Yelp data shows the great reshuffle drove significant population migration from states in the West and Northeast to the South and Midwest – resulting in high levels of new business growth in those areas

The trend of individuals relocating away from traditional business hubs is also reflected internally at Yelp, with fewer employees residing in former office locations like San Francisco and New York in 2022 than in 2019

Yelp Inc. (NYSE:YELP), the company that connects people with great local businesses, today released its first Remote Work Report, revealing how the shift away from office-centric locations transformed local economies, as well as Yelp’s own workforce since the onset of the pandemic. Yelp analyzed three years of user data (2019-2022) to understand how the share of search locations changed on its platform, evaluating shifts in populations across the U.S. based on where user searches were concentrated, as well as how local business growth was impacted in relation to these shifts. The company also reviewed three years of Yelp employee data to identify how the company's own remote work shift led to a more distributed workforce, which mirrored a similar migration away from office-centric locations, as well as employee sentiments around remote work.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230221005137/en/

Yelp data shows significant population migration from states in the West and Northeast to states in the South and Midwest (Graphic: Business Wire)

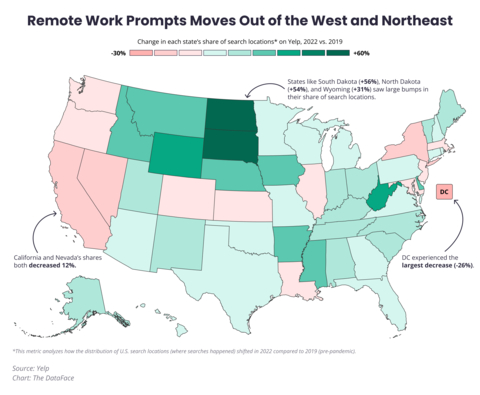

Yelp data found that about 25% of U.S. states, including Washington, D.C., experienced a decrease in their share of search locations, most notably Washington, D.C. (down 26%), New York (down 12%) and California (down 12%). Approximately 30% of U.S. cities* experienced a decrease in the share of searches compared to 2019, with several of them concentrated in large coastal cities and traditional business hubs, such as Brooklyn, NY (down 48%); San Francisco, CA (down 25%) and Beverly Hills, CA (down 24%).

Meanwhile, Yelp data indicates that states like South Dakota, North Dakota and Mississippi are seeing some of the highest increases in their share of search locations. These Midwestern and Southern states are showing a higher average increase in new business openings across nearly all categories – demonstrating the positive economic impact and opportunity remote work has had on local businesses across large swaths of the U.S.

As Yelp fully embraced remote work, its employees have also taken the opportunity to move across the country. From 2019 to 2022, Yelp saw the share of employees living near office locations decrease, including San Francisco (down 70%); New York (down 67%); Washington, D.C. (down 67%); Chicago (down 67%) and Phoenix (down 33%). During this same time period, Yelp saw a 300% increase in the share of employees residing in Florida and Texas. Employee data also found that individuals feel positively about remote work, with 87% of employees feeling favorably about working remotely.

“Our decision to fully embrace remote work at Yelp was informed by employee feedback, which showed that employees have better work-life fit and are highly productive when they have flexibility in how they work – with 93% of employees and their managers reporting they can meet their goals remotely,” said Yelp chief people officer Carmen Whitney Orr. “We’ve seen our employees, as well as communities across the U.S., benefit immensely from remote work and we’re committed to continuing to listen to our employees and lead with empathy as we build out the future of remote work at Yelp.”

States Where People are Relocating Saw Higher Average Business Growth – Driven by Home and Local Services

New home and local services businesses have shown to be the backbone of local economies as new business openings surpass pre-pandemic levels, with notable average increases in states with an increase in share of searches (up 57% and 47%, respectively), as well as states with a decrease in share of searches (up 31% and 19%). Meanwhile, shopping, bars and nightlife, active life and restaurant businesses have not yet fully bounced back to pre-pandemic levels, with each seeing a decrease in new business openings in both states that saw an increase and decrease in share of searches.

Yelp Sees Larger Applicant Pool and Employee Satisfaction in Remote Work Environment

In 2022, U.S.-based Yelp employees lived in 1,304 unique cities – a 50% increase from 2019 (871 unique cities). Additionally, compared to 2019, Yelp found an overall increase in the average number of applicants per job posting in 2022, most notably in roles across general and administrative (up 200%) and sales (up 25%). Yelp also saw a shortened hiring process for these respective roles, with the average time to hire reduced by six days in 2022 – a 23% decrease since 2019.

A 2022 survey of Yelp employees found that 85% of employees feel connected to their teams and informed while working in a distributed environment. Additionally, a survey of Yelp’s employees in February 2022 found that 86% of respondents preferred to work remotely most or all of the time.

Consumers Picked Up New Hobbies Amid Remote Work Shift

Many people have found remote work has improved overall quality of life with the ability to spend time on new hobbies, or with family and friends. As remote workers gain back the time they would have otherwise spent commuting to the office, Yelp user data shows consumer interest in a wide range of hobbies – from active sports to arts and leisure activities – has increased in 2022 when compared to both 2019 and 2021. Popular hobbies that saw an increase in consumer interest in 2022 include pickleball (up 275% compared to 2019), axe throwing (up 68% compared to 2019) and zorbing (up 48% compared to 2019).

Read the full Remote Work Report, as well as previous Economic reports, at yelpeconomicaverage.com. Assets and images from the report can be found here. For more information and Yelp’s latest company metrics, visit: https://www.yelp-press.com/company/fast-facts/default.aspx.

Methodology

Share of Search Locations

This metric analyzes how the distribution of U.S. search locations (where searches happened) shifted in 2022 compared to 2019 (pre-pandemic). For each location, the count of unique devices used to do searches on Yelp at that location is normalized by the total number of devices across all locations. Yelp then calculated the percentage change in the share of search locations in 2022 compared to the share of search locations in 2019 (pre-pandemic). Yelp made an assumption that the level of tourism remains the same across locations.

*U.S. cities: Yelp analyzed New York City by borough to gain a more granular understanding of how people were relocating within the larger city.

Business openings

Business openings refer to new business pages on Yelp in a given timeframe. The business pages are added by either business representatives or Yelp users. Yelp calculated the percentage change in the count of new businesses listed on Yelp, comparing 2022 to 2019, for the same geographic locations, openings are adjusted year-over-year, meaning openings are measured relative to the same time period in the previous period for the same business categories and geographic locations. This adjustment aims to account for seasonality.

Consumer Interest

Yelp measures consumer interest of a category by aggregating the count of select actions that users take to connect with businesses on Yelp, such as viewing business pages, sharing photos or posting reviews. To observe the shift of user attention, which is likely to correlate with their expenditure, the consumer interest of a category is normalized by the total consumer actions on Yelp. By comparing a category’s period-over-period change in the share of consumer interest across categories, we draw inferences about the change in demand for different industries.

Yelp Employee Data

We analyzed various employee and candidate data from Jan. 1, 2019 through Dec. 31, 2022 to provide a high level overview of Yelp’s workforce distribution, engagement and sentiment in a remote environment. All global employees were included in the data sets, but contractors were not considered.

Recruiting Data

For much of the recruiting/candidate data, 2020 was excluded due to the effects that the COVID-19 pandemic had on hiring. Time to hire is defined as the time between when a candidate submits an application and when they accept an offer.

Employee Sentiment Data

Several global Yelp employee experience surveys were also analyzed to provide employee and candidate sentiment data. This includes the company’s 2022 Distributed Work Survey, July 2022 Programs and Benefits Survey, and First 30 Days at Yelp survey. This data is also referred to as “employee listening data” throughout the report.

About Yelp Inc.

Yelp Inc. (www.yelp.com) is a community-driven platform that connects people with great local businesses. Millions of people rely on Yelp for useful and trusted local business information, reviews and photos to help inform their spending decisions. As a one-stop local platform, Yelp helps consumers easily discover, connect and transact with businesses across a broad range of categories by making it easy to request a quote for a service, book a table at a restaurant, and more. Yelp was founded in San Francisco in 2004.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230221005137/en/

Contacts

Press Contact:

Julianne Rowe

press@yelp.com