Fast-food chain Arcos Dorados (NYSE: ARCO) missed Wall Street’s revenue expectations in Q3 CY2025, but sales rose 5.2% year on year to $1.19 billion. Its GAAP profit of $0.71 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Arcos Dorados? Find out by accessing our full research report, it’s free for active Edge members.

Arcos Dorados (ARCO) Q3 CY2025 Highlights:

- Revenue: $1.19 billion vs analyst estimates of $1.23 billion (5.2% year-on-year growth, 3% miss)

- EPS (GAAP): $0.71 vs analyst estimates of $0.14 (significant beat)

- Adjusted EBITDA: $201.1 million vs analyst estimates of $116.8 million (16.9% margin, 72.2% beat)

- Operating Margin: 12.3%, up from 7% in the same quarter last year

- Locations: 2,479 at quarter end, up from 2,410 in the same quarter last year

- Same-Store Sales rose 12.7% year on year (32.1% in the same quarter last year)

- Market Capitalization: $1.52 billion

MONTEVIDEO, Uruguay--(BUSINESS WIRE)--Arcos Dorados Holdings Inc. (NYSE: ARCO) (“Arcos Dorados” or the “Company”), the world’s largest independent McDonald’s franchisee, operating the largest quick service restaurant chain in Latin America and the Caribbean, today reported unaudited results for the three and nine months ended September 30, 2025.

Company Overview

Translating to “Golden Arches” in Spanish, Arcos Dorados (NYSE: ARCO) is the master franchisee of the McDonald's brand in Latin America and the Caribbean, responsible for its operations and growth in over 20 countries.

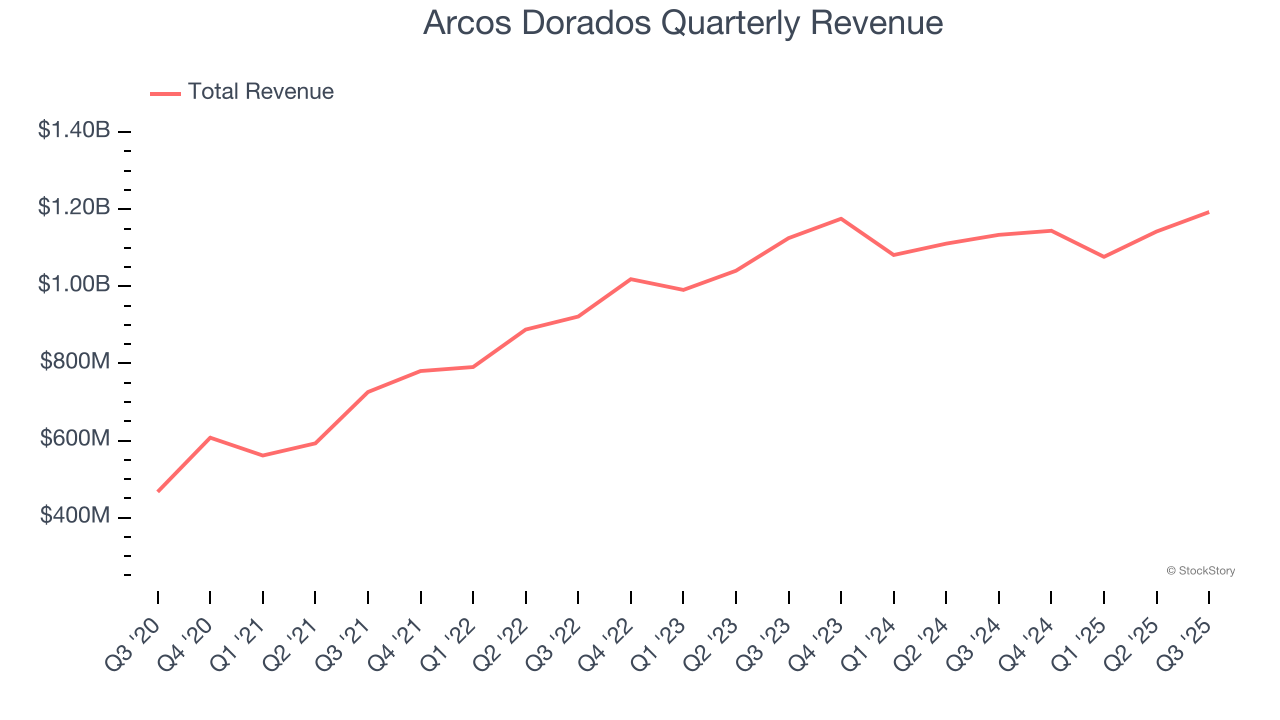

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $4.56 billion in revenue over the past 12 months, Arcos Dorados is one of the larger restaurant chains in the industry and benefits from a well-known brand that influences consumer purchasing decisions.

As you can see below, Arcos Dorados grew its sales at a decent 7.5% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Arcos Dorados’s revenue grew by 5.2% year on year to $1.19 billion, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 10.6% over the next 12 months, an acceleration versus the last six years. This projection is commendable and suggests its newer menu offerings will catalyze better top-line performance.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Restaurant Performance

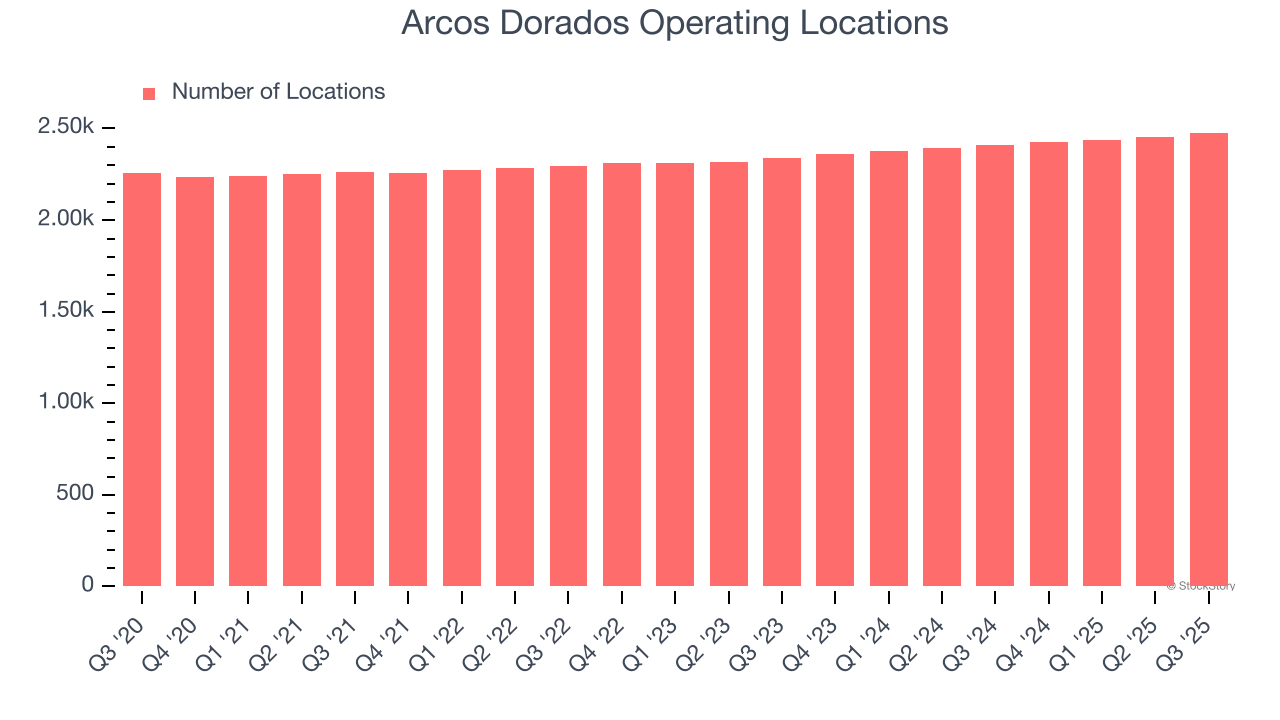

Number of Restaurants

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Arcos Dorados sported 2,479 locations in the latest quarter. Over the last two years, it has opened new restaurants quickly, averaging 2.8% annual growth. This was faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

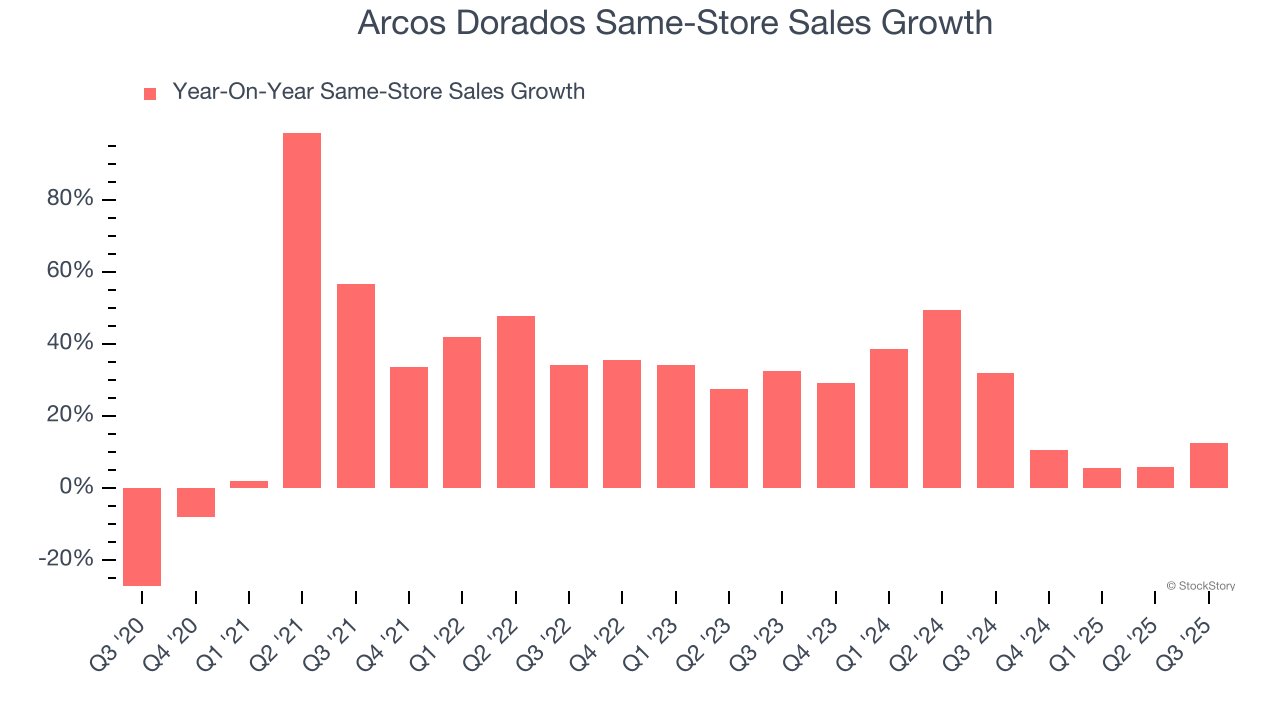

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

Arcos Dorados has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 23.1%. This performance suggests its rollout of new restaurants is beneficial for shareholders. We like this backdrop because it gives Arcos Dorados multiple ways to win: revenue growth can come from new restaurants or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Arcos Dorados’s same-store sales rose 12.7% year on year. This growth was a deceleration from its historical levels, showing the business is still performing well but losing a bit of steam.

Key Takeaways from Arcos Dorados’s Q3 Results

It was good to see Arcos Dorados beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue missed and its same-store sales was in line with Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock traded up 4.7% to $7.56 immediately after reporting.

Arcos Dorados had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.