( click to enlarge )

( click to enlarge )Jamba, Inc. (NASDAQ:JMBA) made a new 52-week high of $2.88 after gaining nealry 5% in yesterday's trading. The 52-week range for JMBA is 1.21-2.88. The stock trend looks really positive and could move up further with resistance at $3. Although sentiment remains bullish on JMBA, overbought conditions could see a corrective decline in the coming sessions. Immediate support is at 2.62-2.4 levels now. From a technical standpoint the stock is trading above all of three major moving averages. Plus, the MACD is positive and rising. Nevertheless, there is a need for some profit-taking for some consolidation from these high levels. For those who did not have a chance to buy the stock, any pull back is your buying opportunity.

( click to enlarge )

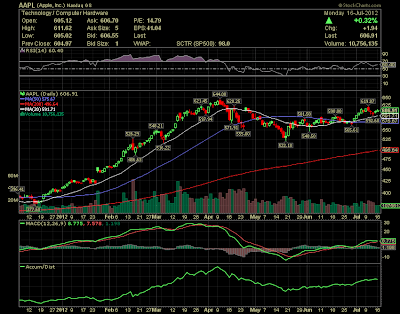

( click to enlarge )Apple Inc. (NASDAQ:AAPL) - In the short term, the stock is in a medium-term bullish configuration. The technical indicator MACD is positive and above its signal line. As long as 575 is not broken down, I favour a down move with 620 and then 644 as next targets.

( click to enlarge )

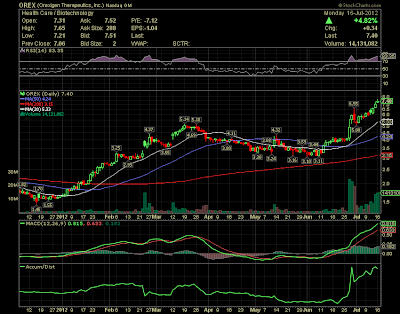

( click to enlarge )Orexigen Therapeutics, Inc. (NASDAQ:OREX) hit a new 52-week high yesterday, trading as high as $7.65 before settling at a close of $7.40. Technical chart still show strong sign of accumulation. I'll be watching the stock today, looking for a follow through move. Resistance reflects yesterday’s high of $7.65.

( click to enlarge )

( click to enlarge )InterDigital, Inc. (NASDAQ:IDCC) - The decline over the last sessions occurred on lower volume and the stock is firming around 27. Technically, the stock still in downtrend in short term but at this level is showing some resistance to move down. The current price is above the 50-day moving average of 26.4. Sustained move above the 28 level could signal development of an new uptrend. IDCC looks like it is gonna squeeze some shorts to me. Let's keep an eye on it.

( click to enlarge )

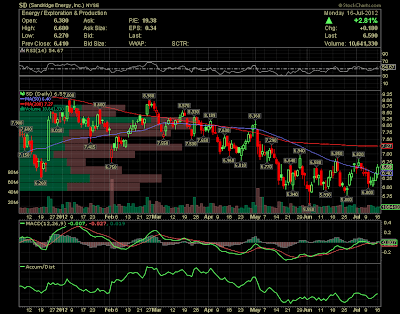

( click to enlarge )SandRidge Energy Inc. (NYSE:SD) - The stock keeps holding the major support nicely. Watching for a close above $6.75.

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC