

Alexander A. Sannikov

Chief Financial Officer

770-246-6426

IR@LuvuBrands.com

Full-Year First Quarter 2023 Results

SUPPLEMENTAL FINANCIAL INFORMATION

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

SOURCE: Luvu Brands, Inc.

View source version on accesswire.com:

https://www.accesswire.com/725940/Luvu-Brands-Reports-Fiscal-First-Quarter-2023-Results-and-Announces-Conference-Call